Chinese streaming and anime fandom platform Bilibili, which had over 85 million average monthly active users as of Q2 2018, landed on the NASDAQ in March, and is now set to get even bigger. At the beginning of October, Tencent, one of the largest IT companies in China and the world, announced that it had invested 317.6 million USD into Bilibili, thereby becoming the second largest shareholder in the latter with a 12% stake.

On October 25, according to Pingwest, Tencent and Bilibili announced that they’d reached a strategic cooperation agreement that covers the upstream and downstream of the ACG (Animation, Comics and Games) value chain. This partnership means, among other things, that Tencent and Bilibili will share their library of original animations (if the copyright allows), and build a deep collaborative mechanism in terms of the purchase, investment, and production of animated programming. They will also share production costs, sync up on premieres and broadcasting, and offer investment priorities to one another. There is a possibility of partnering on games in the future as well, according to Pingwest.

Related:

China’s Gen Z Anime Fans Rejoice as Bilibili Goes Public in USArticle Mar 30, 2018

China’s Gen Z Anime Fans Rejoice as Bilibili Goes Public in USArticle Mar 30, 2018

Although Bilibili has been criticized by Chinese authorities three times this year, and was banned from app stores for a month over the summer due to supposedly spreading “vulgar” content, these setbacks haven’t hurt its users’ loyalty to the platform, of which 81.7% are from Generation Z (individuals born from 1990 to 2009). The popularity of Bilibili’s games, streaming content, and offline events are reflected in the platform’s high conversion rate, which is helping online stores on Bilibili to develop new consumption patterns based on content.

This could be why tech giant Tencent — creator of WeChat and QQ — has taken an interest. In April, at Tencent’s UP2018 “Neo-Culture Creativity Eco-Conference,” Tencent Vice President and Tencent Pictures CEO Edward Cheng emphasized a “systematic focus on building intellectual property’s cultural values” and “upgrad[ing] the modes and the methods of creating intellectual property.” In an interview with WeChat account Tosansheng, Cheng said their goal was to create “a fashionable experience,” meaning an online experience that connects diverse subcultures and builds a comprehensive, digital cultural ecosystem. Both Bilibili and Tencent have invested in dozens of ACG companies in recent years.

Related:

Tencent Eyes Entertainment Expansion with “Neo-Culture Creativity” StrategyArticle Apr 30, 2018

Tencent Eyes Entertainment Expansion with “Neo-Culture Creativity” StrategyArticle Apr 30, 2018

To compete with Jinri Toutiao’s short-video platform Douyin (aka TikTok), which has over 500 million monthly active users and is viewed as the most popular application among the generation born after 1990, Tencent needs Bilibili’s Generation Z user base more than ever. In return, Tencent can offer new promotion channels to Bilibili’s growing network.

On October 31, 36Kr reported that e-commerce company — and primary Tencent competitor — Alibaba has also increased their funding and stock shares in Bilibili, but Bilibili later responded to this story by saying, “All news that is not officially confirmed is false.” Internet companies such as Bilibili that receive investment from both Tencent and Alibaba are rare in China, certainly at this level of maturity. Time will tell whether Tencent’s bigger spend will gain them greater benefits from, and broader access to, Bilibili’s crucial cohort of Gen Z fans.

—

You might also like:

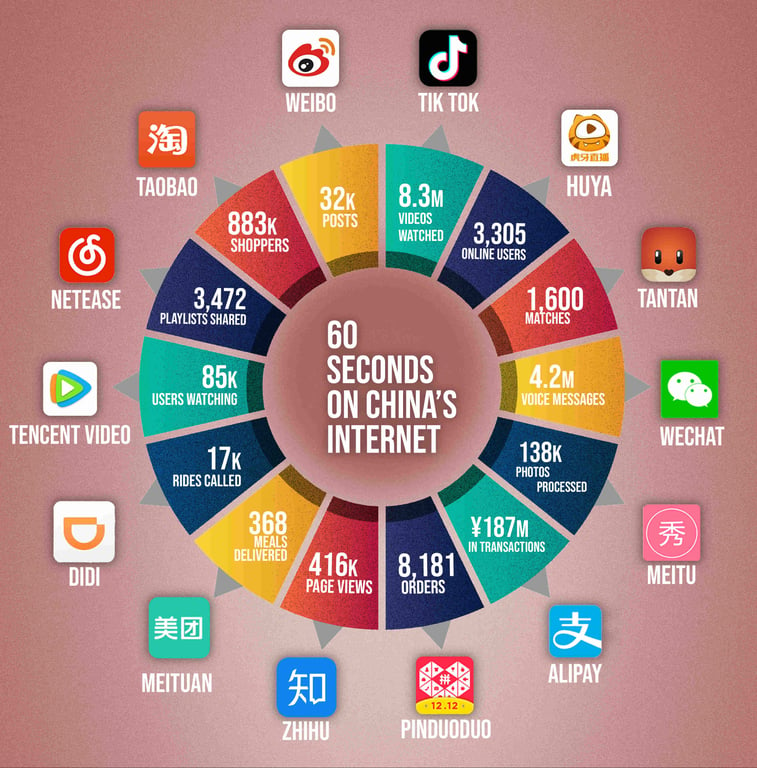

Infographic: Here’s What Happens in One Minute on the Chinese InternetArticle Sep 25, 2018

Infographic: Here’s What Happens in One Minute on the Chinese InternetArticle Sep 25, 2018

How Douyin (TikTok) Became the Most Popular App in the WorldDouyin (TikTok) has weathered repeated controversy to be named as the most downloaded non-game app on Apple’s App Store for the first quarter of 2018Article May 09, 2018

How Douyin (TikTok) Became the Most Popular App in the WorldDouyin (TikTok) has weathered repeated controversy to be named as the most downloaded non-game app on Apple’s App Store for the first quarter of 2018Article May 09, 2018

MC Shitou: Icon of a Fading Internet SubcultureArticle Feb 21, 2018

MC Shitou: Icon of a Fading Internet SubcultureArticle Feb 21, 2018