On April Fool’s Day this year, Mandopop superstar Jay Chou announced in a now-deleted Instagram post that 550,000 USD’s worth of his Bored Ape Yacht Club (BAYC) NFTs had been stolen.

The announcement probably didn’t have the impact he had expected: Because of the date the news broke, some wondered if the post was a prank. Additionally, many of his Chinese fans had no idea what BAYC was or why anyone would be willing to pay over half a million dollars for a JPEG of a hip ape.

For the uninitiated, BAYC is a collection of 10,000 non-fungible tokens (NFTs), each representing a single image of a unique Bored Ape dressed stylishly and affluently — but with a sense of halfheartedness and lethargy.

The NFTs embody a particular identity, a lifestyle that resonates with contemporary youth: carefree, fashionable, cynical, and fond of ‘lying flat.’

The idea for Bored Ape came alive in 2021, as its creators envisioned a future in which a group of ‘apes’ (referring to ‘brainless’ crypto investors) becomes billionaires by holding bitcoin, Ethereum, and other cryptocurrencies. Rich as they are, boredom hits them hard as well. Thus, these apes gather in a club, sharing memes and stories with other like-minded crypto apes.

BAYC is also a digital membership that is highly coveted by the celebrity community, with token owners including idols such as Paris Hilton, Justin Bieber, Madonna, and Stephen Curry. This membership component partially explains why the collection is desired by wealthy individuals and has received its fair share of attention outside the crypto community.

Despite the recent crypto crash that dragged down the token’s value, BAYC still ranks as one of the top three NFT projects by sales volume, with each being sold at a floor price of 84 ETH — equivalent to over 1 million RMB (around 143,500 USD), according to Cryptoslam. It’s worth noting that BAYC’s parent company Yuga Labs, which reached a jaw-dropping 4 billion USD valuation less than a year after its launch, also owns other top-tier projects, such as Cryptopunks and Meetbits.

Buying a BAYC NFT means that one owns the commercial rights to the unique token as well as the underlying character. Therefore, brands owning a BAYC can guarantee the right to utilize the character in all their products. In addition, Yuga Labs charges a 2.5% royalty fee on BAYC’s secondary sales.

A global phenomenon that has made its mark across various fields, including fashion, art, and retail, BAYC has even inspired a fan to create a Bored Ape-themed restaurant that accepts Ethereum and ApeCoin — the native token of Yuga Labs’s metaverse — as payment.

Bored Ape China Club

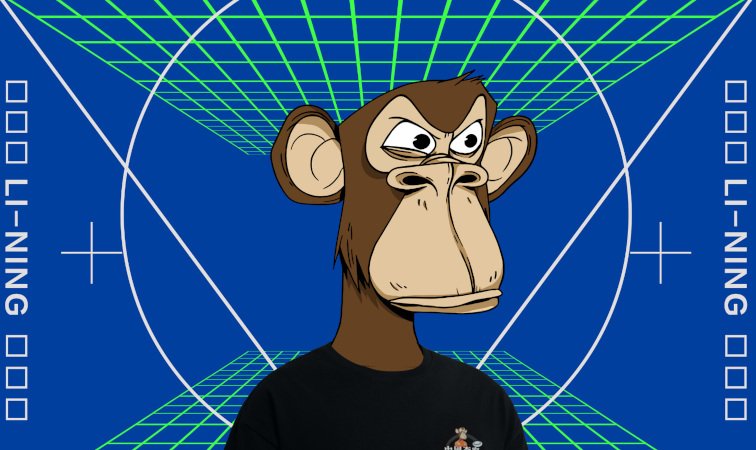

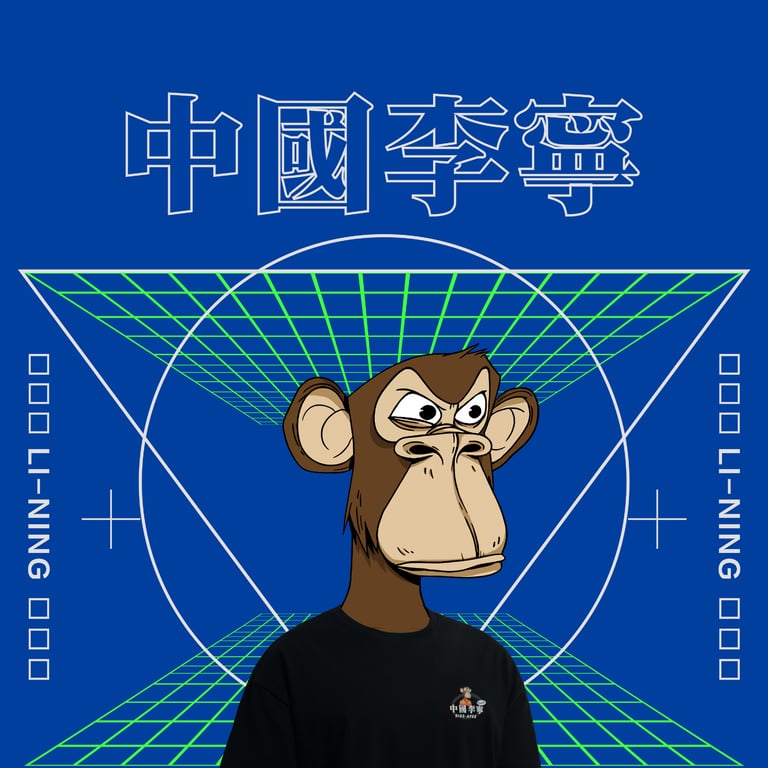

In China, the Web3 icon has also gained momentum from ambitious firms aiming to capitalize on its rising international fame. Following Adidas’s foray into the world of Bored Ape, sportswear giant Li-Ning announced the purchase of BAYC #4102 in April while advertising that it would create a new series of products based on the original design. The effort was seen as the brand endeavoring to consolidate its market share among young consumers.

Besides Li-Ning, traditional industry moguls such as Greenland Holdings and Breo Care have also purchased a BAYC to monetize the attention-grabbing IP.

This summer, Toho Club, a Chinese platform issuing NFTs, paid 139 ETH (approximately 250,000 USD at that time) for BAYC #5513 on June 6, according to on-chain data analyzed by NFTGO. In a press release published on July 29, the firm said it had created 9,999 new Bored Ape variations from auto-generated images of “a pool of 11 body parts and over 400 components.”

Each Bored Ape TOHO Club (BATC) features characteristics of guochao — a trend that revolves around national pride and reviving Chinese cultural heritage — and was sold at 588 RMB (around 84 USD) on August 1. With over 260,000 buyers, the platform generated more than 5.65 million RMB (approximately 810,000 USD) in total revenue.

In addition to the phenomenal popularity of BAYC, state media’s rare endorsement of the newly crafted guochao-inspired apes has fueled a positive reception of BATC in China.

The guochao trend (sometimes translated as ‘China-chic’) has gained massive attention in recent years. Chinese youth have been experiencing a surge of national pride and ‘cultural confidence’ and aim to set themselves apart from previous generations, who adored Western-style fashion while neglecting their cultural roots.

“In reality, we are always afraid of loneliness, anticipating a place where we can talk freely and show our personalities. Everything might change with an ape. Which ape is your favorite?” posted Chinese state broadcaster CCTV on the microblogging platform Weibo.

Booming Business for China’s Bored Apes

Xiao Gao, founder of Flame DAO and a member of the Conflux Network, shares a contentious view of the BATC project, calling Toho’s tokens a copycat taking advantage of BAYC’s brand image without including the collection’s original elements.

“Compared to how Li-Ning rebranded the Bored Ape as it tried to promote the idea of Web3 to a broader market, Toho’s approach lacks sincerity and originality. In fact, they’ve done the project like a speculative scheme. I’m confused and shocked by state media backing such a project,” Gao tells RADII.

Despite Gao’s concerns, BATC has enjoyed considerable popularity among digital asset consumers and found eager buyers on secondary markets.

Unlike top-tier NFT platforms operated in China by tech giants such as Ant Group and Tencent, which impose restrictions on secondary trading, Toho Club allows users to exchange their digital assets in or outside the app. This allowed the price of the 9,999 Toho-issued Bored Ape variants to soar as demand skyrocketed.

At the time of writing, some apes were trading at a premium price of 2,000 RMB (around 290 USD) on secondary markets. “My NFT increased sixfold in value overnight,” wrote a user of the Chinese lifestyle platform Xiaohongshu who purchased an ape from Toho’s platform.

When asked how BATC obtained the blessings of the state media while offering secondary trading, Toho didn’t respond to RADII’s inquiry.

Trading activity related to digital collectibles in China is still a gray area, and platforms have been tiptoeing around the lack of clear rules regarding how such assets can be traded and collected by investors. According to a China Times report, more than 500 platforms were providing services in trading digital collectibles in June of this year, which is nearly five times as much as February’s figure.

June also saw the birth of a new initiative led by the Chinese Cultural Industry Association, backed by tech giants such as Tencent and Ant Group, that aims to crack down on secondary trading.

Bored Ape Goes China-chic

Amid the rising trend of Chinese firms leveraging iconic IPs to realign themselves with young consumers, companies are also keeping pace with the evolution of China-chic trends. Li-Ning, one of the leading domestic brands riding the wave of guochao, was among the first to incorporate Chinese elements like the color red into its designs.

For its latest version of BAYC, the sportswear giant chose an ape that is neither bored-looking nor cynical. Despite the relative playfulness in place, the ape carries a sternness and perseverance, embodying the masculine vitality often found in patriotic and nationalistic messages from the state.

The hybrid ideology in these marketing products demonstrates that renowned Chinese brands do see significant potential in Web3 and that guochao continues to hold importance to youth, says Macdonald’s (alias), the tech lead behind NFT Aerfa, an online community that shares news of novel NFT projects.

An NFT specialist himself, Macdonald’s requested a pseudonym for privacy purposes.

“Li-Ning has great cash flow. Chinese companies at this scale don’t mind pouring some capital into Web3 icons, though no one else has done it yet in the domestic market. To many, the IP represents an opportunity to market or reposition their brand images,” he tells RADII. “As long as they shun tokens and exposure to speculation on digital assets, I don’t think their practices will raise watchdog’s eyebrows.”

In Macdonald’s opinion, the different ideological stances of BAYC and guochao are not an issue for localization because the apes’ cultural implications can be repositioned for a Chinese audience through minor adjustments.

“BAYC could be much more than a symbol of consumerism, decadence, etcetera,” he notes, adding, “After a light touch of localization, it can be a product invoking positive messages. It may seem odd initially, but people will get used to it quickly.”

Cover image via Li-Ning’s official Weibo account