Is China Leading the Race Towards Mass Use of Self-Driving Cars?

With major tech companies exploring autonomous vehicle technology and authorities open to testing, China is in an interesting position in the race for mass adoption of self-driving cars

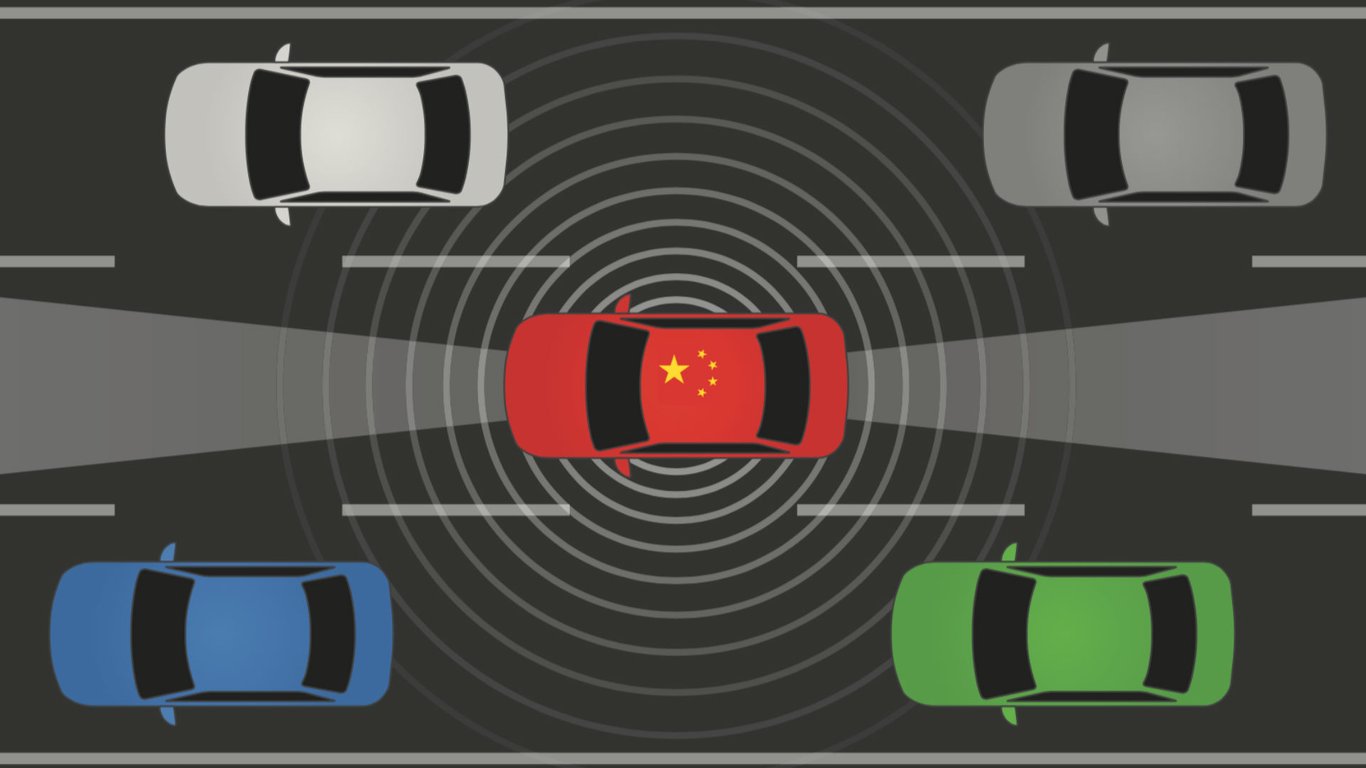

When we think of self-driving vehicles, perhaps this is the first image that pops into our head:

But the future of autonomous vehicles may actually look more like this:

One of Baidu’s Level-4 autonomous vehicles (source: Xin Che Ping)

It seems like every other day there‘s news of the latest advancements in automated driving technologies; however very few people can say they’ve actually ever ridden in such a vehicle. So how close are we to hailing a taxi and not finding a driver, but an advanced AI system who will take us to our destination? Perhaps we should look to the largest automobile market in the world, which also happens to be the Silicon Valley of self-automated technology development: China.

How Ready are China’s Drivers to Let AI Take the Wheel?

According to KPMG’s recently-released Autonomous Vehicles Readiness Index 2019, China currently ranks 20th in the world (The Netherlands is top, Singapore second; the US comes in fourth behind new entrant Norway). In assessing China’s chances of introducing autonomous vehicles to its roads en masse, the report notes,

“China shows relative improvement in the technology and innovation and infrastructure pillars, and gains the highest score on a new measure focused on online ride-hailing, with 21 percent of people having used such a system. However, it scores lower on measures including the availability of latest technologies and consumer adoption of technology. On some measures, including numbers of headquarters and patents — on which it is third numerically to Japan and the US — its score is reduced when these are calculated per capita. China also ranks last on a new measure assessing the data-sharing environment.”

Yet there are a number of factors that mean China could still move up the grid in the race to bring self-driving vehicles into the mainstream.

One significant factor lies in government moves to protect and encourage the domestic industry. Last April, Beijing announced it would be introducing strict regulations on foreign automobile companies’ operations in China. Although they’re not set to come into effect until 2020 (for commercial vehicles) and 2022 (for passenger vehicles), the moves have essentially forced foreign automakers to partner with local companies if they want access to the world’s largest automobile market. With numerous conventional automakers increasingly looking at self-driving technology, to ensure they have a Chinese market for such vehicles they’ve had to make moves to work with Chinese companies and share their technology with them.

Related:

Another factor is that this isn’t just over-zealous car-makers pushing self-driving tech on an unwilling consumer base. The Chinese market is more ready than much of the rest of the world to accept autonomous driving technologies. Nielsen’s “2018 Autonomous Driving Syndicated Report” found that for reasons such as freeing up hands, reducing fatigue, and enhanced safety, more than 80% of Chinese car owners intend to purchase self-driving cars made by conventional automakers as soon as they become available. For the upper strata of Chinese society (those who own cars valued at over 1 million RMB, approximately 150,00 USD), that figure rises to 94% of consumers.

These demographic factors and government regulations combine to create preferable conditions for the development and potential use of such technology on a large scale.

Who’s Leading China’s Self-Driving Race?

There are many competitors vying for the spot of China’s “Next Top Innovator”, but with the aforementioned conditions, many of these are focused on automated driving AI technology development. As Quartz put it in a headline last year, “every big tech firm in China is becoming a self-driving car company.”

Here are some of the key competitors:

Baidu’s Apollo Project

When it comes to scale, this contender is currently in pole position. Internet giant Baidu, who first made their name with search but like Google have moved into a plethora of industries since, has enlisted a host of collaborators for its autonomous vehicle initiative, including big-name car companies such as Ford, VW and BMW, tech companies such as China Unicom, Intel, and Blackberry, retail chain Suning and Tsinghua University, to name just a few.

Baidu’s self-driving vehicle undertaking, which it calls the Apollo project, launched in April 2017. A little under a year later, they were testing autonomous cars on the streets of China’s capital Beijing. “With supportive policies, we believe that Beijing will become a rising hub for the autonomous driving industry,” Baidu VP Zhao Cheng has told SCMP previously. And it seems Baidu’s close government ties are helping the company get that support.

But while Baidu’s government links are strong, they’ve also made concerted efforts to open the Apollo project up to outside influence. In order “to accelerate innovation” the Apollo Open Platform, provides an “open, reliable and secure software platform for its partners to develop their own autonomous driving systems sharing resources,” including an HD map service, an “Autonomous Driving simulation engine”, and a “deep learning algorithm”. The platform is so open in fact, that certain sets of data are available to anyone with a Baidu account.

Pony.ai

The California DMV’s release of its latest data on self-driving cars cause a slew of headlines about how Apple was ranking dead last when it came to the key metric of miles per disengagement. But overlooked in fourth place in those rankings — ahead of Baidu (but still some distance behind Waymo) — was Pony.ai.

Founded in late 2016, Pony.ai has offices in Beijing, Guangzhou, and Silicon Valley and was granted a license to test on Californian roads in June 2017. Four months later, the company began trials in Guangdong and in February 2018, also in southern China, unveiled a fleet of self-driving cars for use by the general public:

Earlier this year, the company also released a driverless taxi app, though it currently operates a limited fleet of less than 20 vehicles.

With several rounds of major funding secured and backing from major car-maker Guangzhou Auto Group, Pony.ai is a serious challenger to Baidu’s Apollo that will be one to watch closely.

Waymo

A name that’s among the most familiar when it comes to talking about self-driving vehicles, Waymo was formed in 2016 as a stand-alone Alphabet subsidiary, having started out as a Google project.

The company has already accumulated millions of miles of drive test routes, and even a taxi-operating licence in the state of Arizona. And while the majority of the company’s short history has been focused on US markets to date, its Chinese arm received Shanghai LLC (limited liability company) status last year, suggesting Waymo intends to make inroads into the Chinese market.

Tesla

Another name familiar to many, Tesla is almost synonymous in many people’s minds with electric vehicles and self-driving car technology.

Elon Musk’s company is currently constructing a factory in Shanghai (which could open as soon as summer 2019) and Musk himself has made repeated overtures to the Chinese authorities.

Related:

And as the company rushes to get stock of its Model 3 to China before the US trade war truce expires, it’s emerged that these cars will come with Tesla’s “Enhanced Autopilot” technology as standard allowing them to build up some crucial data.

Predicting Elon Musk is… not easy. But who’d bet against Tesla becoming a major force in autonomous vehicles in China right now?

Didi

You might know Didi as China’s “Uber killer”. Founded 6 years ago, the company has monopolized the ride share market in China and is attempting to take such services overseas. A major factor in the proliferation of Didi is its AI programs which improve ride allocation and route efficiency. The “Didi Brain”, as the company refers to this system, processes over 4,875 TB of data daily, and can use traffic patterns to predict the next 30 minutes of ride demand with 85% accuracy.

Related:

While other contenders can boast thousands of hours and millions of miles testing their vehicles on the road, Didi’s strength comes from the huge amount of data they’re able to collect through their everyday business — data regarding real-life traffic situations and flows.

Although Didi’s moves in terms of developing actual vehicles have so far been limited, it’s likely that their data mining led to China doing well in KPMG’s assessment of “online ride-hailing”.

So How Close are We to a Mass Roll-Out of Autonomous Vehicles in China?

It’s a tough one to call. But while KPMG’s report may put China toward the back of the field, if the government and transport authorities here decide to ramp-up their existing strong support for self-driving cars, we could well see the country leapfrog some of the others in those “readiness” rankings. With consumers apparently open to adopting the technology and China’s ability to push policies through quickly, don’t be surprised if China crosses the finish line in first in the race for mass adoption of autonomous cars.

#autonomous vehicles

#Pony.ai

Following trials in cities across China, Baidu and Pony.ai’s autonomous taxis are hitting the streets in Beijing, a city with more than 6 million cars on its streets Read More