The US government might have some harsh words for certain Chinese tech companies looking to enter American space — sorry Huawei — but that hasn’t done much to stop a new tide of hopefuls from attempting an overseas IPO. Here are a few Chinese companies who’ve recently or soon will go public in the US, and what they’re all about:

Xiaomi

Hot on Huawei’s heels, and fired up from recent success in the Indian market, smartphone maker Xiaomi is set to IPO in the second part of 2018. TechNode reports:

Xiaomi’s IPO is one of the most anticipated IPO’s in 2018 setting off wide speculation on the possible numbers. If the company’s valuation does reach $200 billion, it will be more than two times higher than Baidu’s current valuation which, according to NASDAQ, amounted to $85 billion at 3pm Beijing time today.

Xiaomi, often compared to Apple within China, has a similarly rabid fanbase built up through an ecosystem of interconnected, Internet-of-Thing devices that appeal to their target demographic of young, middle-class Chinese, such as smart dog collars and their Mi air purifier. Huami, a related but separate company focused on wearables, registered with the SEC in January, and is already peddling their wildly popular Fitbit Amazfit BIP on a US website.

Huya

Less of a household name, Huya is the e-sports arm of livestreaming site YY.com — the one that capitulated to China’s rumored hip-hop ban by removing 77 songs last month. TechNode again:

Chinese live streaming company YY is planning to spin off its gaming streaming unit Huya for an independent IPO. The company has submitted a draft registration statement on a confidential basis to the US Securities and Exchange Committee for a possible listing in the US market… “In the fourth quarter of 2017, driven by both YY Live and Huya, our mobile live streaming monthly active users increased by 36.6% year over year to 76.5 million, and our total live streaming paying users increased by 25.0% year over year to 6.5 million,” stated David Xueling Li, Chairman and acting Chief Executive Officer of YY.

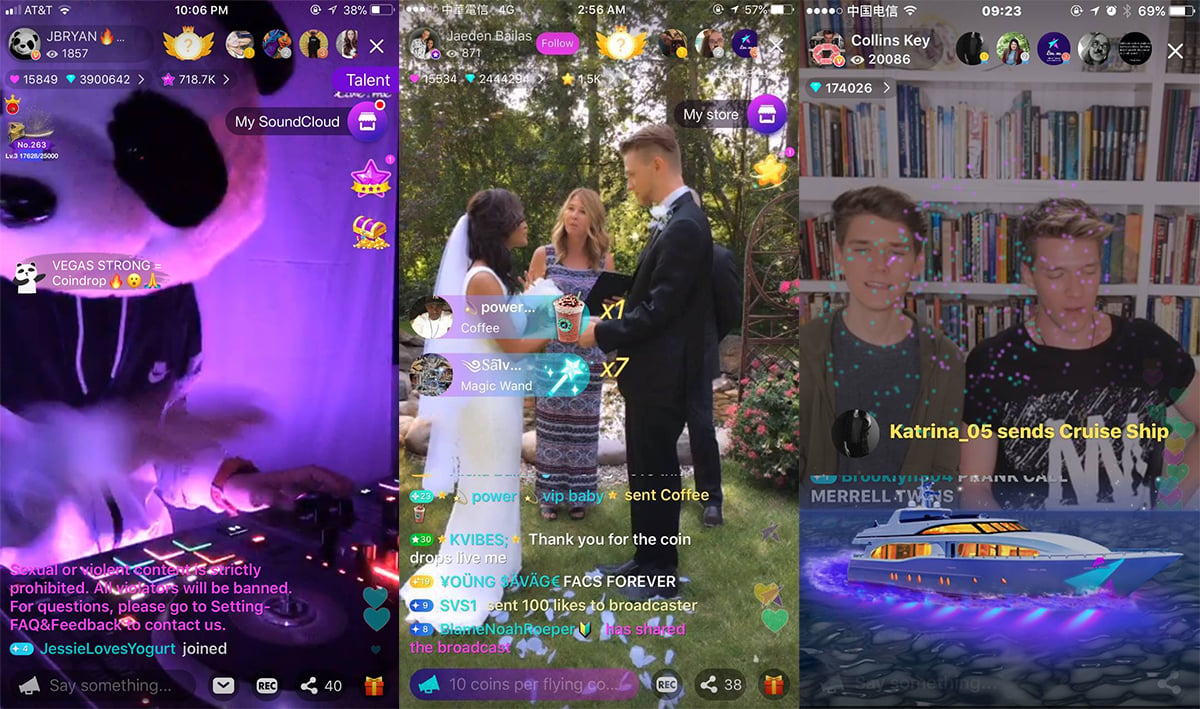

If Huya — and by extension, YY — are looking to make a noise in the US market, they face some stiff built-in competition from two Chinese companies already in the livestreaming game: Musical.ly, which was recently acquired by AI news aggregator Toutiao, and Live.me, which opened a 4,000-sq-foot production studio in Hollywood last October:

Will Live.me Bring China-Style Live-Streaming to the US?Article Oct 31, 2017

Will Live.me Bring China-Style Live-Streaming to the US?Article Oct 31, 2017

iQIYI

Elsewhere in the entertainment industry: video streaming site iQIYI filed for an IPO in the US less than two weeks ago. TechNode caught this one at the time, too:

The Beijing-based company filed with an offering size of $1.5 billion. iQiyi is aiming for a public market valuation of as much as $10 billion, people familiar with the matter said. Just like how IFR reported in October 2017, iQiyi chose three banks—Goldman Sachs, Credit Suisse Group and Bank of America—to lead the IPO.

The rumored $1 billion US IPO comes less than two months after iQIYI, a property of search giant Baidu, announced a partnership with Sony to produce a new suite of Netflix programs. Expect to hear more about this would-be “Netflix of China” in the coming months.

iQiyi Teams Up with Sony to Bring New Series to Netflix WorldwideArticle Jan 09, 2018

iQiyi Teams Up with Sony to Bring New Series to Netflix WorldwideArticle Jan 09, 2018

Bilibili

Last, but maybe our favorite of the bunch due to their underdog status, is Bilibili: another video streaming platform, but with a much fiercer built-in user base of diehard comics and anime fans. The Drum reported on this a few days ago:

Chinese video site Bilibili has filed for a $400 million IPO, with the announcement coming weeks after market leader iQIYI revealed its own IPO plans. Bilibili is an online entertainment platform, which boasts a monthly active user base of 72 million people who flock to the site’s videos, live broadcasts and mobile games. It attracts a predominantly young audience with 82% of users born after 1990. The site, which started as an online comic platform and is best known for its streaming anime content, has not disclosed timetables or pricing for the New York Stock Exchange listing.

They’ll face stiff competition from Baidu-backed iQIYI, but they’re also going for a more niche audience, and they have a much stronger bullet comment game. Good luck!

Cover image: Shutterstock.com