Amidst its recovery from a previous government crackdown, the world’s largest gaming market is facing another wave of uncertainty, as Beijing unveiled new gaming regulations aimed at tightening controls over the Chinese online gaming industry, which triggered a massive selloff of the country’s major gaming stocks by panicked investors.

The National Press and Publication Administration (NPPA) announced a set of draft rules last Friday to curb excessive in-game purchases. Once in effect, games will be required to impose a cap on how much players can top up their accounts and alert users of their irrational spending with pop-up notifications.

Rewards that entice players to invest money, such as daily logins and first-time or consecutive top-ups, are banned, as well as auctions, speculations or overpriced transactions of virtual gaming items offered or endorsed by game publishers. Additionally, developers must ensure game content meets the necessary guidelines.

“The removal of these incentives is likely to reduce daily active users and in-app revenue, and could eventually force publishers to fundamentally overhaul their game design and monetization strategies,” said Ivan Su, an analyst at Morningstar, quoted by Reuters.

The rules, although still in their early stages and subject to public input and subsequent modification, have dealt a swift blow to the industry and its players, wiping tens of billions of dollars off their market value.

Tencent Holdings saw its shares tumble more than 12% on Friday, while its top rival, NetEase, took a 25% hit; shares of Bilibili, a social media and video streaming site that derives a portion of its revenue from online gaming, fell about 10%. Many more companies were severely affected.

Vigo Zhang, vice president of Tencent Games, said the company has been strictly implementing regulatory requirements since 2021, adding that the game hours and consumption of minors on Tencent’s games are at a historically low level.

“The new rules are not expected to fundamentally change business models, operational rhythms or other core elements of online video games,” Zhang said.

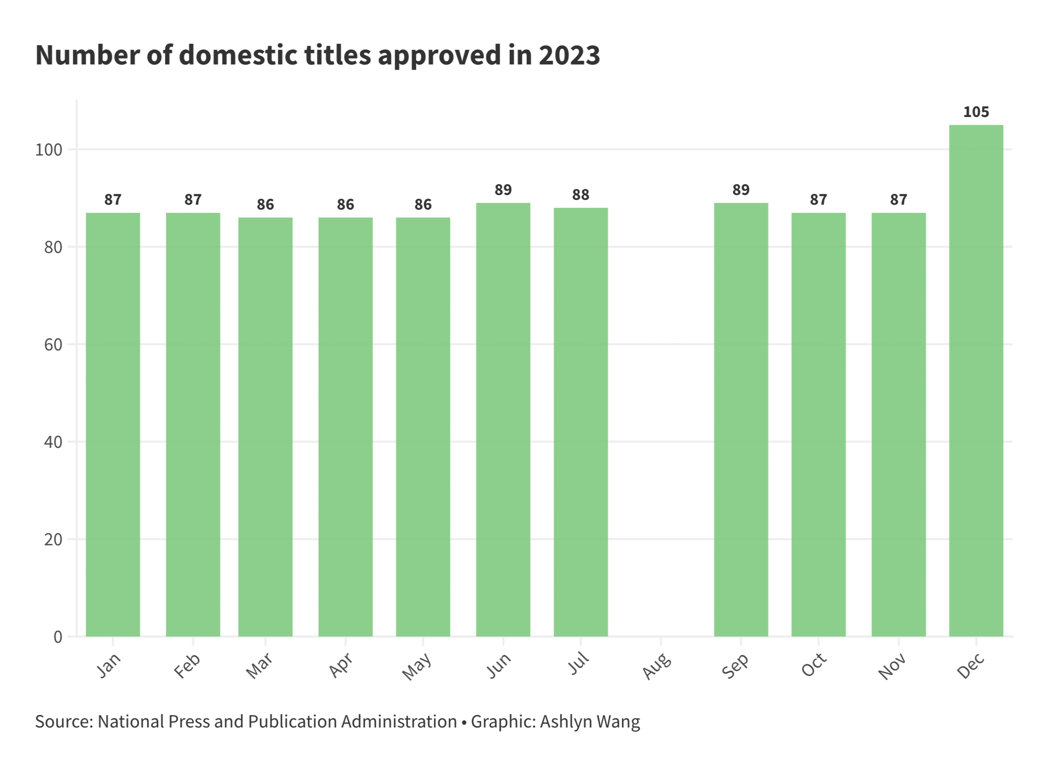

In the wake of Friday’s turmoil caused by its sweeping move and the fear spread across the Chinese gaming market, the NPPA moved to soothe concerns by greenlighting a batch of new titles — 40 imported ones on Friday and 105 domestic on Monday — pushing this year’s total number of approvals to 1,075, the highest since 2021. In the preceding two years affected by the industry freeze, annual approvals were 748 and 512 respectively.

A statement was also released on Saturday, in which the administration pledged to “carefully study” the views of all parties and make improvements, specifically referring to the rules involving excessive spending and the prohibition of forced duels between players.

NetEase responded over the weekend that it believed the proposed version was mainly to compensate for the previous lack of management in relevant areas, and would not substantially impact its business.

After a four-day closure of the Hong Kong market, on Wednesday China’s tech giants regained some of the ground they had lost. Tencent shares rose by 4%, and NetEase shares jumped more than 11%. It’s worth noting that the latter’s surge may be partly attributed to domestic media coverage earlier this week of its potential reunion with Blizzard to relaunch the U.S. company’s hit games in China.

Domestic media outlet TMTPost said the new regulations would have a primary influence on small and medium-sized game makers, more so than on industry leaders like Tencent and NetEase.

According to a gaming sector report released by the China Audio-Visual and Digital Publishing Association (CADPA) in mid-December, the country’s domestic game industry revenue in 2023 was 303 billion RMB (around 42.6 billion USD), up 14% year-on-year. The player base reached a new record high of 668 million.

But, despite the positive trends in the sector, the shadow of the prior slump continues to loom, as evidenced by stakeholders’ fierce reactions towards the new regulations.

The draft rules are open for public comments until January 22.

Cover image via liyuhan / Shutterstock