On July 5, Suzhou’s HB World — the first film theme park to be built by major film production company Huayi Brothers — held its opening ceremony. On Monday, it finally “grand opened” to the public.

The hype around this event reminds me of the difficulties my friends with kids had buying a ticket to Shanghai Disneyland back in June 2016, when that park had just opened and people queued up by the thousands to get a peek at Mickey Mouse and Buzz Lightyear. One year after opening, 11 million people had been to Shanghai Disneyland, Disney’s sixth theme park worldwide and one that was quick to turn a profit. 34 million people have visited the park as of this month.

The park’s success flies in the face of a prediction made by Wang Jianlin — founder of China’s largest real estate development company, Dalian Wanda Group — on CCTV program Dialogue in 2016: “Shanghai Disney will not profit in 20 years, as long as Wanda is here,” Wang said. A few months later, he himself visited the park for “observation and learning.” Last year, Wanda sold its own theme parks and hotels to Sunac China Holdings Limited, with the stated intent of refocusing on content production and film distribution.

So, what’s happened with China’s film theme parks since then?

Why film theme parks?

After decades of making films domestically and generating original IP, the film industry in China has begun to grow at an explosive pace. At the same time, competition in the industry has grown fiercer than ever.

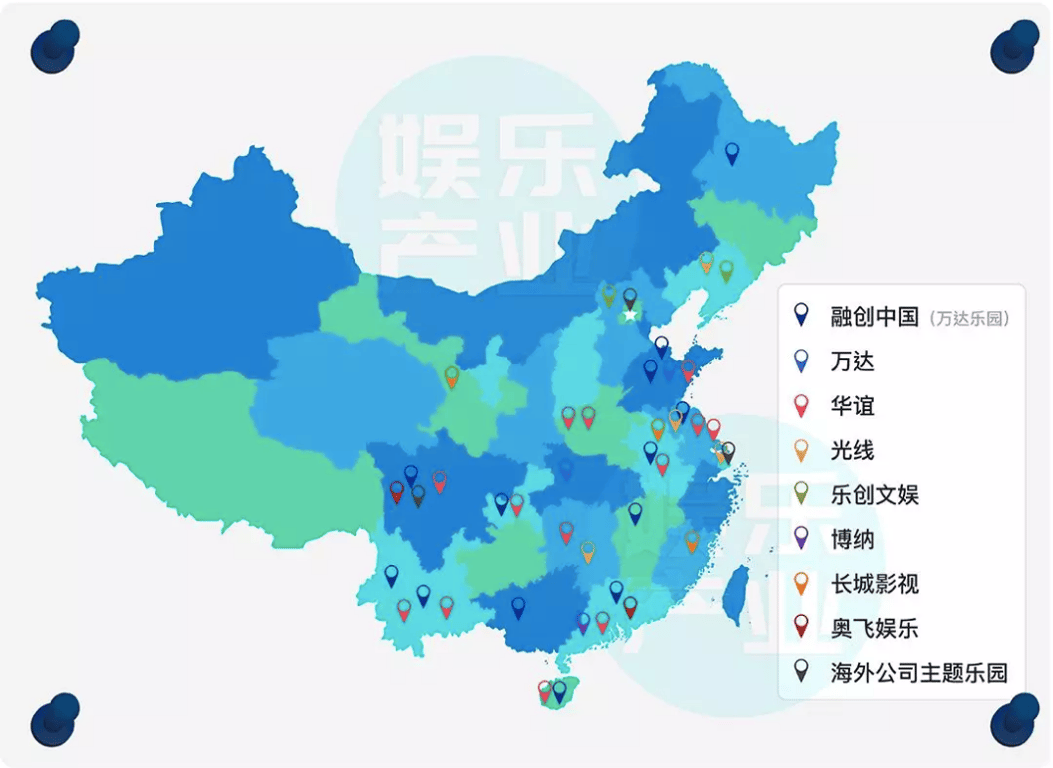

Despite exiting the theme park business, Wang’s Wanda owns 495 theaters and 4,383 screens in China, as well as American theater chain AMC and production company Legendary Pictures. Other major players in this space include Enlight Media, which owns 66.85% of online ticketing platform Maoyan, and Huayi Brothers Media Group, which was founded by (actual brothers) Wang Zhongjun and Wang Zhonglei in 1994 as one of the first private film production companies in mainland China. Despite its headstart, in recent years Huayi Brothers has seemed to lose its edge at the distribution end of the industry chain.

In an interview with trade publication Entertainment Capital (link in Chinese), Huayi Brothers CEO Wang Zhonglei expressed his confusion about the Chinese film market during the 2014-2015 period. In particular, he emphasized Huayi’s need to expand their business to hedge risk from investments made in their productions, especially following box office flops such as 2012’s Back to 1942 and 2016’s The Wasted Times.

However, as the production company behind box office successes such as Devils on the Doorstep, Journey to the West: Conquering the Demons, Detective Dee, and a string of Feng Xiaogang blockbusters, Huayi Brothers sits on quite a bit of widely-known, original content with strong market value waiting to be dug out. How to maximize the value of their IP after the production is done and the movies have been released is a question that not only Huayi, but all film production companies in China seem to be asking themselves.

By way of an answer, in 2014 Wang Zhongjun introduced a strategy that he called “De-Film-Unitary”, designed to steer from films to what he termed “real scene entertainment.” Two years later, he pointed to Disney — whose income from parks and resorts far exceeds that from their film productions — as Huayi’s benchmark when speaking to the Harvard Business Review about Huayi’s blueprint.

“Real scene” or real estate?

On Huayi’s official website, the HB World film theme park is categorized as “film real scene entertainment,” combining a film studio with a lot geared towards tourists (similar to HB Cultural City in Shenzhen), a “film town” combining IP and local culture (such as the Youth Yard in the far-southern Chinese island Hainan, where Feng Xiaogang’s Youth was filmed), and a “film city”: “a flagship combination product of ‘film town’ and ‘film world.’”

Both HB Cultural City and Youth Yard follow an “asset-light strategy” by which Huayi Brothers cooperate with real estate developers, who carry out the fundraising and construction. For these two ventures, Huayi Brothers only offers use of their IP and content.

In 2017, Youth Yard attracted over 2 million tourists, and made 82.84 million RMB (about 12 million USD), capitalizing off of the success of the film. (Youth, set during the Cultural Revolution, struck a chord among moviegoers born in the 1950s and ’60s, who would have been teenagers at the time.)

How Feng Xiaogang’s “Youth” Navigated Censorship and Delays to Find a Global AudienceArticle Jun 04, 2018

How Feng Xiaogang’s “Youth” Navigated Censorship and Delays to Find a Global AudienceArticle Jun 04, 2018

Mission Hills Group, the developer of Feng Xiaogang’s Movie Town (which contains the Youth Yard), was number one in real estate sales in Haikou last year, racking up 825 million RMB (about 123 million USD). Despite this strong early performance, however, many are questioning how long interest will last, especially as the hype around the film’s theatrical release fades.

In many cases, “real scene” film-related entertainment parks have turned out to be little more than behind-the-scenes real estate deals, in which local governments profit from property tax generated by tourism development while the real estate developers are allowed to build houses on land granted for tourism. But a lack of classic or fresh IP in such development projects leads to them aging poorly, which in turn will lead — some analysts think — to declining sales and a loss of value in the real estate itself.

IP: All or Nothing

Market research company Mintel’s report (link in Chinese) on theme parks in China in 2017 shows that 42% of urban consumers had been to a theme park that year, and that total theme park revenue will reach 89.2 billion RMB by 2020 with a 17.7% compound increase. OCT Parks and Fantawild Group (who own popular children’s TV show Boonie Bears) and Chimelong Group (which is building a Monster Hunt theme park) made it into the Top 10 theme park groups worldwide in 2017. However, only 10% of the approximately 2,700 theme parks built in China since 1989 saw profits in 2017.

Wanda Wuhan Movie Park, the only indoor film theme park in the world, closed 19 months after it opened at the end of 2014, despite receiving 3.8 billion RMB (almost 570 million USD) in investment. In the same CCTV interview in which he scoffed at Shanghai Disneyland’s prospects, Wanda CEO Wang Jianlin questioned the high cost of the Disney park, which was built for a whopping 5.5 billion USD. Maybe the question Wang should have been asking himself is: why has Disney opened just 6 theme parks in the past 63 years, instead of opening 13 in the last 5 years, as Wanda did?

It’s not difficult to invite the best teams to design and build a park, as long as there is cash. But serialized IP that connects to guests — franchises such as The Lord of the Rings or Harry Potter — is still incredibly rare, and something that Chinese production companies interested in theme parks are eager to cultivate.

Which brings us back to HB World, and its grand opening earlier this month. The new park — 100% owned and operated by Huayi Brothers — includes sections themed around representative works like Detective Dee (a whodunnit franchise set during the Tang Dynasty), Assembly (a popular Chinese Civil War picture),and If You Are The One (a Feng Xiaogang-helmed romcom from 2008).

How many Chinese movie lovers and families will be willing to shell out 30 bucks to see a recreated Tang Dynasty palace, a northern Chinese town from the ’40s, or Hokkaido-style streets remains to be seen, and might determine whether Huayi Brothers will be able to reclaim the lead in this round of the “real scene” theme park battle.

One promising sign: there is already a fake HB World website, which might mean that some people do see hope in the prospect of China building a film theme park around its own, homegrown intellectual property.

Find out what HB World is like inside here:

Photos: Inside Suzhou’s New HB World Film ParkArticle Jul 25, 2018

Photos: Inside Suzhou’s New HB World Film ParkArticle Jul 25, 2018

—

Cover photo: HB World by Thana Gu for RADII

You might also like:

Too Much Magic: A Day at Shanghai Disneyland’s One-Year AnniversaryArticle Jun 21, 2017

Too Much Magic: A Day at Shanghai Disneyland’s One-Year AnniversaryArticle Jun 21, 2017

How Feng Xiaogang’s “Youth” Navigated Censorship and Delays to Find a Global AudienceArticle Jun 04, 2018

How Feng Xiaogang’s “Youth” Navigated Censorship and Delays to Find a Global AudienceArticle Jun 04, 2018

Meet the New Chinese Members of the AcademyArticle Jul 02, 2018

Meet the New Chinese Members of the AcademyArticle Jul 02, 2018