China’s rise to become the world’s largest adopter of electric vehicles (EV) was not preordained. The establishment of the country’s EV industry was shaped over a decade, as the government recognized pollution as a growing issue that the rising middle class would exacerbate.

From the 1990s onwards, the number of vehicles on Chinese roads began to rise, with the country eventually becoming the biggest car producer in the world in 2009. In the same year, the Chinese government introduced a policy called “Ten Cities and [One] Thousand Vehicles,” a pilot program that picked 10 cities in the country and tested out 1,000 electric vehicles on their roads.

In 2021, China is now home to 44% of the world’s electric vehicles (more than 4.5 million vehicles), which is almost triple the number of electric vehicles in the US. At this point, you might find yourself asking: How did the country’s EV industry come so far in such a short period?

Subsidizing an Environmental Movement

The decision by the Chinese government to aggressively adopt EVs was made based on four factors: to become a world leader in this young industry, to cut back dependence on the Middle East for oil, to reduce the amount of air pollution in urban areas and to cut back on carbon emissions.

This decision-making process combined various rationales for adoption, combining political, economic and environmental motives.

When we speak about the aggressive tactics that precipitated the rise of EVs in China, one particular policy stands head and shoulders above the others. In the early 2010s, the Chinese government announced plans to provide subsidies to encourage buyers to snap up electric cars instead of traditional combustion engine vehicles.

This policy was introduced to offset the higher price of electric vehicles, and the subsidy was as high as 60,000RMB (more than 9,200USD) for people buying fully electric cars. This policy was initially rolled out in five Chinese cities: Shanghai, South China’s Shenzhen, Hangzhou and Hefei near the eastern coast of the country, and Changchun in Northeast China.

Related:

Watch: Is China Helping or Hurting Our Environment?China can be painted as both a hero and villain when it comes to its role in our climate crisisArticle Apr 22, 2020

Watch: Is China Helping or Hurting Our Environment?China can be painted as both a hero and villain when it comes to its role in our climate crisisArticle Apr 22, 2020

Similarly, governmental subsidies supported the rise of some of China’s largest EV producers. Take the example of BYD, which is widely known as one of the most popular and oldest electric vehicle producers in the country (and which is backed by none other than Warren Buffet). BYD’s rise came about as local governments provided tax breaks for the automaker, as well as grants, in addition to the purchase subsidies and tax breaks that buyers of these cars were afforded.

The gradual rise of the Chinese electric vehicle market during the 2010s was experimental, for sure, as it started the decade as a blue ocean market — a segment of the economy that has little existing competition or which is entirely new.

At the turn of the decade, some of the country’s largest EV manufacturers didn’t even exist. There was no NIO, no XPeng or Li Auto, and Tesla was still preoccupied with the American and European markets. The first few years of the decade were spent trying to figure out how the environment for these firms could be incubated.

Industry Maturation

The middle of the 2010s saw the establishment of several formative electric vehicle automakers in China, which brought new and better technologies into the Chinese market and rapidly increased the rate at which consumers bought electric vehicles.

You might also like:

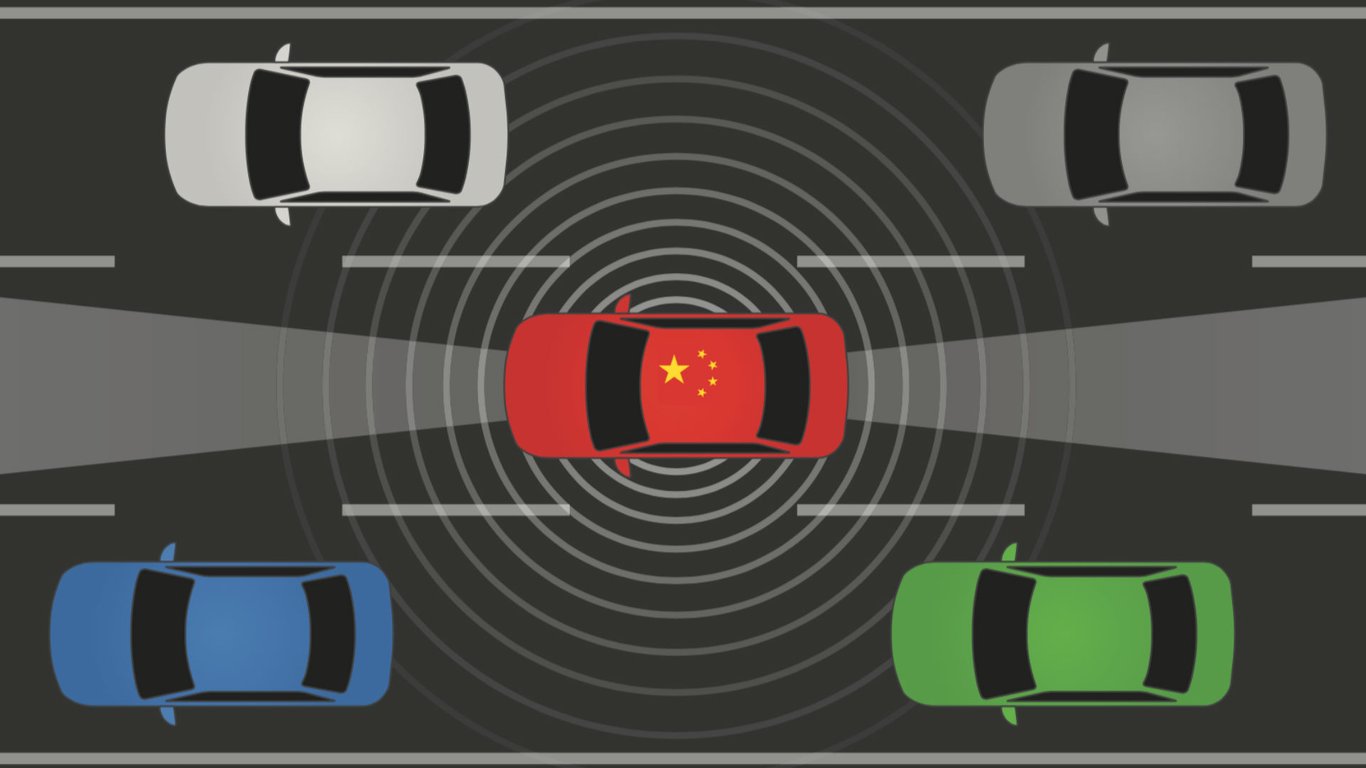

Is China Leading the Race Towards Mass Use of Self-Driving Cars?With major tech companies exploring autonomous vehicle technology and authorities open to testing, China is in an interesting position in the race for mass adoption of self-driving carsArticle Feb 14, 2019

Is China Leading the Race Towards Mass Use of Self-Driving Cars?With major tech companies exploring autonomous vehicle technology and authorities open to testing, China is in an interesting position in the race for mass adoption of self-driving carsArticle Feb 14, 2019

NIO was established in 2014 and has become globally known for its battery-swapping technology, a super fast and more efficient form of battery charging that has proven successful for taxis and public transport systems. XPeng was also founded in 2014 by two former executives of a Guangzhou-based automotive company as they sought to develop their own new EV models, with the first model being released in 2018.

Tesla entered the Shanghai market in 2013 but didn’t begin locally producing cars until five years later. One major factor in the rise of these companies has been investment from major Chinese tech companies such as Alibaba, Tencent and Xiaomi. These companies had already succeeded in disrupting a variety of digital markets and they succeeded in helping to forge a new path in the electric vehicle industry by becoming early investors in the EV blue ocean.

At the same time, some of the country’s biggest state-owned automotive companies began getting in on the action. SAIC, China’s largest car company, used its relationships with international car brands Volkswagen and General Motors to upset the electric vehicle market and mount a convincing challenge to the predominance of Tesla in the country. Meanwhile, another state-owned car company, BAIC, partnered with German carmaker Daimler to create Beijing Electric Vehicle (BJEV) in 2017, launching their Arcfox brand.

Related:

GM Launches China-Exclusive Electric Car, It’s Extremely SmallArticle Aug 09, 2017

GM Launches China-Exclusive Electric Car, It’s Extremely SmallArticle Aug 09, 2017

These huge companies are taking over the market and have the potential to provide consumers with a cheap and reliable EV in the next few years. Reference, for example, SAIC’s Hong Guang Mini, which costs consumers just 28,800RMB. That car reportedly sold almost 30,000 units in January of this year.

Present State of the Market

As of 2021, the government continues to offer a host of benefits to new EV buyers. Among the consumer benefits are VAT (Value Added Tax) exemptions and price caps on certain kinds of subsidized EVs, meaning the average new buyer isn’t paying more than 300,000RMB if they follow the guidelines for subsidized vehicles.

In the long-term, subsidies will be rolled back on private vehicles (by 10% a year from 2020-2023). However, some manufacturers must produce a certain percentage of EVs, with the target set at 25% of production by the end of this decade. These measures have played a crucial role in the continued growth of the EV sector.

Related:

Watch: How China is Strategizing its All-In Move to Electric CarsArticle Oct 08, 2017

Watch: How China is Strategizing its All-In Move to Electric CarsArticle Oct 08, 2017

As an example of this growth, Reuters reported that March 2021 was the 12th consecutive month of increased EV sales in China, with more than 225,000 units delivered.

Cover image via Unsplash