Didi is China’s biggest ride-share company. The app fought off international competition by driving Uber out of the country, and currently clocks over 550 million users and tens of millions of drivers in Asia, Australia, and South America. Founded in June 2012, it now holds an over 80% share of China’s private ride-hailing market.

For years, Didi seemed untouchable. But a few small companies in China’s second-tier cities are starting to nip at its heels.

Related:

China Explained: The Rise, Fall, and Uncertainty of Didi’s Ride-Hailing DynastyArticle Nov 15, 2018

China Explained: The Rise, Fall, and Uncertainty of Didi’s Ride-Hailing DynastyArticle Nov 15, 2018

A channel on Chinese messaging app WeChat called “Deep Echo” (深响) recently published a wide-ranging look at the industry in China. In particular, it highlighted the growing phenomenon of smaller scale ride-share companies.

A company named T3 Travel announced in August that it had signed A-list actress Zhou Dongyu as the brand’s first spokesperson. They’re currently ranked ninth nationwide in terms of market share, but their goal is to gain 20% of the market in each of its operating cities, and are expanding rapidly.

Another car-hailing company based in southern China, Ruqi Travel, is expanding its services after getting investment from Guangzhou Automobile Group, Tencent, and Guangzhou Public Transport Group. The one-year old brand operates in the city of Guangzhou, and is about to start service in urban Foshan.

Related:

Meituan: The “One-Stop Super App” That’s Hungry for ExpansionArticle Jul 04, 2018

Meituan: The “One-Stop Super App” That’s Hungry for ExpansionArticle Jul 04, 2018

While these are just two companies, over the past two years there has been a significant increase in the number of ride-share apps attempting to enter the market. The article points out that second-tier ride-share apps may also have advantages that Didi does not.

Specialized apps in second-tier cities have close connections to the local area, and a higher probability of success in tasks such as obtaining license plates.

For ride sharing, service is still king, and smaller businesses are often able to provide better service both for passengers and drivers. Hexing Travel, for instance, has registered all their drivers as full-time employees, and provides specialized training in health, safety, and service skills.

Related:

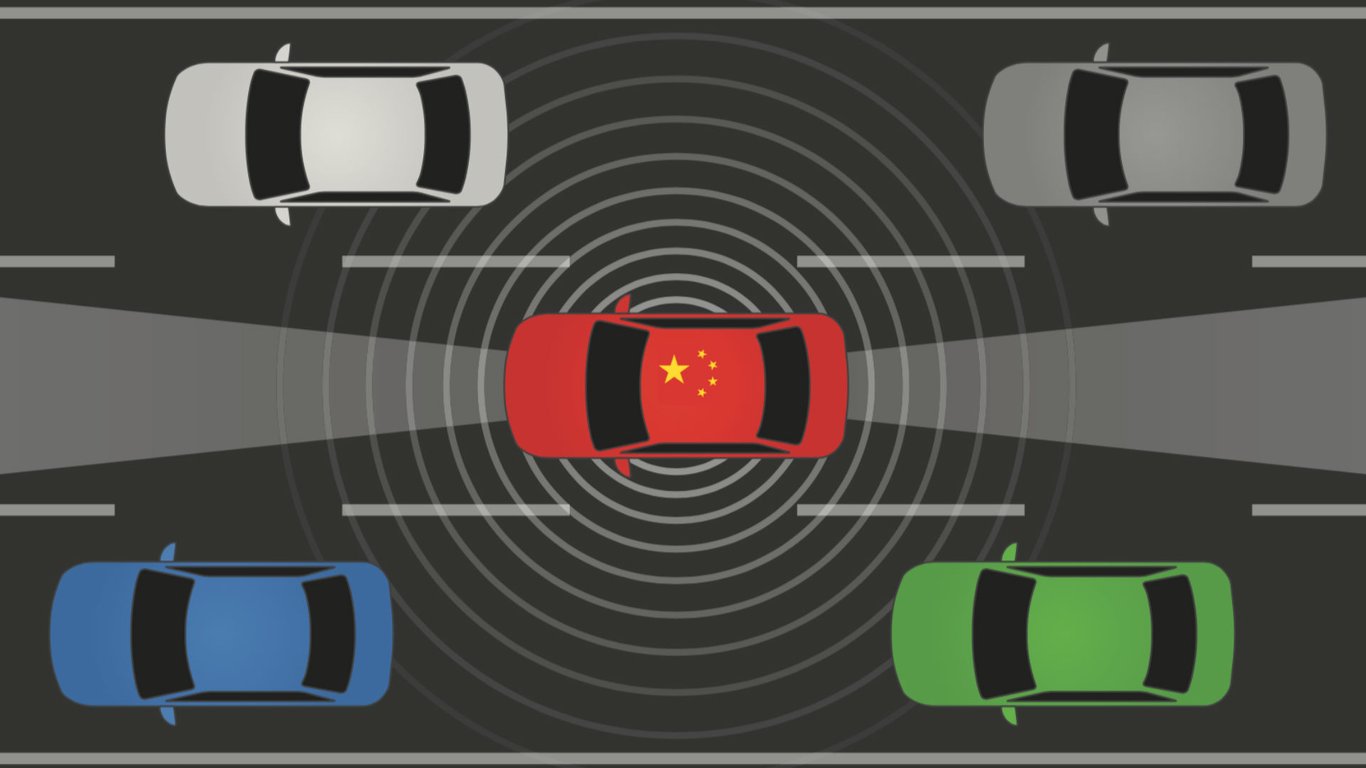

Is China Leading the Race Towards Mass Use of Self-Driving Cars?With major tech companies exploring autonomous vehicle technology and authorities open to testing, China is in an interesting position in the race for mass adoption of self-driving carsArticle Feb 14, 2019

Is China Leading the Race Towards Mass Use of Self-Driving Cars?With major tech companies exploring autonomous vehicle technology and authorities open to testing, China is in an interesting position in the race for mass adoption of self-driving carsArticle Feb 14, 2019

Meanwhile Didi is a huge company, and as a result faces major oversight and regulation that make it harder to keep up with the more nimble little guys. It also has faced issued with compliance costs, a tarnished public image in the wake of several grisly controversies, and a business model that struggles to account for the whole country.

The company had a watershed summer in 2018, during which several passengers were murdered by their drivers. Didi publicly apologized and implemented several safety features into the app in response — including a button that connects passengers to local police — but the news permanently affected public perception of Didi’s quality control and safety measures.

The company is constantly walking the tightrope between controlling costs and improving service, and if smaller providers are able to outdo Didi in customer experience, we may see a mounting threat to Didi’s dominance.

Despite a growing threat to its dominance, Didi still holds the majority share in the market. In August, the China Transportation and Communication Information Centre released data on the national presence of 98 ride-share and car-hailing companies. Didi still led the list, established in 306 cities.

But with ride-hailing brands Wanshun in second place at 272 cities, and Shouqi in third at 141, competition seems to be on the rise.