Just like the fate of many an online celebrity, Chinese influencer platform and KOL (“Key Opinion Leader“) queenmaker Ruhnn soared on a wave of hype before crashing back down to earth yesterday, after their Nasdaq IPO raised an initial 125 million USD and then their stock lost more than a third of its value.

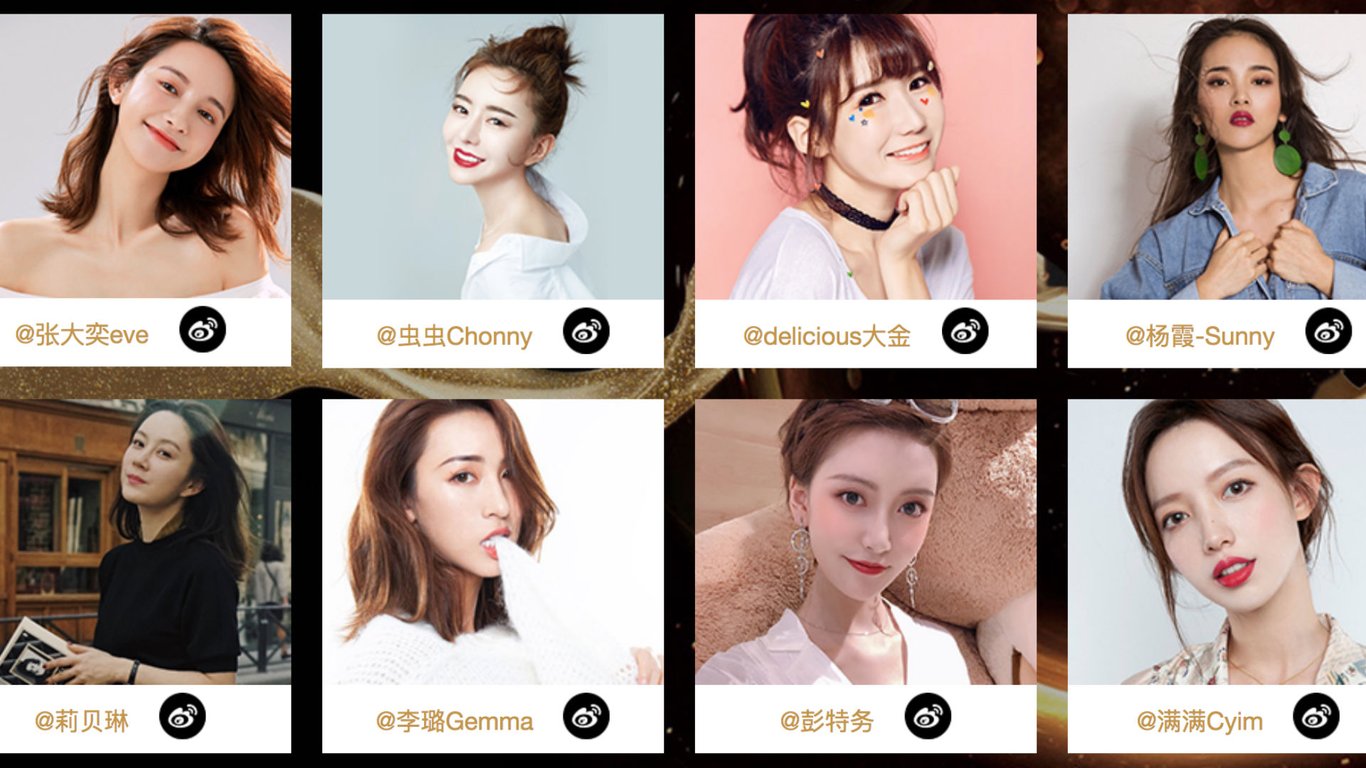

Alibaba-backed Ruhnn is at the forefront of efforts to spur the commercialization of China’s army of online “influencers“, providing the wannabe Kardashians of China with ecommerce support and enabling them to cash in on their 网红 “wang hong” (internet famous) status. The platform connects brands with KOLs, while also providing the latter with training on how to become even more famous and create engaging digital content.

Those services netted the Hangzhou-based firm nearly 950 million RMB (around 141 million USD) in revenue in 2018 — though they still managed to record a net loss of 90 million RMB last year.

Some of Ruhnn’s KOLs

After launching on the Nasdaq yesterday and selling 10 million American Depositary Shares at 12.5USD each, “the midpoint of its expected range” according to TechCrunch, Ruhnn ran into trouble and watched its stock slide — by market close, the value of the firm’s shares had dropped by 37.2%.

The platform is “is over-reliant on a few top KOLs”, according to TechCrunch, while there are also signs that for China’s younger generation of consumers, online influencers are starting to lose their midas touch.

Maybe Ruhnn should look into hiring the “poetry-quoting hobo” to improve their fortunes.

Related:

“Hermès Fried Rice” and the Cult of Online Influencer FoodsArticle Jun 28, 2018

“Hermès Fried Rice” and the Cult of Online Influencer FoodsArticle Jun 28, 2018