Some popular content creators on the Chinese video platform Bilibili have announced that they are leaving the platform, an exodus many viewers and industry insiders attribute to Bilibili’s struggle to attract advertising revenue and competition from short-form video platforms like Douyin, China’s version of TikTok.

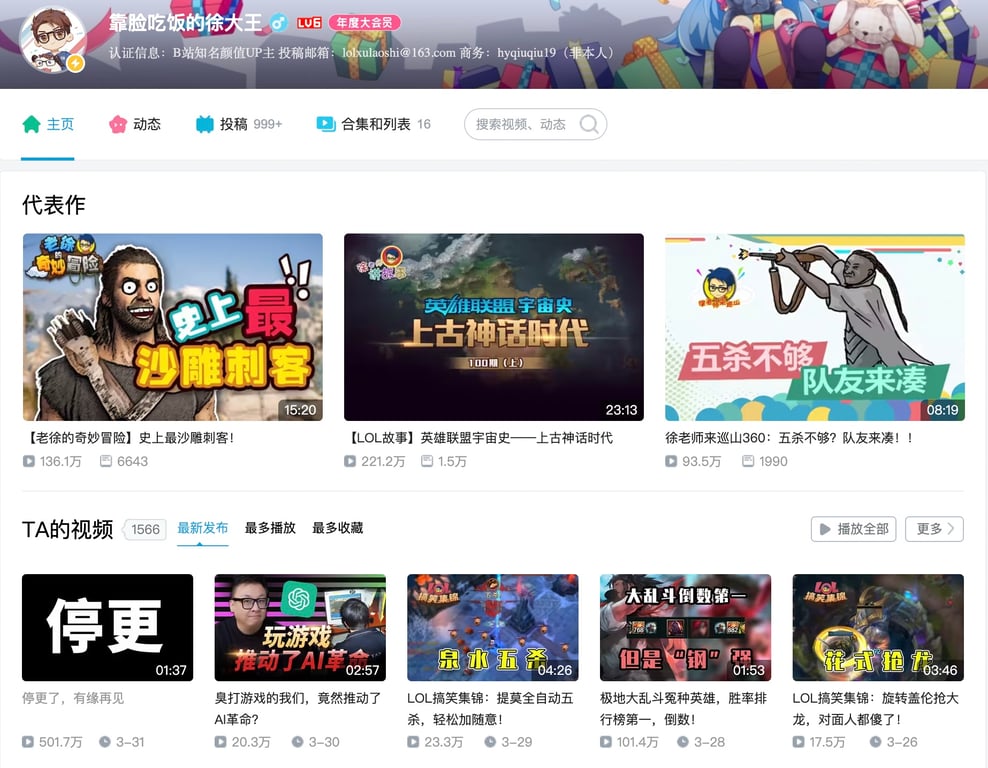

Two of the most high-profile creators to leave are Xu Dawang, who has 3.9 million followers, and –LKs–, who has 3.1 million. In 2020 and 2022, respectively, they were among Bilibili’s 100 most popular creators, according to their Bilibili profile pages.

Xu later clarified on Weibo that his decision was “personal business” that “had nothing to do with Bilibili,” and a Bilibili insider told Shanghai-based digital media outlet The Paper that the departures did not signify a larger trend. However, many online commentators still see the two high-profile departures as a worrying sign for the app.

Weakening Incentives and Ad Revenue

Bilibili content creators earn income through the platform’s incentive program and sponsored content. Some creators have told The Paper that their income has fallen by 30 to 90% in the past year, making full-time content creation untenable.

Although the incentive program, created in 2018, may not be a primary source of income for creators, it serves as proof of their skill and encouragement to continue creating high-quality content.

The Paper article revealed that Bilibili had changed its incentive program multiple times since last year, leading to complaints from many creators about reduced earnings from views and likes.

According to financial digital media outlet Jiemian News, the amount creators could make used to be as much as 30 RMB (4.3 USD) per 10,000 clicks. Now, they’ll receive only 5 RMB (0.73 USD) for the same level of engagement.

Bilibili $BILI.US 4Q results missed market expectations. Revenue grew by 6% YoY, the slowest pace since its IPO, to RMB61 billion.

— Smartkarma (@smartkarma) March 6, 2023

Non-GAAP net loss narrowed to RMB1.3 billion as gross profit margin slightly improved from last year due to cost-cutting. 1/ pic.twitter.com/1uoxlsBfe1

Sponsored content, on the other hand, plays a more significant role in the revenue earned by Bilibili creators.

Unlike on YouTube, where creators are paid through Google Adsense, a program that runs video advertisements before or during YouTubers’ content, most creators on Bilibili partner directly with advertisers to create sponsored content. (These partnerships happen on YouTube too, but it is often a secondary form of revenue.)

However, as internet advertisers spent about 6% less in 2022 than in 2021, it has been difficult for Bilibili creators, especially less famous ones, to find sponsors.

That means despite Bilibili paying creators 9.1 billion RMB (1.3 billion USD) last year, an 18% increase from the previous year, many creators are earning less than before.

Tough Competition

Bilibili has been around since 2009. With an origin in ACG (animation, comics, games) content, it was a favorite platform among China’s Gen Z for years. However, Bilibili was quickly upstaged by the short-form video platform Douyin soon after the latter’s launch in 2016.

The two have co-existed thus far, but the departure of high-profile Bilibili creators may signal that the Bilibili profit model is becoming unsustainable.

Bilibili’s total advertising revenue in 2022 was about 5 billion RMB (734.5 million USD), a 12% increase from the year before. However, that was much less than the 145% growth it saw between 2020 and 2021.

It also pales compared to Douyin’s 264 billion RMB (38 billion USD) advertising haul from last year.

1) ByteDance’s revenue rises 30+% in 2022 to $80B+ pic.twitter.com/llyosLMEVI

— Bay Area Times (@BayAreaTimes) April 3, 2023

Douyin reportedly has more than 700 million daily active users, while Bilibili has just 92.8 million. The short-video app also has a more sustained revenue-generation model in the form of lucrative livestreams. Douyin itself has in-app stores, making it a powerful and personalized ecommerce platform.

Bilibili is aware of its challenges and has made efforts to improve its advertising appeal.

In 2021, it launched a vertical short video section on its mobile app called ‘Story Mode,’ which boosted daily views and increased user engagement with advertising. However, it is uncertain whether the recent exodus of creators will have further implications for the platform’s future.

Cover image via Depositphotos