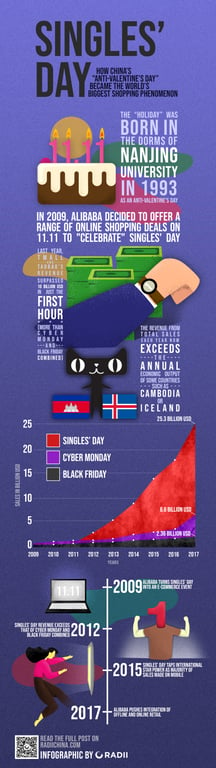

Singles’ Day, as you probably know by now, is the world’s biggest day of shopping. You’ve probably heard about the fever of consumerism which grips China each November 11th, as customers gear up for no-holds-barred spending binges (if you haven’t, you should read up here).

But to some, the Singles’ Day wave doesn’t seem sustainable. Can you really keep consumers coming back to willingly spend significant amounts of money, at a greater rate each year? At what point will buyers become disillusioned with the most commercial of commercial holidays?

Most importantly, was Singles’ Day a success this year? Well, yes and no. But mostly yes. Let’s take a look at some highlights.

Related:

China Explained: How Singles’ Day Became the World’s Biggest Shopping EventWhat is China’s Singles’ Day and how has it grown to dwarf Black Friday and Cyber Monday combined?Article Nov 07, 2018

China Explained: How Singles’ Day Became the World’s Biggest Shopping EventWhat is China’s Singles’ Day and how has it grown to dwarf Black Friday and Cyber Monday combined?Article Nov 07, 2018

Alibaba generated 30.8 billion USD of Gross Merchandise Volume on 11.11 2018

That’s an increase of 27%, compared to 2017’s 25.3 billion USD, and of course it’s Alibaba’s highest earnings yet. But that rate of change is down from last year’s, when GMV grew by a whopping 42%; it’s also the slowest growth rate seen by Alibaba’s Singles’ Day sales since the event began in 2009. With an ever-expanding array of new retail strategies, marketing plays, and gamification surrounding the holiday, Alibaba will probably continue to draw greater revenue each year. But with acceleration slowing down, we may be getting closer to a ceiling.

How much did Alibaba make in the first hour?

The first hour of 11.11 is always a crucial opportunity for headlines. Last year, international outlets published reports of revenue breaking 10 billion USD in “just over an hour.” This year, we watched from the Tmall Singles’ Day media room, as a revenue counter ticked up live alongside a massive onscreen stopwatch. The tension in the air was palpable as GMV crossed the 10 billion USD threshold at one hour and forty-seven seconds — “just over an hour”, again. With 2018’s event being billed as the 10th anniversary of Singles’ Day, and the last one with Jack Ma at the helm, that has to sting a little. So close.

Rivals are gearing up, too

Rival e-commerce platform JD.com made some big plays this year too, drawing nearly 23 billion USD in revenue. The website has been upgrading its delivery infrastructure, and over 90% of those orders were shipped on 11.11 or the day after. One Beijing resident, a Mr. You, ordered a hot meal from JD.com, and received the order four minutes after check out. The website also set aside 7 million RMB of “11.11 funds” to reward their delivery drivers on the front lines — probably a good PR move, as JD.com’s record high this year comes in spite of recent high-profile news scandals. Like, several of them.

Singles’ Day Countdown at the Mercedes-Benz Arena in Shanghai

How’s the post office looking?

China’s state postal service expects to process nearly 1.9 billion deliveries as a result of the holiday. The peak points of pressure will appear over the 11th and the 12th, when daily processing capacity will max out at three times above average — 43% higher than the highest daily processing volume on record in 2017.

Who are some winning brands?

180,000 Chinese and international brands participated in Singles’ Day this year. In the first hour, according to the live broadcast info from Tmall’s Singles’ Day media center, the top 10 best-performing brands were as follows, in descending order: Xiaomi, Apple, Huggies, Pampers, Samsung, Dyson, FitFlop, Phillips, ASUS, and Nintendo.

Nintendo’s Switch console definitely gave the gaming company a boost, while Huggies and Pampers both targeted savvy parents looking to stock up on a necessary essential for months to come. But Xiaomi was the big winner here, pulling in over 3 billion RMB in sales — some of its most popular products were phones, air purifiers, and smart bracelets.

Related:

Wǒ Men Podcast: Buy, Buy, Buy – Singles’ Day SpecialArticle Nov 09, 2018

Wǒ Men Podcast: Buy, Buy, Buy – Singles’ Day SpecialArticle Nov 09, 2018

Newer Retail?

In 2016, Alibaba announced its strategy of “New Retail” — a kind of retail that blurs the line between online shopping and the in-store experience. The phrase has since become a huge buzzword for the company. In 2017, the theme was also new retail, with a focus on executing the strategy in concrete ways. Online/offline hybrid pop-ups, “smart stores” connected to Tmall, and augmented reality shopping experiences appeared across the country. In 2018, the theme was, unsurprisingly, new retail.

To be fair, Alibaba did go kind of crazy with it. Their new retail supermarket chain Hema (think, “Amazon Go meets Whole Foods”) had around 100 stores participating in the holiday, offering loyalty points, virtual red packets of money, and deals. Nearly 400 RT-Marts (one of China’s largest hypermarket chains) were equipped with new retail capability as well. For consumers living in China’s less developed cities, 3,000 Tmall Corner Stores served as real-world touchpoints for e-commerce activity, while Alibaba continued to integrate mom-and-pop convenience stores across 20 provinces into its 200,000-store strong, new retail-ready Lin Shou Tong network (all part of an initiative called “Rural Taobao”). “Old” retail got in on the action too, with major Chinese outlets Intime, EasyHome, and Suning all offering special 11.11 deals.

So there’s certainly a lot of activity going on. But until we can walk into a Family Mart convenience store and buy a sandwich without human interaction, or have clothes from the mall downtown delivered via drone, “new retail” still has a long way to go before its truly part of everyday life in China.

—

Related:

Here Comes New Retail: How Alibaba Wants to Change the Way We Think about ShoppingArticle Nov 14, 2017

Here Comes New Retail: How Alibaba Wants to Change the Way We Think about ShoppingArticle Nov 14, 2017

Our Singles’ Day infographic: