In May of this year, China notified the World Trade Organization (WTO) that it intended to regulate the manufacture, sale and use of electronic cigarettes. E-cigarettes have gone largely unregulated in China until now, in spite calls for action from various parties, with noticeably slow movement on the part of lawmakers. Anti-smoking activists and manufacturers alike praised the 68-page WTO statement as a major step in tobacco control and product safety.

The emergence of e-cigarettes over the past decade has presented a challenge for legislators around the world. Scroll through Chinese ecommerce site Taobao and you’ll find claims that they are a healthier, or even completely risk-free alternative to traditional cigarettes. (The science is inconclusive on both claims.) But in a country where an estimated 300 million citizens smoke, a product that properly regulated contains less toxins, could provide a new pathway to helping smokers quit for good.

Like traditional smokes, e-cigarettes are highly addictive, and are no magic cure. Their role would be as part of broad and effective public health policy — something that critics say China is still sorely lacking.

Anti-smoking banners on display in Beijing during World No Tobacco Day 2015

Though the country has long indicated its commitment to tackling smoking, are strong economic interests, including an expanding state-owned enterprise, slowing progress? One possible indicator is that advertising for traditional cigarettes is reportedly on the rise, with China’s tobacco control watchdog recently issuing a warning over the issue (link in Chinese) — pointing out that such ads were actually banned in 2015.

The future certainly seems hazy — and a booming electronic cigarette industry is a major contributing factor.

Lighting Up Electric

Whether e-cigarettes could actually play a role in reducing the number of smokers — and smoking-related deaths — or not, is of growing importance to China. The country has few public health issues as pervasive and pressing as tobacco smoking. Smoking-related illnesses consistently top the list of so-called “preventable diseases,” and the high cost of these health issues is putting pressure on an already strained state apparatus. (A 2011 study put that cost at around 22.7 billion USD, or around 0.7% of China’s GDP.) Today, it’s estimated that 1.1 million people die from smoking-related illnesses each year.

China has indicated its commitment to addressing smoking as a public health issue in a number of ways over the past 20 years. The government signed up to the World Health Organization (WHO) Framework Convention on Tobacco Control as early as 2003, officially implementing its recommendations in 2006. These included education and public awareness campaigns, a commitment to regulation of “contents of tobacco products” — an issue associated with so-called “fake” cigarettes, which contain higher levels of nicotine and carbon monoxide, along with other impurities such as insects and even human feces — and “protection from exposure to tobacco smoke.” (That 0.1 in the 1.1 million deaths above? It represents an estimated 100,000 people who die annually from secondhand smoke.)

There has been change, but it has come slow. Campaigners have long criticized perceived close ties between regulators and industry as a block to effective strategizing.

Until just last year, both the lucrative state tobacco monopoly — which licenses cigarette manufacturers, although, crucially, not e-cigarette manufacturers — and tobacco control were both administered by the same government department: the Ministry of Industry and Information Technology.

Though a new health commission has since been formed to run tobacco control, there are still potential conflicts of interest at play.

Tobacco is Big Business

Hot on the heels of that WTO document, Chinese Tobacco International (CTIHK) made an impressive debut at the Hong Kong Stock Exchange in June of this year. Share value quadrupled in only the first three weeks — a strong, if not unprecedented, performance at a time of uncertainty in the SAR marketplace.

CTIHK is a subsidiary of China’s state-owned tobacco monopoly, representing Chinese-produced cigarettes internationally. The majority of product goes to Southeast Asia, but new markets are emerging along the Belt and Road. The foreign market for Chinese cigarettes is currently valued at around 722 million USD, according to Financial Times. Tobacco is big business, and investors want a piece of it.

Related:

Will China’s Dreams of Industrial Cannabis Production Go Up in Smoke?Chinese companies are flocking to the fast-growing cannabis industry – but that interest is at odds with the government’s strict stance on weedArticle Apr 15, 2019

Will China’s Dreams of Industrial Cannabis Production Go Up in Smoke?Chinese companies are flocking to the fast-growing cannabis industry – but that interest is at odds with the government’s strict stance on weedArticle Apr 15, 2019

Is it possible to reconcile the huge economy of the smoking industries with the need for strong anti-smoking policy, or will money ultimately take priority over health? “It is certainly the case that the Chinese government has long prioritized what it sees as the economic benefits of tobacco over public health concerns arising from tobacco consumption,” says Dr. Eric Feldman, an expert in medical ethics and health policy.

Writing in 2016, he noted:

“Tobacco consumption in China is extremely high, tobacco control policies are weak, and there is no sign that smoking rates in China are decreasing at a significant pace.”

Strong rhetoric and commitments made to international frameworks are a positive step, but while the tobacco industries are so profitable, smoking cessation is unlikely to gain real traction, and market expansion contradicts the promise of a smoke-free China.

Hard Policy, Soft Power

One of the country’s best-known role models for smoking cessation is actually President Xi Jinping, who quit some time in the 1980s, and has been praised by WHO for leading by example.

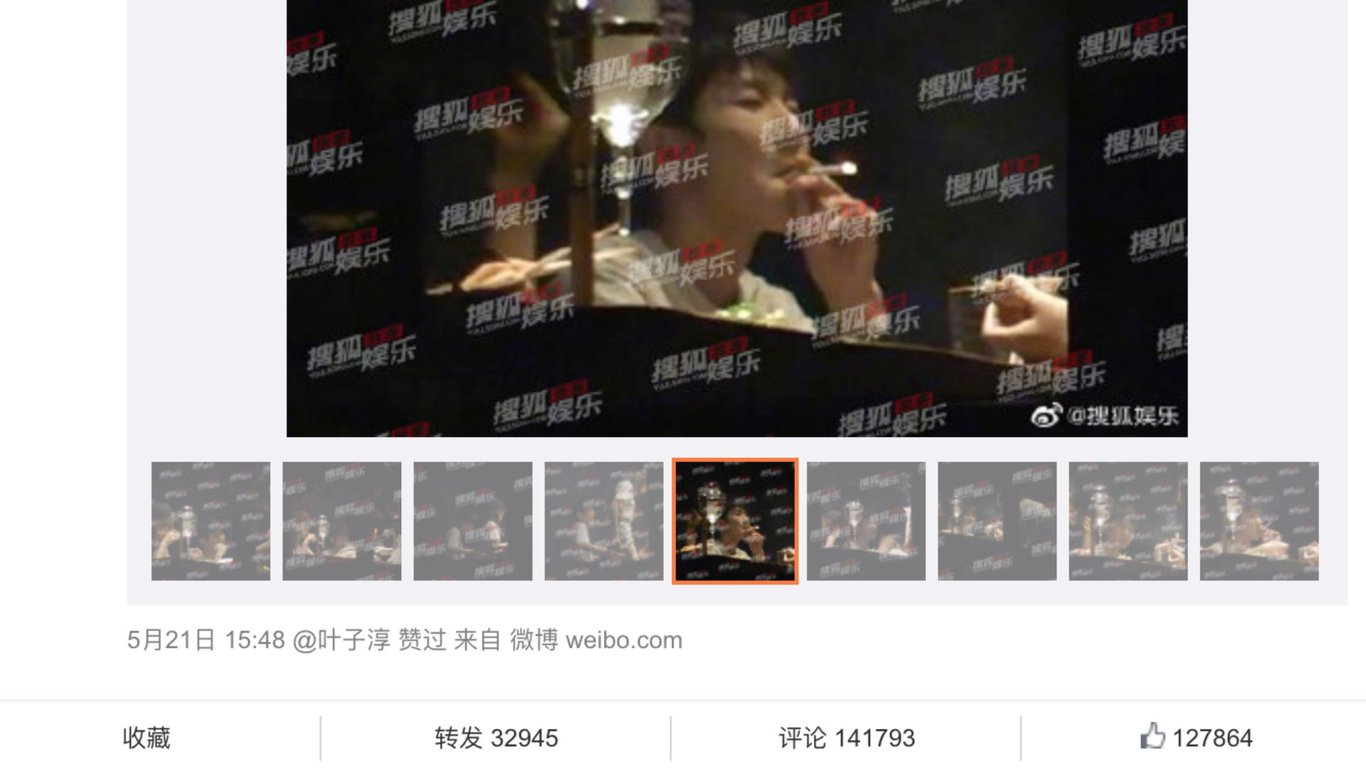

The “good behavior” of public figures is seen as a soft power tool in educating the population, particularly young people, and those who skip the script are met with retribution. Teen idol and TFBoys member Wang Yuan’s career is reportedly in the balance after being photographed smoking at an event in Beijing.

Related:

Forget the Trade War, All China Can Talk About Right Now is Smoking Pop IdolsA TFBoy has been spotted smoking and the Chinese internet is going crazy about itArticle May 23, 2019

Forget the Trade War, All China Can Talk About Right Now is Smoking Pop IdolsA TFBoy has been spotted smoking and the Chinese internet is going crazy about itArticle May 23, 2019

It set the Chinese internet ablaze; some were angered by his actions, whilst others claimed he was treated too harshly.

Indeed, Wang is hardly alone.

“Smoking is everywhere,” says James Ma, a creative industries worker in Shanghai. He has tried to quit several times, but finds it hard, and sees “cutting down” to be a more realistic target. Smoking is not allowed in his office, but colleagues gather outside his building for regular breaks, something he sees as unavoidable with his long hours. On weekends, Ma’s favorite bars and clubs are crowded with people smoking, despite the ban on smoking indoors. “If the bar is upstairs, everyone will stand in the stairway,” he says, “so walking to the entrance you pass through a crowd of smokers.”

Chinese men smoke in a non-smoking area at Guangzhou South Railway Station

Cigarette smoking is difficult to avoid in many walks of life, even for those who don’t smoke. Susan Luo, a Sichuan native also living in Shanghai, remembers her grandfather being a heavy smoker from an early age. He died two years ago of lung cancer, but at the ripe age of 82. Thinking of him, Luo can see how some people still fail to see smoking as a health risk. “I don’t think he ever thought about quitting,” she says.

The overall effectiveness of China’s national anti-smoking strategy seems to be lacking. Public awareness on the dangers of smoking is as low as 25% nationwide. This in turn inhibits enforcement of smoking restrictions. Bans on smoking indoors have been introduced in major cities including Beijing, Shanghai, and Guangzhou — but hit up your local karaoke bar, restaurant or store in any of these cities, and you’ll no doubt encounter smoking.

The Way Forward?

Could e-cigarettes be a meeting point between health needs and economic interests? Assuming that they are less harmful than traditional cigarettes, then there is a potential benefit to encouraging people to switch. The industry is tremendously profitable — with a market value of 4 billion RMB two years ago — and, according to research by CRI, capturing just 10% of current smokers would be worth over 100 billion RMB to the e-cigarette industry.

Despite being a Chinese invention, and with as many as 80% of the world’s e-cigarettes being manufactured in China, there is still relatively low usage or even awareness of them amongst the population, although this is likely to change in the coming years. Regulation is crucial if industry and health policy are to work side-by-side.

Showgirls with e-cigarettes at the first Vape China Expo in 2015

At present, e-cigarettes are not clearly defined in Chinese law. The WTO filing represents an intention to legislate, rather than being legislation in and of itself, and does not identify a clear path forward. As Feldman (2016) notes, are they be tobacco products or as pharmaceutical devices? He identifies “tobacco product” as potentially the easier category, but raises concerns that this would not stem the number of smokers overall, and may even lead to proliferation. Add to this that they would “be regulated by those responsible for the lax regulation of combustible tobacco products,” and it is easy to feel pessimistic about a smoke-free future.

New laws would require new licensing and product controls to be put into place, per the Tobacco Monopoly Law. It is unclear how long this could take, and it remains to be seen whether undue stress on productivity would be tolerated. It has taken years to get this far, it could take years more.

Related:

Photo of the Day: Hopelessly DevotedArticle Sep 27, 2018

Photo of the Day: Hopelessly DevotedArticle Sep 27, 2018

Disentangling public health from the interests of a highly lucrative industry is a global problem, though an especially complex one for China. Strong rhetoric and commitments made to international frameworks are a positive step, but while the tobacco industries are so profitable, smoking cessation is unlikely to gain real traction. E-cigarettes may well be a less harmful alternative that could reduce morbidity and alleviate pressure on the state — but they are a short-term fix, and the industry is unlikely to accept being phased out any more than manufacturers of traditional cigarettes have.

As new markets open, investors continue to profit, but at the expense of a population woefully undereducated on a risk that could cost them their lives.

Cover image: Pixabay