Luckin Coffee has made headlines across the globe for supposedly being (and often touting itself as) China’s “Starbucks killer” — but is this pure hype or does the much-buzzed startup pose a serious threat to Starbucks’ coffee empire?

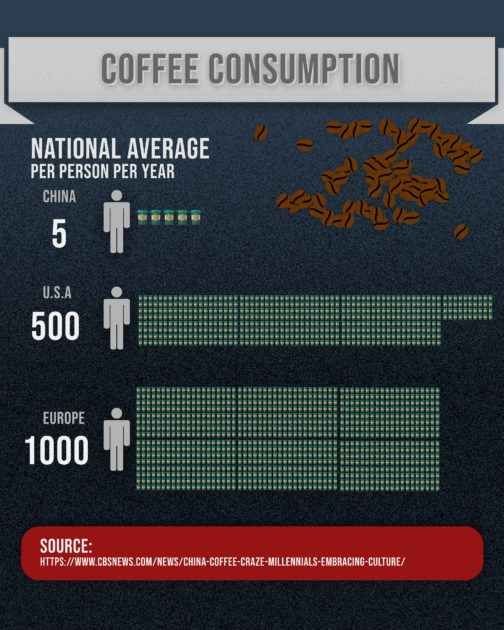

Although coffee consumption across China remains relatively low compared to Europe and the US, that picture is rapidly changing. Tier 1 cities, in particular Beijing and Shanghai, are now full of cafes with baristas mixing up all kinds of “third wave” coffees and waxing lyrical about beans.

Starbucks has naturally benefited from, and been at the forefront of driving, this change. China is the Seattle-founded drinks giant’s fastest-growing market and home to its largest store — the bewildering Shanghai-based Reserve Roastery. While overseas rivals such as Costa have made more tentative moves in the country, Starbucks appears to have glided almost effortlessly to cornering China’s coffee consumption.

But late last year, a challenger emerged.

Luckin Coffee, China’s boldest coffee chain start-up, has stirred up the competition since founding in Beijing in October 2017. It’s already the second largest coffee chain in the country and in less than a year, it’s gone from scratch to being valued at 1 billion USD, selling over 5 million cups of coffee in the process.

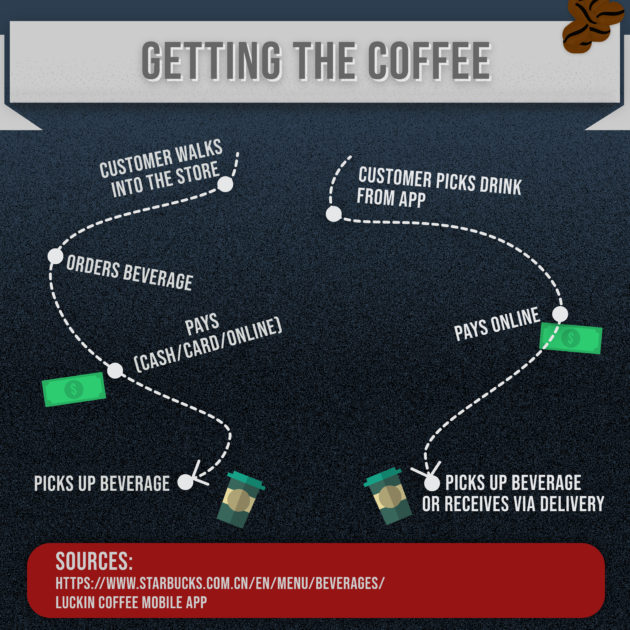

The Chinese coffee company owes much of their success to their market strategy including using lobby and delivery stores making it easier for consumers to purchase their coffee beverages. The entire ordering experience takes place within their app, whether you’re getting their coffee delivered to your door or if you’re at one of their pick-up points — ask a barista for a cappuccino and they’ll look at you sheepishly and point you toward a QR code.

Starbucks has worked hard to stay on top of China’s ever-changing digital trends, and has reportedly begun to consider more delivery options as the country’s take-out craze continues, but Luckin’s entire business is founded around being digitally savvy.

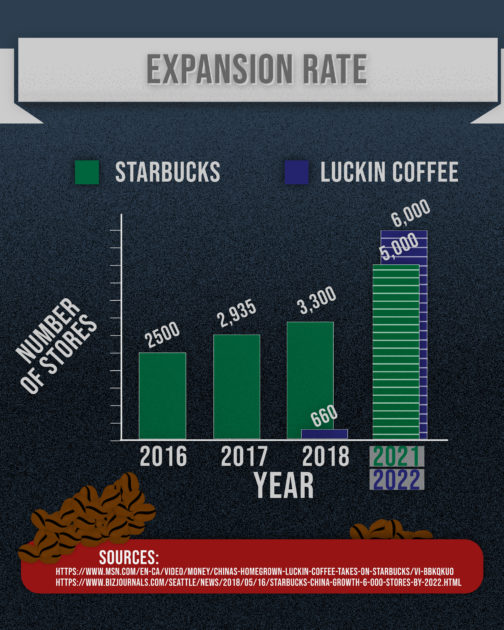

Starbucks opened its first store in China in 1999 and is now a fixture of downtown areas in most of the country’s major cities. The number of Starbucks stores in China is currently around 3,400 — making the country its second biggest market after the US — but the chain plans to add 500 more by the end of next year and to have reached 5,000 outlets by 2021.

That may sound pretty impressive, but Luckin — spurred on by a huge influx of investment and no apparent pressure to turn a profit just yet — has announced plans to their currently modest collection of 660 stores into 6,000 by 2020.

So how does the coffee compare? In this regard, Starbucks doesn’t seem to have too much to worry about. Luckin’s prices are generally cheaper, but their coffee is also generally weaker in the flavor department.

Nevertheless, Luckin appears to have some of Starbucks’ investors rattled. And with a reported 200 million USD in its pocket from a funding round this month (which included a cash injection from the Singaporean government’s GIC fund), it doesn’t look like Luckin will be slowing down any time soon.

—

Infographics: Thanakrit Gu

You might also like:

Digitally China Podcast: Behind the Hype of China’s Starbucks Challenger, Luckin CoffeeArticle Oct 23, 2018

Digitally China Podcast: Behind the Hype of China’s Starbucks Challenger, Luckin CoffeeArticle Oct 23, 2018

How a Cut-Price Upstart Took on Alibaba and JD to Become China’s Fastest-Growing E-Commerce PlatformGroup-buying, bargain-sharing platform Pinduoduo has gone from nothing just three years ago to being valued at over 20 billion USD as it looks to list on the Nasdaq this monthArticle Jul 18, 2018

How a Cut-Price Upstart Took on Alibaba and JD to Become China’s Fastest-Growing E-Commerce PlatformGroup-buying, bargain-sharing platform Pinduoduo has gone from nothing just three years ago to being valued at over 20 billion USD as it looks to list on the Nasdaq this monthArticle Jul 18, 2018

There’s Now an AI Robot Cocktail Bar and Coffee Shop in ShanghaiArticle Jun 11, 2018

There’s Now an AI Robot Cocktail Bar and Coffee Shop in ShanghaiArticle Jun 11, 2018