Editor’s note: This article by Rita Liao was originally published by TechNode. It has been re-posted here with permission.

2017 has been an exhilarating year for China, which saw an army of entrepreneurs turn the country into a world leader in fintech, gaming, and the sharing economy. 2017 has also been a tumultuous year for the middle kingdom, where a government newly attuned to the power, and threat of the internet sent shockwaves through a range of tech sectors. To reflect on the past year, TechNode have identified a list of government moves in 2017 that have left lasting impact over the country’s internet space.

1. ICO ban

In September, China’s central bank declared initial coin offerings (ICO) illegal and called time on all fundraising activities involving virtual coins.

The ICO market allows startups to skip banks and traditional fundraising channels by selling digital tokens publicly. While the ICO uptrend is global, reports show that the demand has been predominant in Asia, especially China. In a country where investment opportunities are slim, ICOs took off at a breakneck speed for it provided an alternative investment and funding channel. About 70% of bitcoin miners are based in China, according to a survey (in Chinese) conducted by China’s state broadcaster CCTV.

The ICO ban was part of the Chinese government’s move to curb risks in the country’s fast-growing fintech systems, including the similarly rampant micro-lending online business (which has also faced crackdown in the past few months). The booming ICO market was “disrupting the socioeconomic order and creating a greater risk danger,” says the National Internet Finance Association of China.

The ban, however, has not stopped earnest Chinese investors from buying into ICO deals. According to the Financial Times, over-the-counter bitcoin sales rose from 5% before the ban to over 20% in November. Many Chinese ICO investors have subsequently relocated offshore to continue their businesses.

2. Centralized mobile payment

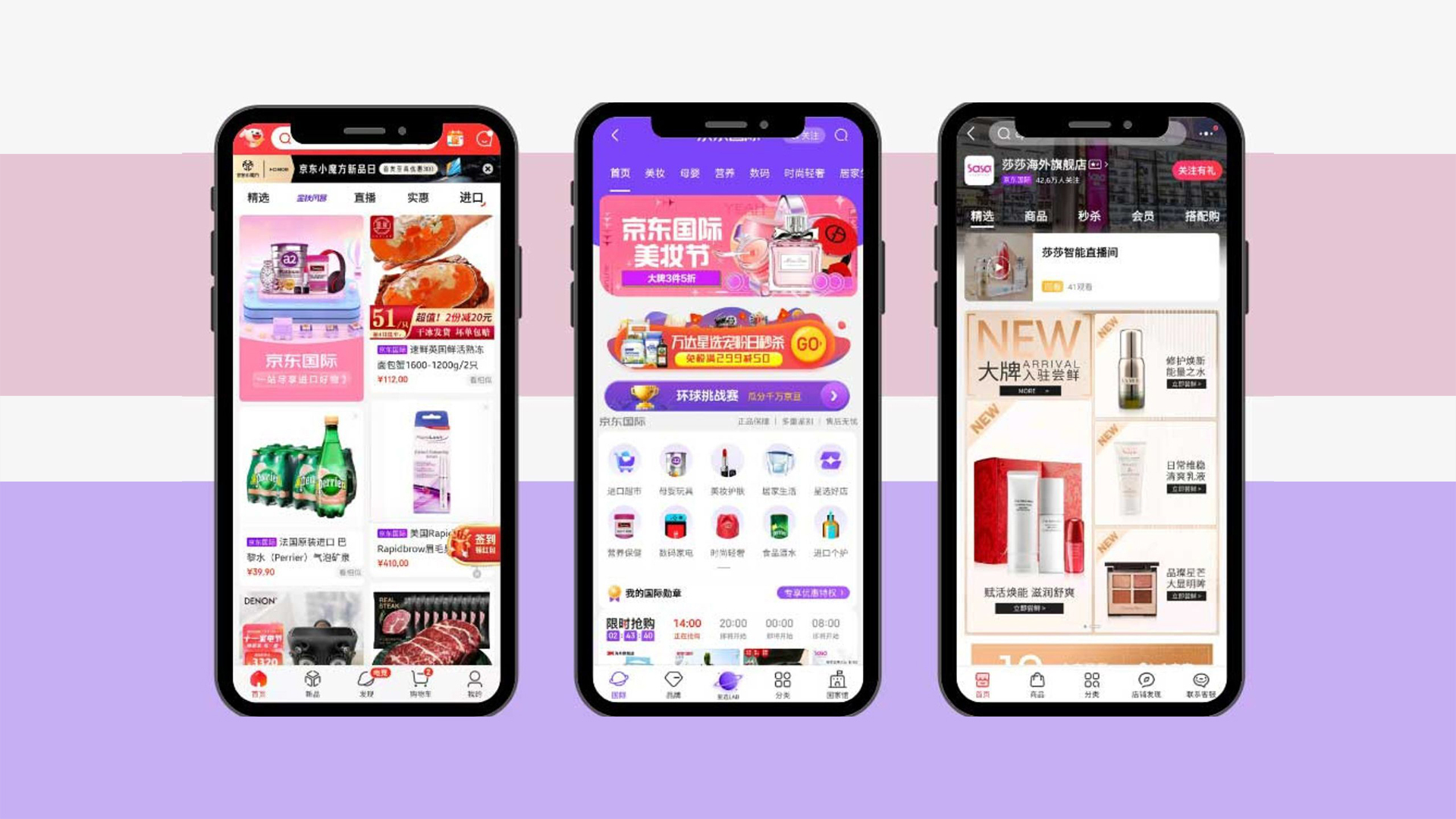

In August, China’s central bank took aim at mobile payments oligopolies with a clearing mandate: By next June, online payment companies must re-route all transactions through a newly established centralized clearinghouse.

This will force mobile payment groups to share proprietary transaction data with commercial banks and enable the central bank to monitor online payments directly without requesting data from processors.

![]() One China, Two Ecosystems: Alibaba vs TencentArticle Nov 20, 2017

One China, Two Ecosystems: Alibaba vs TencentArticle Nov 20, 2017

Cashless has become a new fashion in China. In 2016, China consumers spent an estimated $5.5 trillion through mobile payment platforms—most of which via Alipay and WeChat—about 50 times more than their American counterparts, according to a report by China Tech Insights. Growing internet penetration, affordable smartphones, and relatively cheap data have made mobile payment the answer to daily consumption in China.

The meteoric rise of third-party payment, however, makes traditional financial institutions wary. When a user makes a purchase through Alipay or WeChat, banks do not obtain payment details such as the merchant’s name and location. Online and mobile payments are a valuable source of data for things like targeted advertising as well as credit scoring, a newly minted system in China.

3. Cybersecurity law

In June, China ushered in a tough new cybersecurity law intended to tighten control over the speech and thought of its citizens and restrict global businesses operating in China. Previously, the Chinese government has focused its censorship strategy on maintaining the Great Firewall, an infrastructure restricting access to external sites unsavory by Beijing. Over the past two years, the focus has been to legalize content control and state access to private data, and June saw these efforts come to their full fruition.

Speech

Under the new cybersecurity law, any online information deemed damaging to the Communist party is illegal. To further discipline what netizens say online, the Cyberspace Administration of China issued new regulations in September over the country’s instant messaging apps, making group chat owners accountable for what is said in their space. Real-name registration for online platforms—a policy first introduced in 2014—was also enforced to its greatest extent this year.

Data

The law has also sent a chill through foreign companies as it requires all companies to store data collected in China onshore and allows data surveillance by China’s security apparatus. The law also asks foreign companies to offer IaaS (Infrastructure as a Service, a form of cloud computing that provides virtualized computing resources over the internet) in partnership with Chinese enterprises. China is too large a market to ignore, and foreign players who choose the stay have bent to Beijing’s behest. In June, Apple moved its China data to a state-owned company in the Guizhou hinterland and in November, Amazon sold part of its operating assets to a local Chinese partner.

Content

The popularity of new media forms, insiders suggest, challenges state-owned outlets who were once the centralized pipeline for news and information, and thus inevitably leads to state control. In September, China placed “maximum fines” on some of the country’s largest social media operators—Baidu’s online forum Tieba, Sina’s Twitter-like Weibo, partly owned by Alibaba, and Tencent’s WeChat—over failing to police content on their platforms under the new cybersecurity law.

The constant drip of media regulation has also worried the country’s content creators. In July alone, media watchdogs closed down several celebrity gossip sites, restricted the types of videos netizens can post, and suspended several online streaming services all on the grounds of “inappropriate content.”

In response to heightened censorship, tech companies hire human “auditors” to filter content deemed illicit by the government. The popular news aggregator Toutiao, which prides itself on its AI-driven recommendation algorithms, reportedly hires thousands of human censors. Chinese copycats of the hit survival game PlayerUnknown’s Battlegrounds went as far as modifying the games by adding core socialist elements like military drills.

China’s Latest Proposal to Block Internet VPNs Still Doesn’t Make SenseArticle Jul 12, 2017

China’s Latest Proposal to Block Internet VPNs Still Doesn’t Make SenseArticle Jul 12, 2017

VPN

China has long vowed to ban virtual private networks (VPNs), the technology that allows people inside mainland China to bypass the Great Firewall, but 2017 is by far the roughest year for the country’s VPN users. In January, the Ministry of Industry and Information Technology ruled that only authorized VPNs could be used in China, making most existing VPN services in China illegal. In July, netizens bemoaned Apple’s decision to remove VPN apps from its China App Store.

Control of information is not new in China, but Xi’s call for tightened ideological control has extended the government’s hand to the internet, an arena that was once more permissive. The sweeping cybersecurity measures rained down on China’s tech industry in the months leading to the country’s top-level party reshuffle in October, and many reckon they are here to stay.

“China stands ready to develop new rules and systems of internet governance to serve all parties and counteract current imbalances,” so said Wang Huning, the ideological mastermind behind the Chinese communist party, at the country’s top-level cybersecurity forum in October.

4. The visible hand

Beijing has planned to take 1% stake in Tencent, Sina Weibo, and Alibaba’s Youku Tudou, which will allow it to appoint government officials to the companies’ boards, according to the Wall Street Journal. The stake would also make it easier to enforce the new cybersecurity law, for it would allow easier state access to data from these private entities.

At another level, the government is one of the biggest clients for these large tech firms, who are helping to build grand-scale public projects ranging from public transportation, which intends to make life more convenient for the people, to a nation-wide surveillance system, which gives the authority an omnipresent grip over its 1.4 billion people.