5 Reasons Why China’s Online Retail is Insanely Successful

Editor’s note: This article by Masha Borak was originally published by TechNode. It has been re-posted here with permission.

E-commerce in China has seen such rapid growth in 2017 that even something as mundane as selling vegetables is starting to sound sexy. During the first six months of 2017, China’s online retail sales of goods and services recorded a 33.4% year-on-year growth amounting to RMB 3.1 trillion ($470 billion).

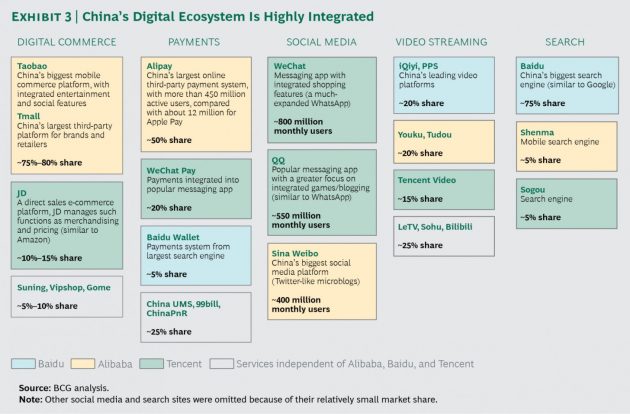

The success has drawn China’s largest e-commerce companies to new frontiers: Alibaba, JD, Tencent and even Meituan have been heavily investing in fresh food e-commerce, offline stores, as well as tapping into rural areas with drones. The expansion into offline is part of China’s “new retail” trend which aims to erase the distinction between online and offline shopping.

Alibaba and Boston Consulting Group have published a series of articles titled “The New Retail: Lessons from China for the West” which explores how differently China’s digital marketplace has evolved from western ones and what is driving their success. Here are some of their key insights.

1. Personalized discovery

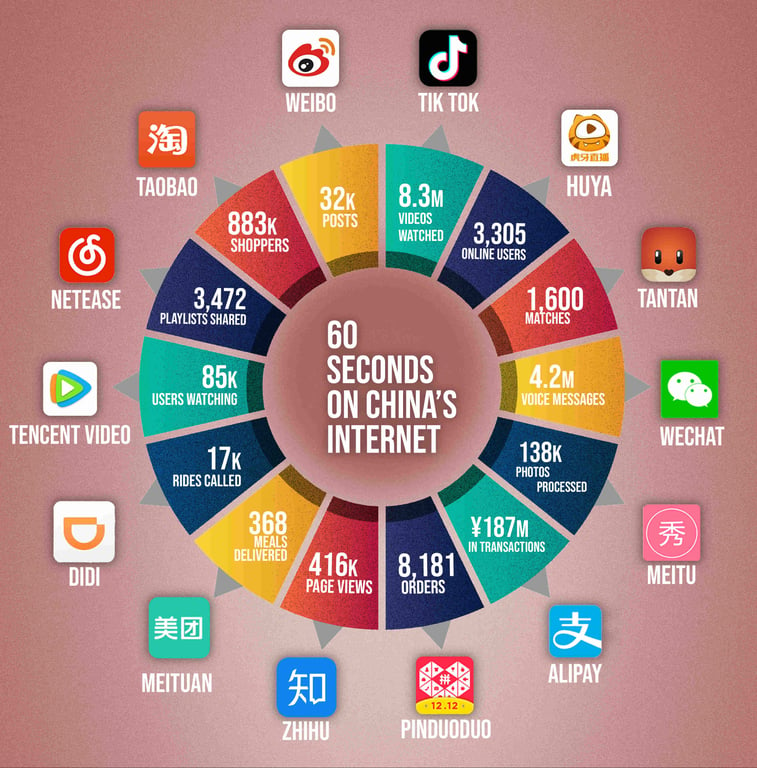

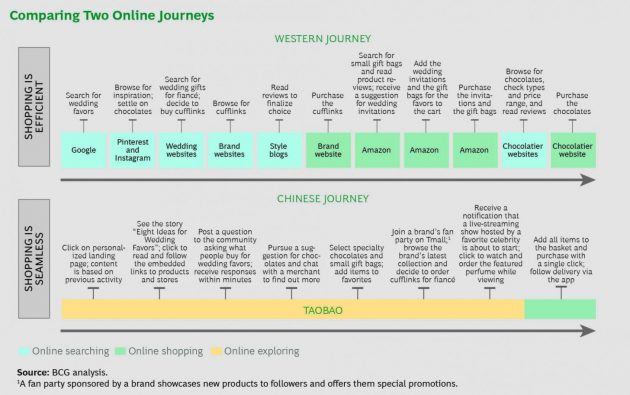

Unlike western consumers which mostly search for desired items on websites such as Amazon or directly on retailer websites, Chinese do their online shopping as if they are browsing through a mall with friends and family. Brands prefer to set up stores on well-established platforms instead of running their own websites. This gives them an opportunity to be a part of a shopper’s journey of discovery – Chinese consumers log into their favorite shopping platform to see the hottest new trends and receive real-time customized recommendations.

Image credit: Boston Consulting Group

Personalization is key in leading the discovery. Although online merchants in the west offer suggestions based on searches and buying history, China’s largest e-commerce company Alibaba goes deeper than that: it gathers social interaction and location data boosted by with data analytics and AI. A good example is this week’s Chinese Valentine’s Day when Alibaba published maps of where singles live in Chinese cities and where people go on dates.

2. Seamless sales

Imagine you are watching a video tutorial, browsing through social media or reading news. Some shiny new thing catches your eye. Unlike Western consumers who would typically have to exit their Pinterest/Facebook/Whatsapp to search for the item, Chinese consumers can get the object of their desire in one click.

Thanks to platform integrations, shoppers in China discover brands and products through an increasingly diverse set of channels. Gaming, news, social media, and the ever popular live streaming phenomenon in which internet celebrities (网红, wǎnghóng in Chinese) market themselves and products are all connected to e-commerce websites. One example is JD’s recent partnerships with Qihoo360 and Baidu which will allow the e-commerce giant to seamlessly target consumers where they spend their time on the internet, be it social, search, maps, news or security.

Another example is Taobao and WeChat which have turned into super apps by absorbing more and more features that allow users to shop, entertain themselves and communicate in just one app. This allows the path from discovery to purchase to become seamless.

3. Content is king

The recent rise of live streaming is just one channel that marketers use to capture consumers’ attention. Innovative ways which help drive sales are being developed every day in China. Some companies choose to partner up with key opinion leaders (KOLs) like celebrities or experts and market through WeChat. Others live stream their products directly from Taobao, Tmall or JD.com, like these farmers who used live streaming to sell their kumquats during Chinese New Year.

Image credit: Boston Consulting Group

Experimentation is the force driving the shopping boom and some of these experiments are highly technologically advanced. Tmall has made a mirror app that allows users to apply up to 2,000 makeup shades from brands such as L’Oreal and Bobbi Brown. Users can share photos with friends and buy products from the app. Alibaba is experimenting with virtual reality with Buy+ events which transport shoppers into virtual malls. Grocery retailer Wumart has launched its own mobile wallet that gathers user data to give discounts and recommendations.

4. C2B innovation

Unlike the classical Business-to-Consumer (B2C) relationship which goes only one way, Consumer-to-Business (C2B) innovation allows customers to add value to the company by harnessing their insights. China’s is currently leading the way in this new approach. By using data insight and following trends, social media, and events, Chinese companies can give shoppers exactly what they want at the right time. This allows more experimentation: if the product fails, it can be withdrawn fast, and if it works, it can scale up.

Image credit: Boston Consulting Group

Again, the abundance of data makes it easier to predict trends. But the C2B approach requires more than that—the entire process of creating and launching a product takes only a few weeks instead of a few months. This is why speed and agility are crucial.

5. Agility, flexibility, and speed

When Alibaba was first founded in 1999, China’s consumer companies were less developed than their western competitors. However, the initial hindrance soon proved to be a boon. New companies, less burdened by physical retail operations and bureaucracy, used agile decision making to develop a vibrant and highly competitive market. This has also been transferred to agile product development.

Agility is also required from factories. Fast fashion has made manufacturers more flexible than ever, offering smaller volumes and frequent changes to production lines. Fast-react suppliers allow companies to sell products before they are even manufactured, and not just in the fashion industry. Thanks to the abundance of manufacturing sites and geographical proximity, Chinese companies are in the best position to profit from this.

Western companies, on the other hand, often have to make their order far in advance and wait for their shipment.

Finally, access to speedy distribution through e-commerce platforms has solved a big headache for many companies. The miniature “kuaidi” electric tricycles can now be seen throughout the country making their deliveries to shoppers eager to open their packages.

#TechNode

#pinduoduo

The move highlights a growing trend of Chinese technology companies considering going global, a trend partly accelerated by China’s regulatory crackdowns on the tech sector, as well as intense competition and weakening consumption in the domestic market Read More