On December 31, one of China’s biggest pop stars took the stage for Bilibili’s New Year’s Eve Gala. Before millions of mostly post ’90s-born viewers, Luo Tianyi played the guzheng, a classical Chinese stringed instrument, live on the streaming platform.

The catch, however, is that Luo can never actually play “live” — she is a virtual pop star created by a Shanghai technology company to perform in front of thousands of fans.

With upwards of three million followers on Chinese social media platform Weibo, Luo and her fellow “virtual idols” are not only changing the music industry. They’re also cash cows, raking in millions of Renminbi from big brands and laying the foundation for a new kind of online influencer made not of flesh and blood, but of pixels.

“Virtual influencers” have been a buzzy trend in the viral marketing world since the first appearance of Lil’ Miquela, a social experiment and eventual influencer who inspired speculation of a possible virtual influencer craze as early as 2017.

But in China, the trend is only starting to manifest — and a number of factors, both cultural and technological, mean that it’s one that is fast picking up speed.

Anime Enthusiasm

To understand “virtual influencers,” one has to recognize that their predecessor, the “virtual idol,” was what made audiences familiar with the trend. Though the first virtual pop star dates back to as early as 1996 with Japan’s Kyoko Date, it was another Japanese idol — Hatsune Miku — that turned the trend into a phenomenon. To date, Miku regularly sells out shows on her frequent tours in mainland China.

Miku proved so popular in China that a Shanghai technology company decided to create their own domestic spin on the trend. Enter Luo Tianyi, a silver-haired, vocaloid-powered pop star whose hit songs are penned by a throng of writers and dedicated fans. Of the 40 or so virtual idols estimated to be active in China today, Luo is without a doubt the most successful, filling stadiums with throngs of fans who pay hundreds of dollars a ticket to see the virtual star.

“There really isn’t much of a difference between virtual idols and real idols,” says Chai Ayu, VP of Chaodian, a subsidiary of Bilibili. “As long as they provide positive values, they are the idols that Chinese fans will love.”

It wasn’t long after these idols’ creation that brands saw their lucrative potential, and the all-virtual pop idol morphed into a new identity: the all-virtual influencer. Luo Tianyi herself became a brand ambassador for Pizza Hut, and began appearing in commercials for KFC and Vitasoy.

Chai says that Luo’s fandom is largely comprised of China’s Generation Z, or those born post-‘90s and ‘00s — a target demographic for many brands. He says:

“Many brands can smell future possibilities. They’re eager to try working with emerging [intellectual property], to occupy the minds of young people more quickly.”

It’s worth noting that the idols and influencers mentioned here don’t actually utilize any artificial intelligence. They are essentially pre-programmed, 3D computer-generated models that use motion graphics and a team of skilled writers to keep the wheels in motion.

It’s not a coincidence that these idols and influencers bear a resemblance to anime characters, either. In China, there is a diehard enthusiasm for ACG (anime, comics and games) within a niche but fast-growing community — estimated at more than 300 million people by the end of 2016, and worth 600 billion RMB (90 billion USD) in China by 2020, according to one Shenzhen-based consultancy firm.

Related:

Communist Youth League Removes Virtual Idol Project After Feminist CriticismThe Youth League’s latest attempt to connect with the kids has become a lightning rod for Chinese feministsArticle Feb 18, 2020

Communist Youth League Removes Virtual Idol Project After Feminist CriticismThe Youth League’s latest attempt to connect with the kids has become a lightning rod for Chinese feministsArticle Feb 18, 2020

Jing Daily suggests that unlike their hyper-real Western counterparts, Asian virtual influencers “[stop] short of precisely replicating human features” to preserve the “sense of fantasy” that is required to connect with their audiences. The cartoonish aesthetic also offers a workaround for any uneasy feelings caused by the “uncanny valley,” a term invented by computer scientists in the 1970s for computer-generated models that resemble real humans too closely.

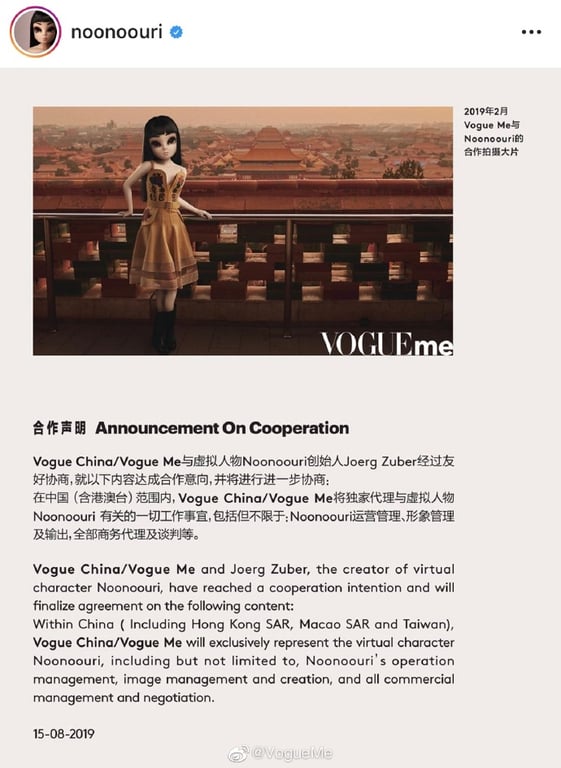

Increased Investment in Influencers

This “sense of fantasy” might explain the appeal of Noonoouri (known as “努努Noonoouri” to her growing Chinese audience). An “18-year-old model living in Paris” with supersized eyes and smooth skin, her online clout helped land her as a brand ambassador for TMall Luxury Pavilion last year. Though she only has only 14,000 followers to date on Weibo, Vogue China saw her potential and signed her as the first virtual model to be exclusively represented by them within China.

Image: Weibo

By comparison, China’s first homegrown virtual influencer only surfaced in early 2019. Online magazine Voicer introduced Poka (or “PokaPoka” on Instagram) via an interview on their website, quizzing the virtual model — who was credited as an “intern” at the magazine — on her favorite foods and fashion trends, and even publishing some of her “drawings.” Poka has since lent her likeness to brands such as Gucci, Canada Goose, and independent fashion brand Shushu/Tong.

“The rewards are obvious,” says Raymond Zhang, Strategy SVP at Mogu, a fashion ecommerce platform based in Hangzhou. “Virtual [influencers] can work nonstop. They don’t have any real ‘people’ problems, they can just be selling products and working 24/7.”

Although virtual influencers remain a new phenomenon in China, this year alone has seen an array of new names appear in the field.

Xiao Wanzi (小完子) — a virtual marketing “persona” created by highly successful cosmetic brand Perfect Diary — provides an interesting case study that takes advantage of the messaging platform WeChat, an app indispensable to life in China. Dozens of “Xiao Wanzi” accounts with identical profile pictures — each run by a Perfect Diary employee — offer makeup tips, generate discussion, and moderate private WeChat groups for the brand’s closest fans.

And during Shanghai’s first-ever all-online Fashion Week, TMall revamped their virtual influencer Aimèe — who debuted during last year’s 11.11 shopping festival — to entice users into buying Prada and Miu Miu products while browsing the stream. TMall announced that the model will be featured in an upcoming series of short videos and live broadcasts in order to reach younger consumers.

TMall’s virtual influencer, Aimée, in Prada and Miu Miu (image: courtesy TMall)

Apps: The Next Generation?

For a hot minute in 2019, a South Korean avatar-making app had taken over Chinese social media feeds. With Zepeto, users could swap photos with their real-life friends, and add background images from their own camera rolls. Some even published styling and wardrobe guides on social media platforms such as Little Red Book (小红书).

Related:

This Avatar Builder is Blowing Up on Chinese Social Media Right NowArticle Dec 05, 2018

This Avatar Builder is Blowing Up on Chinese Social Media Right NowArticle Dec 05, 2018

Aside from skin color and hairstyle, the avatars all had little variation — all bore cutesy wide eyes and smooth skin, as if part of Noonoouri’s extended family. But to some brands, these apps represented a marketing goldmine. Within weeks, Gucci had tapped real-life WeChat influencer Liaobuqi Daily (了不起日报) to place her avatar in a variety of locations listed in the brand’s travel guide, Gucci Places.

The popularity of avatar-making apps like Zepeto, as well as deepfake apps that face-swap ordinary people onto the bodies of celebrities, seem to indicate Chinese audiences are warming up to increasingly sophisticated digital likenesses. So in China, where over half of college-aged youth would choose “online celebrity” as their ideal career choice, could apps empower users to become online influencers themselves?

The answer to this might be more complicated than it appears. Zhang points out that much like virtual idols — which require a team of artists, animators and writers to even exist — their flesh-and-blood counterparts that sell products online are only one small piece of the puzzle.

“The important part of becoming a super successful [influencer] in China — and globally — is having access to products, to brands, to marketing,” he stresses. “It’s very difficult. You need to have a team that can support you from multiple perspectives.”

Related:

Kim Kardashian West Joins China’s Livestreaming Ecommerce Craze Ahead of Singles’ DayKim Kardashian made a guest appearance with top livestreamer Viya Huang, and sold out 15,000 bottles of her namesake perfume in minutesArticle Nov 08, 2019

Kim Kardashian West Joins China’s Livestreaming Ecommerce Craze Ahead of Singles’ DayKim Kardashian made a guest appearance with top livestreamer Viya Huang, and sold out 15,000 bottles of her namesake perfume in minutesArticle Nov 08, 2019

But Zhang acknowledges that China’s proclivity for apps and ACG might indeed make consumers more likely to follow a “virtual idol.” “People are big fans of this,” he says, “so I think people are more receptive to this idea of a ‘virtual KOL,’ or any type of virtual entertainer.” And indeed, as the internet becomes oversaturated with influencers — often called “key opinion leaders” (or KOLs) in China — and consumers risk becoming tired of them, some might argue that an artificial influencer at least drops the pretence of being genuine. As Lil’ Miquela put it in a 2017 YouTube interview: “Can you name one person on Instagram who doesn’t edit their photos?”

In the land of Meitu, market research, and manufactured pop idolatry, the lines between what’s real and fake are becoming increasingly blurred. And in what looks to be a not-so-distant future, the “uncanny valley” is leveling out. Users are warming up to digital likenesses, and brands clearly see an opportunity to capitalize on it.

Header image: Martina Monelli

Update: A previous version of this article stated that TMall’s virtual model Aimée was debuted at Shanghai Fashion Week AW20.