Which names comes to mind when you think of e-commerce in China? Taobao and Alibaba? Jingdong? These twin powerhouses have dominated the landscape for years now, to the extent that they have become synonymous with innovative online shopping in the country. But ask this same question to people outside of China’s tier 1 cities and a third name is likely to feature heavily among the answers: Pinduoduo.

Pinduoduo is China’s fastest-growing e-commerce platform, and has gone from nothing just three years ago to planning for a 1.6 billion USD IPO in the US, thanks to its focus on “lower tier” cities and what Forbes has termed its “Facebook-Groupon mashup” model.

WHAT IS PINDUODUO?

Founded in September 2015 by Shanghai-based ex-Google engineer Colin Huang, Pinduoduo offers cut-price products and a “fun”, shareable shopping experience.

“Pin” (拼) in Chinese means aggregating or pooling — in this case, group buying. “Duoduo” (多多) simply means “lots”. On the app, customers contribute the same stake on the same product in the hopes of getting a discount, which sometimes can reach up to 90%.

Pinduoduo has everything, from women’s silk stockings to smartphones, T-shirts to toilet cleaner, cockroach traps to e-cigarettes — and nearly all with incredibly low prices. For example, paper towels that would cost around 5 or 6USD in local supermarkets can be found on Pinduoduo for just 1 or 2USD including free shipping.

Products for sale on the Pinduoduo app

Even though the average amount spent on each Pinduoduo order increased from 32.80RMB (4.90USD) to 38.90RMB (5.90USD) in the first quarter of this year, that sum would still not be enough to qualify for free shipping on Taobao or JD.

In less than three years, Pinduoduo has witnessed phenomenal growth. It now boasts 400 billion monthly transactions and has 295 million active users, just shy of the 301.8 million who frequent Jingdong (JD.com). Last year, Pinduoduo’s revenue more than tripled to 278 million USD.

PIONEERING “SOCIAL E-COMMERCE”

Pinduoduo’s business model is actually quite simple: it brings together people who want to buy the same item, while getting bulk buy prices from factories and suppliers.

Cleverly, when people spot a deal on Pinduoduo the app allows them to share a link to the item directly to their WeChat groups and friend feeds. Their friends and family members then see it and once the number of customers has reached the required amount, the deal is made. Within a few days the items will be shipped to customers’ respective addresses.

The idea of socializing and sharing is intrinsic to the platform, giving customers a greater sense of belonging and participation than they might get from simply adding an item to a digital shopping basket. By initiating a deal to purchase the items together in bulk on social media platforms, users interact with their friends, family, and neighbors. Pinduoduo therefore enables everyone to become a KOL within their own social circles.

Related:

“Hermès Fried Rice” and the Cult of Online Influencer FoodsArticle Jun 28, 2018

“Hermès Fried Rice” and the Cult of Online Influencer FoodsArticle Jun 28, 2018

“I started using Pinduoduo a year ago,” says Changsha resident Zhang Meng, a regular on the platform. “I find the items cheaper than at the supermarket or on other online shopping platforms and I barely use Taobao or JD now. My friends and I talk about what to buy and we help each other to get deals.”

Such recommendations among friends brings in a level of trust that is crucial to Pinduoduo’s success, says Xu Rongcong, an analyst at China Merchants Securities. “Social e-commerce focuses on the ‘acquaintance economy’, based on the credit endorsement of social relationships. Therefore, the platform is more likely to gain the trust of consumers.”

A Pinduoduo banner encouraging users to “pin” together

The model also has the advantage of incidental purchases, continues Xu: “Compared to traditional e-commerce where there is a need before people make a purchase, social e-commerce actively stimulates demand through social activities, increasing the chance of non-targeted shopping for users.”

LOVE FOR THE “LOWER TIERS”

Cutting out middle parties to offer low cost products, and making those deals easily shareable, are key features of Pinduoduo. But another crucial factor has been the company’s focus on so-called “lower tier” cities and rural areas — essentially the less-developed parts of China way from more image-conscious mega-cities such as Shanghai and Beijing.

While numerous e-commerce platforms fought it out for well-off and high-end customers in the eastern metropolises, Pinduoduo turned its attention elsewhere.

Tissues, tea, and trainers – some of Pinduoduo’s top sellers

Residents living in third- and fourth-tier cities tend to be more budget-savvy and less averse to cut-price products or items without a famous name brand attached to them. In 2016, the urban population of the third- and fourth-tier cities was 168 million, more than the total population of the first and new first tier cities (such as Chengdu), and nearly twice the urban population of second-tier cities.

As other businesses such as video-sharing app Kuaishou have found, focusing on China’s sometimes “forgotten” consumers can open up a huge market and help build a loyal following.

Related:

China’s tech giants are following users back to their small city hometownsArticle Aug 18, 2017

China’s tech giants are following users back to their small city hometownsArticle Aug 18, 2017

“65% of Pinduoduo’s users are from third-tier and below cities,” says Xu.

70.5% are female and 57% are aged between 25 and 35. Most of these users are married women who are careful about what they buy and try to get the lowest price. Compared to people in first- and second-tier cities who are busy with making a living, the residents of the third-tier and below cities have more time. Group buying becomes one thing they would spend their free time on.

CUT-PRICE COMPETITION

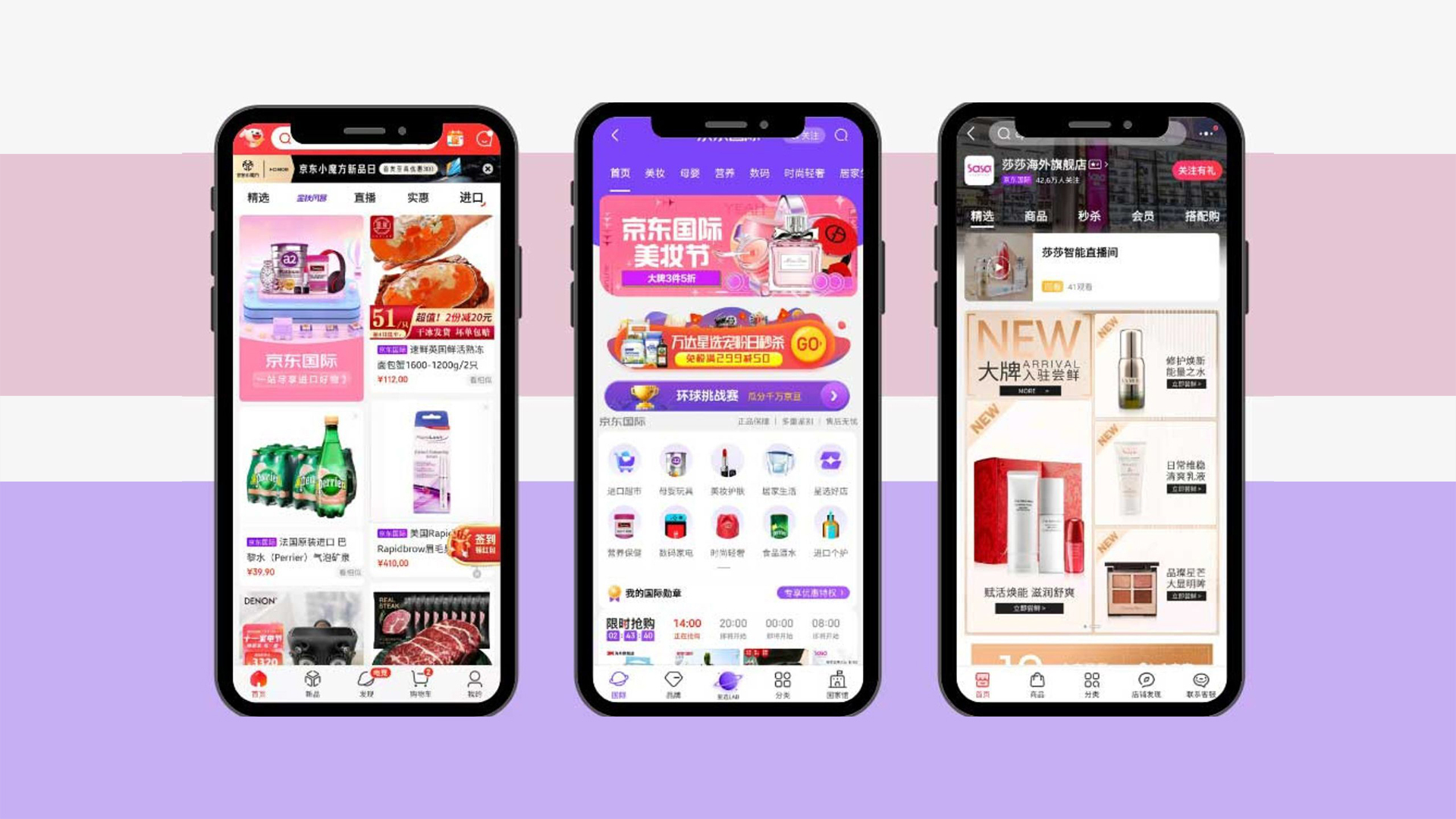

Pinduoduo’s incredible growth hasn’t gone unnoticed by the original e-commerce giants. In March, Taobao launched a “special price edition” of its platform which offers discounted merchandise. One month later, JD launched a group buying function that effectively works in the same way as Pinduoduo, albeit in a less prominent fashion.

This is perhaps only fair, given that Pinduoduo is building off of the consumer infrastructure that Alibaba and JD have nurtured over the years. “Users’ consumption habits — for example, in using online payment, online shopping, and delivery — have been cultivated by Ali and Jingdong,” says Xu. “Pinduoduo doesn’t need to spend any time or energy on that now.”

And of course, there’s a Tencent vs Alibaba angle to all this — because there usually is in China. In this case, Tencent is one of Pinduoduo’s major backers; it’s second-largest shareholder in fact.

Related:

![]() One China, Two Ecosystems: Alibaba vs TencentArticle Nov 20, 2017

One China, Two Ecosystems: Alibaba vs TencentArticle Nov 20, 2017

As the platform — which is still yet to make a profit — becomes ever more prominent, it faces other challenges too. Complaints about fake and shoddy goods being sold through the app continue to grow. For example, there are dozens of shops selling low-price products of a diaper brand called “Daddy’s Choice”, claiming they are official flagship stores. However, the brand has stated that it has never authorized any shop on Pinduoduo to use its logo or slogan.

Meanwhile, it’s not difficult to discover knock-off brands for sale on the platform. “Vivi” smartphones can be found on Pinduoduo’s product listings, a clear imitation of mainstream Chinese smartphone brand Vivo.

“Vivi” phones for sale on Pinduoduo

And perhaps inevitably given its initial numbers, the platform has failed to maintain such incredible growth. “After the explosive increase of active users in 2017, the growth rate has slowed down sharply according to its quarterly report for the first three months of 2018,” says Xu. “As it’s becoming increasingly difficult to get traffic at low cost, Pinduoduo needs to work hard on its category, target group expansion and infrastructure.”

Which is where its US IPO comes in. On June 29, Pinduoduo filed for an IPO with the US Securities and Exchange Commission, with Forbes reporting that the firm hopes to raise 1 billion USD through the move; on July 17 that number had risen to 1.6 billion USD according to Reuters. If it’s successful, this would represent a remarkable achievement for a company that is still approaching its third birthday, and would mean a major injection of cash as it seeks to continue on an upward trajectory.

—

You might also like:

How Douyin (TikTok) Became the Most Popular App in the WorldDouyin (TikTok) has weathered repeated controversy to be named as the most downloaded non-game app on Apple’s App Store for the first quarter of 2018Article May 09, 2018

How Douyin (TikTok) Became the Most Popular App in the WorldDouyin (TikTok) has weathered repeated controversy to be named as the most downloaded non-game app on Apple’s App Store for the first quarter of 2018Article May 09, 2018

5 Reasons Why China’s Online Retail is Insanely SuccessfulArticle Aug 31, 2017

5 Reasons Why China’s Online Retail is Insanely SuccessfulArticle Aug 31, 2017

Google Invests in JD.com as the E-Commerce Site Eyes Further Global ExpansionArticle Jun 18, 2018

Google Invests in JD.com as the E-Commerce Site Eyes Further Global ExpansionArticle Jun 18, 2018