No Cash, No Cashiers

Hey, have you heard that In China, A Cashless Trend Is Taking Hold With Mobile Payments? That In Urban China, Cash Is Rapidly Becoming Obsolete? That China Is on Track to Fully Phase Out Cash?

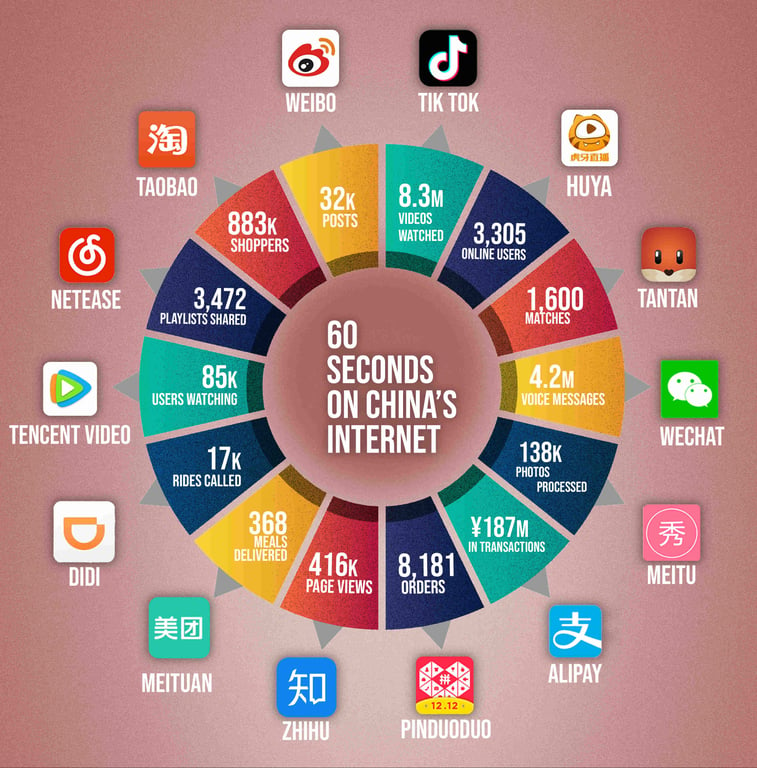

If you read any major American news outlet, you probably have. Mobile payment platforms like Alipay and WeChat Pay — which are linked to your bank account and let you pay for literally everything with your phone — have become so unquestioningly ubiquitous in most major Chinese cities that Western commentators are tripping over themselves to try to explain the system to audiences still woefully beholden to hard paper and plastic.

The numbers are indeed impressive. A Financial Times profile of the phenomenon published in February says that the “value of Chinese third-party mobile payments more than tripled to Rmb38tn ($5.5tn) in 2016,” due in part to related booms in areas of the mobile economy that entail frequent micro-payments, like dockless bike share and ride-hailing apps. There’s also “late-mover advantage”: since credit cards never sank into Chinese culture, and China’s economic growth over the last few decades has coincided with an explosion in its tech sector, companies here have been able to nimbly leapfrog over other payment methods and develop a system based on the small computer in virtually every urban citizen’s pocket.

A survey (n = 1,006) of Chinese respondents over 18 released last month by market research firm YouGov added some new numbers to the pile of future-shock accruing around mobile payments. Among the group polled, 73% said that they use mobile payments for in-store purchases. 86% still use cash as well, but the adoption rate of online payments in offline, real-world stores is noteworthy. Only one third of the survey group said that they use cash every day, and more than half of them believe China will be totally cashless within the next 20 years. 10% think it’ll get there within five.

Naturally, the rapid adoption of this integral technology has led to some cultural hiccups. One China-based FT reporter wonders about mobile pay etiquette:

Mobile payments have created a new etiquette dilemma, what to do when you get an important-seeming call just as you're just about to pay

— Tom Hancock? (@hancocktom) July 25, 2017

This might not be a problem for much longer. As China dashes towards cashless-ness, it may ditch cashiers as well. Earlier this month, Alibaba opened their first unmanned brick and mortar store, Tao Cafe, where up to 50 customers at a time can order food and drink without the need for any human interaction whatsoever. “Your profile picture is shown on the screen after you place an order. It also shows the wait time. There is no hassle of waiting for your name to be called like in ordinary cafes,” one early adopter told Chinese news outlet Xinhua.

Tao Cafe works by matching Alibaba’s mobile payment platform (Alipay), its e-commerce platform (Taobao), and a cloud of biometric user data connected to each that lets you walk up to a machine, get your face scanned, order your coffee and be on your way. Sure, the idea of tech companies having even more reason to collect your personal data (really personal, like face and eyeball scans) will turn off some potential users, and sure, Amazon opened a cashierless convenience store in December, but Amazon doesn’t have 100 million people actively using its platform to pay for stuff in stores every day, and out of those 100 million people, I think it’s safe to say a lot of them won’t mind trading an extra bit of their personal information for a couple minutes shaved off their breakfast wait. Alarming but true; these are fast times.

If you prefer your “cashierless retail in China” stories a bit less dystopian in vibe, enjoy this video of Moby Mart, an “autonomous, staffless, mobile store” created by Swedish company Wheelys, which started beta testing last month in Shanghai:

Cover image: Moby Mart