For foreign brands trying to compete in China, tariffs and taxes are a problem. If you’ve ever popped over to Hong Kong to buy a new phone or computer, you understand why: things are expensive on the Mainland. And, while new regulations removing tariffs on some imports may provide a measure of relief, global brands will continue to face a challenging price-setting environment. With prices inflated by value added tax (VAT) and import duties, global brands have a difficult-to-impossible time maintaining pricing consistency.

Foreign brands are harmed by higher China retail prices in two very real ways. First, taxes and tariffs insulate domestic brands from mid-market and low-end competition, making it essentially impossible to compete on price. Second, an informal network of re-sellers-cum-smugglers called daigou has sprung up.

Daigou purchase goods at retail (and very likely at wholesale with the consent of knowing sales managers looking to juice their stats) outside China and smuggle them into the country. The difference in margin between “the China Price” consumers pay at retail and global retail prices give daigou ample margin to sell below sticker price while making a comfortable profit.

Cosmetics, consumer electronics, luxury and household goods are all popular daigou categories, but really there’s a daigou market for everything from milk powder to Smart Toilets to guitars. The bulk of daigou sales occur online, primarily on Taobao and WeChat, but there are also brick and mortar daigou stores in malls like the Aegean Sea.

There’s a “daigou” market for everything from milk powder to Smart Toilets to guitars

Brands tend to employ two distinct strategies to combat the daigou problem. Option one is what I call the Warren Zevon approach: Lawyers, Guns and Money. Essentially, brands hire lawyers and investigators to track down and prevent sales, pleading with e-commerce platforms to regulate the sale of their brands.

The Lawyers, Guns and Money are generally brought in at the request of a China-based distributor or wholesaler in response to their frequent, loud and desperate complaints about “smuggling.” Long story short, it doesn’t work. Bringing Lawyers, Guns and Money to fight daigou is a hellish, preposterously ineffective game of whack-a-mole played with a very small and very futile hammer.

The second — and far more effective — approach is focusing on building your brand in China and being agnostic about where sales occur.

The brand building playbook should include the following:

- Having a local team on the ground that manages the sales and marketing process.

- Spending real marketing dollars to connect with consumers.

- Building strong e-commerce channels.

- Viewing retail as both a sales and marketing channel — a showroom where the experience of your brand captures the hearts and minds of consumers.

- Having a tracking system that captures purchases made abroad by Chinese consumers so you can use the data to market.

- Basically ignoring and/or tolerating daigou.

Luxury and lifestyle brands in particular seem to get the playbook. They spend dollars building out an offering that appeals to Chinese consumers, viewing everything they do in China as a form of marketing.

The shoe market is an excellent example and success story. Beijing, Shanghai and Shenzhen are dominated by global brands like Nike, Adidas and Puma, who have followed the branding-driven playbook to a tee. Local competitors like Li Ning have struggled to keep up, ceding market share and shedding revenue.

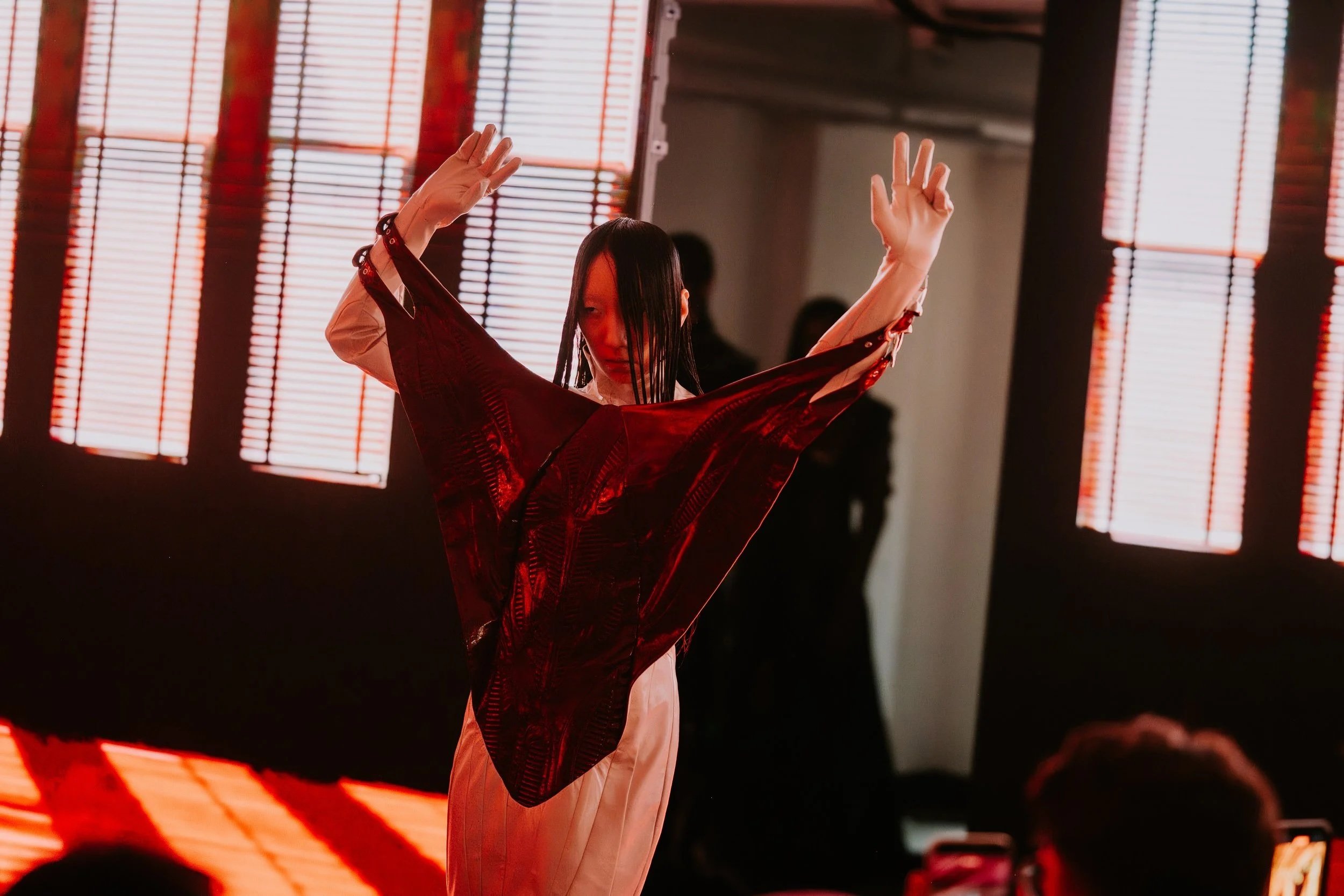

Radii favorite Kris Wu struts for Adidas

As a side note, I’ve always wondered when a particularly savvy global brand would create something like “an Uber of daigou,” a platform that turns smugglers into something like affiliate marketers or authorized re-sellers. (Full disclosure: I’ve actually pitched this idea several times only to be rebuffed by Lawyers, Guns and Money.)

In a nutshell, if you’re a company with a strong brand, the best strategy to beat the daigou and succeed in China is to connect with consumers and stop tilting at windmills. Let the windmills electrify your brand and leave the Lawyers, Guns and Money at home.

Cover image: SCMP