Cambricon Technologies reported its first-ever quarterly profit in the fourth quarter of 2024. The Beijing-based company reportedly achieved a net profit ranging between 240 million and 328 million RMB (approximately $32.74 – $44.74 million USD), marking a significant turnaround after incurring losses of 724 million RMB (about $98.76 million USD) in the first three quarters of the year.

This financial milestone underscores Cambricon’s pivotal role in China’s pursuit of semiconductor self-sufficiency. Amid escalating export controls by the US and restricted access to advanced AI processors from companies like Nvidia, Chinese tech firms have accelerated the development of domestic alternatives. Cambricon has emerged as a key player in this landscape, offering AI accelerators that cater to a range of applications, from edge devices to cloud data centers.

While Cambricon’s annual revenue of approximately 1.2 billion RMB ($163.7 million USD) in 2024 represents a fraction of Nvidia’s global earnings, the company’s nearly 70% year-over-year growth highlights its expanding footprint in the AI chip market.

Investor confidence mirrors this trajectory, with Cambricon’s stock price on the Shanghai Stock Exchange’s Star Market surging over 470% in the past year, elevating its market capitalization to around 300 billion RMB (around $41 billion USD).

Despite trailing Nvidia in technological advancements — Cambricon’s processors are considered to be approximately four to five years behind Nvidia’s offerings — the company is making significant strides considering its market performance and outlook this year. Throughout 2025, Cambricon plans to continue its growth trajectory by enhancing its product portfolio and improving the performance of its AI processors.

The company aims to capitalize on the expanding Chinese AI-semiconductor market, which is projected to reach 178 billion RMB (around $24.28 billion USD) this year. By focusing on innovation and addressing the specific needs of domestic clients, Cambricon is well-positioned to strengthen its market position and contribute significantly to China’s semiconductor industry.

Cambricon’s first profitable quarter is a significant achievement, reflecting both the company’s strategic initiatives and the broader momentum within China’s tech sector toward self-reliance in today’s most critical technologies.

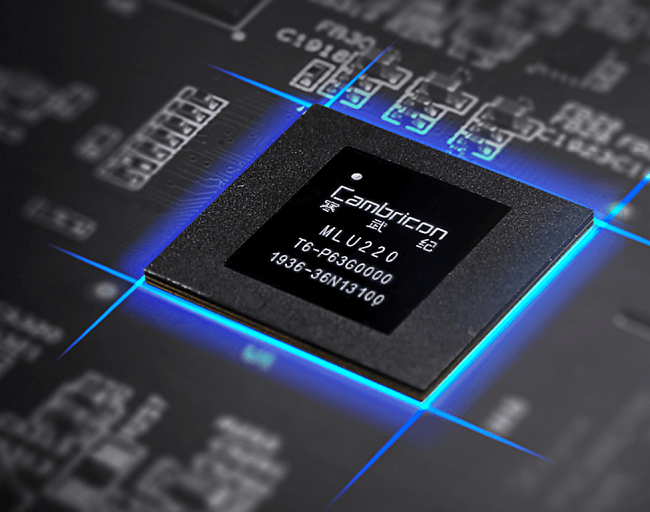

Banner image via Cambricon.