“Stop spewing nonsense, this is not pricey at all, you should reflect on why your salary hasn’t risen all these years.”

No, this isn’t a parent berating their child, but instead a twisted sales pitch from Li Jiaqi — the infamous Chinese “Lipstick King” influencer and livestreamer. When he made this comment during a livestream in October, it was met with a major backlash amongst Chinese social media users.

This wasn’t the first time livestreamers in China have demonstrated their fallibility. From instances of flagrant tax evasion, to the extreme case of the popstar turned convicted rapist, celebrities in China often seem to fall as fast as they rise. And casting our lenses globally, this is evidently not a China-specific issue. If the goal is to make sales, the unpredicatability of human beings, from high school bully influencers to scandal-prone popstars, can be a liability for businesses.

According to McKinsey China’s research, the ecommerce livestreaming market has reached over a trillion RMB since its inception in 2017, a figure that it took traditional ecommerce channels over a decade to achieve. Another study in 2020 from the National Bureau of Statistics in China estimated its contribution to the economy at $210 billion, equivalent to 1.4% of GDP. Any brand who wishes to succeed in China needs to carefully consider livestreaming goals as part of its omni-channel sales strategy. Certainly the age-old marketing funnel of awarness-consideration-purchase has not changed, except that with the rise of livestreaming, this purchase cycle has significantly shortened. Meanwhile, time spent on shopping has dramatically expanded, and a new entertainment value has been folded into the experience.

This is, however, not a cheap business for brands. “For the top livestreamers, they can take a 25-35% commission on the sales of the product” said a Tik Tok executive close to the matter, speaking anonymously. Given the Matthew effect at play here, top influencers usually have strong commanding power in terms of negotiation and product choice, leaving brands on the weaker end of the bargain. While top influencers like Li Jiaqi and Viya made over 58 billion RMB in sales in 2020, accounting for over 20% of the industry, those at the middle and bottom of the curve are struggling to get views. These livestreamers work out of booths in factory-like studios, which take up entire buildings, each floor dedicated to a different product category. Often found in Hangzhou and Yiwu, close to the manufacturing sources for the goods being sold, in these centers commoditized livestreamers sell everything from clothing to electronics.

But it’s clear that this model is no longer working for those at the bottom of the food chain. Since 2022, 9 out of 10 livestreaming hubs in Hangzhou have shut down.

Why not engage AI then? For the recent Singles’ Day shopping festival we saw major beauty brands such as L’Oréal, Shiseido, and Estée Lauder all use AI livestreamers in their campaigns. Purely on JD.com, a major Chinese ecommerce platform, over 4000 brands used AI livestreamers during their 11.11 campaigns, and doubled their sales compared to the previous year.

Given the commoditized nature of ecommerce livestreaming and its formulaic sales techniques, the AI models can be pre-trained with relevant slogans and dialogues, optimized for sales volume. Unlike a human livestreamer, they can go on 24/7, with no unexpected faux pas. Things can even be scaled up in multiple languages, pre-recorded or in real-time.

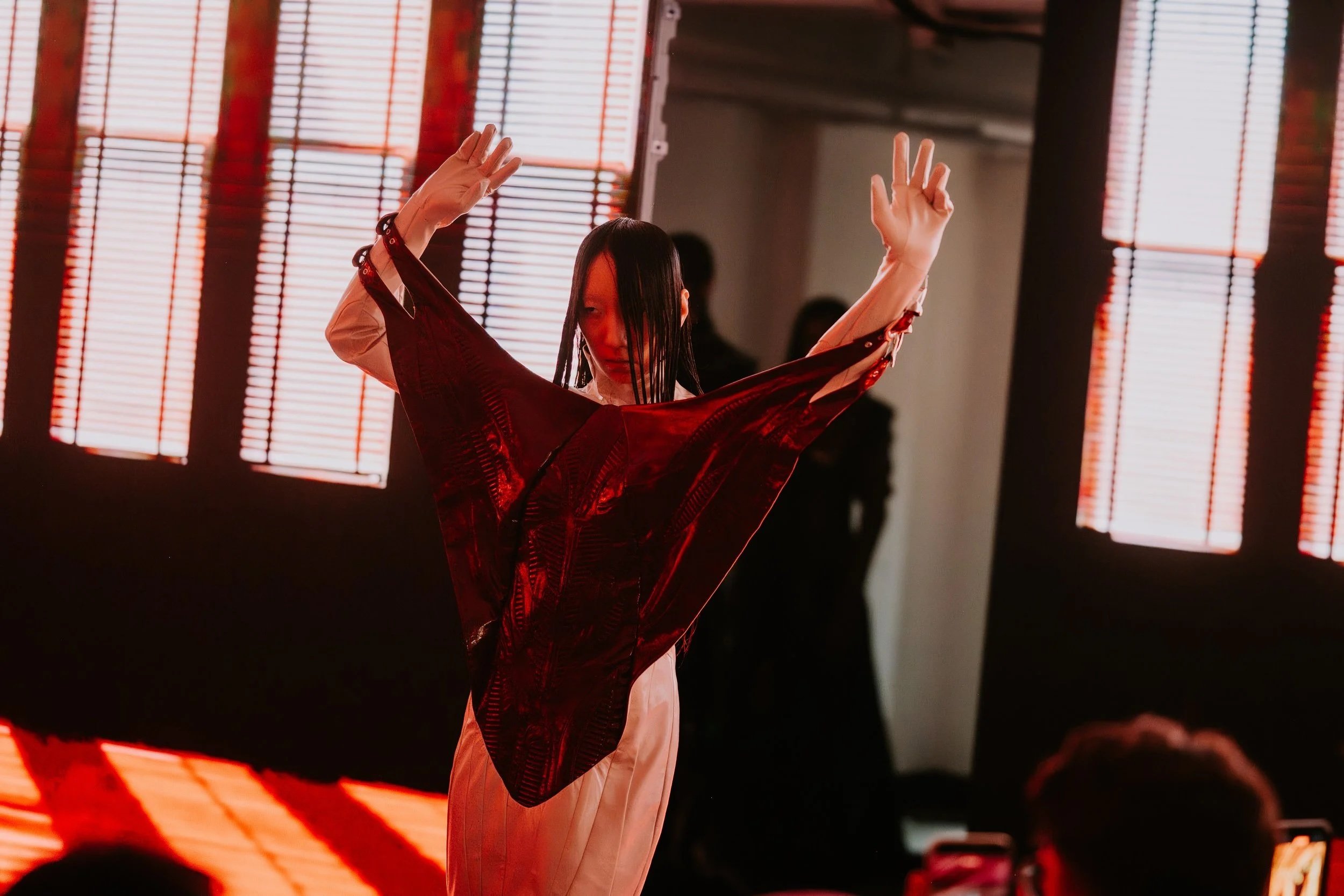

AI livestreamers have been part of China’s tech scene since at least 2017. In the West, AI influencers such as Lil Miquela and Lu from Magalu are usually engaged on Instagram and more traditional digital campaigns, working in collaboration with major retail and luxury brands. The appearance of these influencers sometimes plays up their artificiality, emphasizing that they are expressions of a new technology, rather than real people. Yet in China, given the popularity of livestreams and the major influence of Douyin, AI livestreamers need to look and feel much more real. This creates a higher barrier to entry, but also a more direct flywheel of growth for the creators behind these influencers.

So the biggest issue currently facing the universalization of AI livestreamers is still cost. Whether for JD.com or large international brands, the price of creating an AI livestreamer from scratch is at least millions of RMB. Furthermore, they can only be operated or modified by those with a large backend server. But it is simply a matter of time before we see more and more “AI Salarymen” (打工人) coming into the fold.

Banner image illustrated by Haedi Yang.