Yinuo Li is director of the China Country Office for the Bill & Melinda Gates Foundation, where she oversees a team that works with China’s public, private, and nonprofit sectors to address key domestic and global health, development, and policy issues. This article has been republished from the collection Get Smart on China with permission.

What do we really know about China’s engagement in Africa? In spite of the frequent warnings we hear from Western media outlets about Chinese neocolonialism, exploitation and collusion with corrupt despots, in truth we really don’t know very much about China’s impact as Africa’s largest economic partner. Or rather, we didn’t — until now.

The value of Africa-China trade has shot up from $13 billion in 2001 to $188 billion in 2015 — that’s three times that of Africa’s next biggest trading partner. FDI has also rocketed, from just $1 billion in 2004 to $35 billion in 2015. If this rate continues, and that seems more than likely, China will be Africa’s largest source of FDI stock within the next ten years. China is the second- or third-largest donor of aid to Africa, mostly in the form of concessional loans or export credits, and no other country finances more infrastructure in Africa. In the China Office, we firmly believe that this critical relationship has a major role to play in further promoting development across Africa and in helping the foundation to achieve its goals.

Recognizing just how important it is that we understand the relationship better, the China Office commissioned McKinsey to investigate and find out the reality of Chinese private and public investment in Africa. Focusing on trade, investment stock, investment growth, infrastructure financing and aid, the McKinsey team chose to look at eight African countries that together account for two-thirds of Sub-Saharan Africa’s GDP and represent half of China’s FDI in the region. In these eight countries, they interviewed over 1,000 Chinese firms and factories and over 100 senior African government and business leaders. After many months of careful research, their findings have at last been published in a report called Dance of the Lions and Dragons, and I’d like to tell you a little about them today.

The first challenge the McKinsey team faced was to work out just how many Chinese firms there are in China. This is a great example of just how little data is available about China’s investment in Africa, and how unreliable the data that does exist really is. For example, numbers from the Chinese government state that there are 210 Chinese firms operating in Nigeria. According to the Nigerian government, that number is just 83. The McKinsey team found 608. The same data for other countries is equally, if not even more, inaccurate. Extrapolating this trend across the continent, the report estimates that there are more than 10,000 Chinese firms operating in Africa.

Chinese companies can be found in a huge cross section of the African economy, with nearly one-third working in manufacturing, a quarter in services and a fifth in trade, construction and real estate. It’s also worth noting that this report finds that the idea of “China, Inc.”, a monolithic, state-coordinated investment drive across Africa is a myth; 90% of Chinese firms in Africa are privately owned. While 50% of investment by Chinese firms is from state-owned enterprises (which tend to be bigger and therefore able to invest more), only 15% of financing is linked to the Chinese government.

Benefits and challenges

The report identifies three main benefits to African countries from Chinese investment:

1. Job creation and professional development

Contrary to the oft-heard accusation that Chinese firms employ only or mostly Chinese workers, the report found that at the 1,000 firms interviewed, 89% of employees were African. If this holds true for all the 10,000 Chinese firms in Africa then that means several million jobs for local people.

Nearly two-thirds of Chinese companies offer their employees some form skills training. Half of all construction or manufacturing companies, which need skilled labor, offer apprenticeship training.

2. Transfer of new products and technology

In the last three years, 48% of Chinese firms have introduced a new product or service to the local market, e.g. smartphones for less than $50. 36% have introduced a new technology, often adapted specifically for the African market, e.g. selfie technology that better captures darker skin – you can see from the pictures below what a difference it makes!

3. Financing and developing of infrastructure

Chinese construction firms account for 50% of Africa’s international engineering, procurement and construction market and are valued by African governments for their efficiency of cost and rapid delivery.

Naturally there are still serious challenges, including, for example, the fact that only 44% of managers in Chinese companies are local Africans, or that, by value, only 47% of sourcing by Chinese firms was from African ones. There have been cases of labor violations or environmental damage by Chinese firms, which are likely to fuel existing negative perceptions of Chinese investment in Africa. These are areas where there needs to be real improvement. However, the report makes it very clear that, on the basis of the data, Chinese engagement represents a “strong net positive for Africa’s economies, governments and workers”.

Partnership archetypes

One thing that makes this report particularly interesting is that it categorizes the different ways in which African countries are partnering with China. By looking at the strength of the bilateral government relationship between each country and China, as well as the depth of their economic engagement with Chinese investors and businesses, the writers were able to identify four archetypes of partnership.

South Africa, for example, is a robust partner because it has a high level of economic engagement (investment, trade, loans and aid) combined with a clear China strategy. Nigeria, meanwhile, has strong and growing links with China, although not to the depth of South Africa, but no clear strategic plan for how it works with China, making it a solid partner. Angola is an unbalanced partner because its partnership has been narrowly focused (mostly on oil in return for infrastructure and financing). Cote d’Ivoire, however, is classed as a nascent partner as its partnership with China is only just starting out and no model has yet been established.

Recommendations

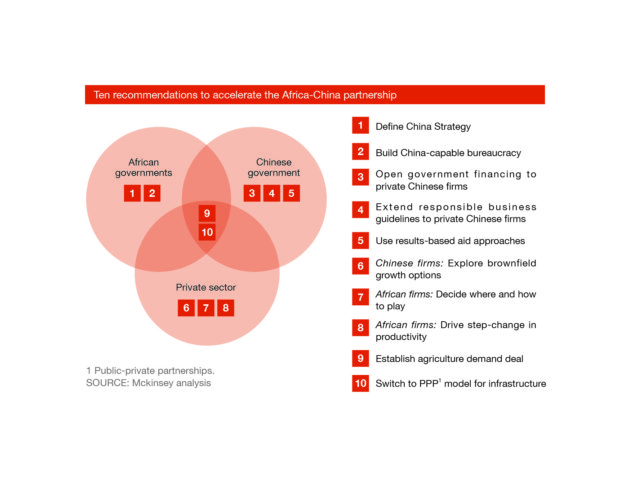

Based on the evidence collected and given the considerable benefits to African economies from partnership with China, the McKinsey team made a number of recommendations for deepening and accelerating the relationship in ways that will most benefit African economies and citizens:

In the China Office, we, just like Bill, strongly believe in China’s potential as a development partner for the rest of the world, and particularly for Africa. At the core of the China strategy are our efforts to work with Chinese stakeholders from both the public and private sectors, in order to help China take up that role as a leader in global development. This report will help us to better understand the dynamics of this hugely important relationship and strategize on how best to leverage it. Please do take a look at the full report — it makes for a fascinating read!

Cover image: Chinese and Senegalese construction workers (One.org)