Like in the years preceding it, the unveiling of Malaysia’s budget in 2022 was an important event that would shape the Southeast Asian country’s economy for the following twelve months. But among the many announcements made by then-Finance Minister Tengku Zafrul, one stood out as a signal of the ruling government’s commitment to becoming an EV leader in the region: Full exemption of import duty, excise duty, as well as sales tax for EVs until the end of 2025.

With this legislative push guaranteeing significant savings for consumers, EV showrooms nationwide are busier than before, bustling with activity in stark contrast to the lukewarm interest before the tax breaks. And although the EV industry is typically represented by usual suspects — Tesla, BMW, and Kia — Chinese-made EVs are making serious inroads into the Malaysian market.

The numbers don’t lie. In 2023, Shenzhen-based BYD was th best-selling EV brand in Malaysia. Propelled by its three hallmark models Dolphin, Atto 3, and Seal, BYD surpassed German automobile powerhouse BMW, according to data from the Malaysian Automotive Association (MAA).

Similarly, in Thailand BYD has cornered the EV market, with its Atto 3 by capturing 31% of the country’s EV market share just a year after launch.

The vehicle is feature-packed beneath the hood; the top-of-the-line Performance variant produces around 230 kW of maximum power and 360 Nm of torque with an 82.5 kWh battery pack fueling the vehicle. BYD’s early days as a battery maker shine here. The battery pack is built into the chassis using proprietary technology, making it sturdier, less prone to corrosion, and safer in the long run.

In terms of other safety features, the Seal is backed up by the advanced driver-assistance system (ADAS) for cruise control calibration and crash prevention prompts.

All of these and more for the price of 199,800 RM (around 42,000 USD). The cheaper Performance model starts at 179,800 RM (around 38,000 USD). Comparatively, the Model 3’s Standard range is priced from 189,000 RM (around 40,000 USD)

So, while an entry level Tesla may be marginally cheaper, a higher-end Chinese EV might actually be better value for money. For most Malaysians that’s a strong enough proposition to sign on the dotted line.

“It’s just a great deal, really. I get that Tesla is a famous brand but what I want is a car that truly gives me the bang for my buck,” said Steven Goh, a marketing manager in KL eagerly awaiting the delivery of his pre-ordered BYD Seal.

Goh was deciding between the Model 3 and the Seal, and test drove both vehicles. He ultimately chose the latter after months of deliberation. “Don’t get me wrong, the Model 3 is a beautiful and functional car, but I thought that for the amount I was paying, it didn’t satisfy my wants in my first EV. The features, the space, the design, and after-service benefits. The Seal ticked all the boxes. It’s a logical choice,” he said.

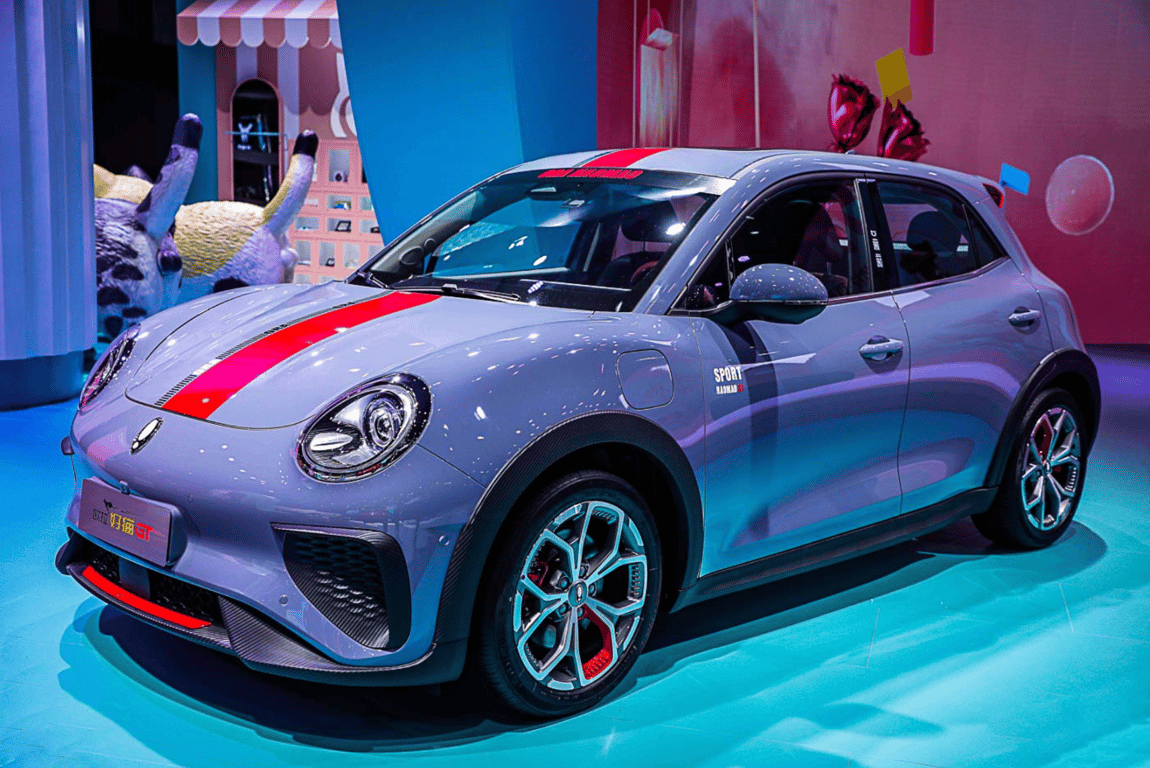

Despite its price-to-value USP (unique selling point), the BYD Seal isn’t an entry-level EV. By crossing the 150,000 RM threshold, it’s considered a splurge for the common Malaysian. This is where brands like Ora and Neta fill the gap. The funky, pastel-colored Ora Good Cat starts at 113,800 RM (around 24,000 USD) for the base model while the Neta V hatchback is priced at 100,000 RM (around 21,000 USD), making it the cheapest EV in Malaysia at the time of writing.

Between tax breaks, and the flood of new models from Chinese EV makers, Malaysia looks to be steering itself toward a future where owning an EV is not a luxury, but an increasingly prevalent, affordable choice.

Banner image via BYD Malaysia.