The World Internet Conference held last week in Wuzhen, a small town about two hours outside Shanghai, is positioning itself as the Davos of the global internet world. Four years in, it’s doing a pretty good job.

The WIC doesn’t have the flash or the parties of Davos, but global leadership gatherings are about the attendees, and WIC 2017 delivered power players including CEOs Tim Cook (Apple), Sundar Pichai (Google), Jack Ma (Alibaba), and Pony Ma, whose Tencent recently surpassed US$500bn in market value, eclipsing Facebook.

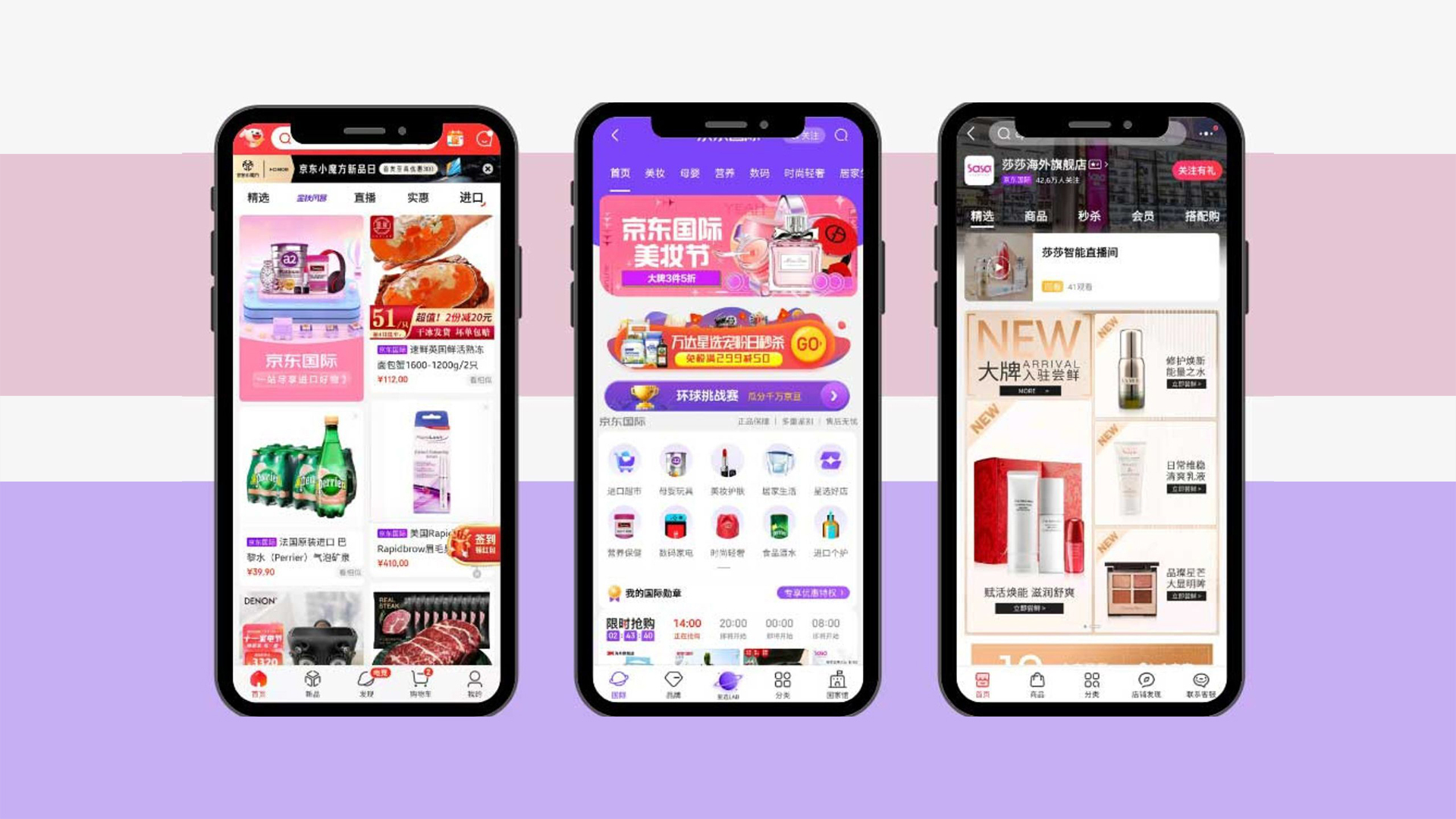

Almost a trillion dollars in market cap at the table (image by Matthew Brennan)

While three of the top 20 political leaders in China attended the event, along with the Deputy Prime Ministers of Thailand and Mongolia, the more important part of the WIC’s guest list was its heavily curated group of global internet power elite, who gathered for open- and closed-door sessions over two days in a meticulously restored river village and adjoining conference facility built solely for the event. While Pony Ma and Jack Ma don’t hang out together like they used to, all the major players were in the house, and talking business.

My gun is bigger than yours

The main stage presentations were each about five minutes long, and there was nothing subtle about the order of company presentations — size matters, and the largest go first. Presentations focused not on new product announcements, but on market power and technology advantage. How many users. How much data. How many AI researchers. What can we do that you can’t.

Like schoolyard rivals, each company strutted their stuff and radiated an unspoken challenge to the rest. The ARkit technology, to give one example, makes Apple the largest Augmented Reality platform in the world, because they make their existing iPhones and iPads AR-capable through software — and they don’t want you to forget it.

The WIC Conference Facilities

A quiet sense of confidence

Having covered the internet industry in China since 2004, the rapidity of change never ceases to amaze. This year at the WIC it seemed that China no longer feels it must justify its seat at the table, nor fight for recognition.

China is a global internet power, with the #2 economy in the world for a home market, and leading market positions in key internet sectors in Southeast Asia, India, Eastern Europe, Africa and Latin and South America. China is confident as it faces off against Google, Apple, Facebook, and Amazon, who are strong in North America and Europe but weak in mobile-first/mobile-only markets like Southeast Asia. Surround the cities from the countryside.

A “decisive victory” in SE Asia and India

I would argue that China is the most competitive market in the world to start and build a company. Monopoly is not against the law, and entrepreneurs are playing long-term, and playing to win.

Lei Jun (center) is very focused on his phone

Lei Jun is the CEO of Xiaomi, and the leader of an ecosystem that has the potential to rival Alibaba and Tencent, especially as competition grows outside China. He was blunt in his comments when asked about their strategy outside China. Xiaomi has won a “decisive victory” in India, where they have taken #1 market share in smartphones away from Samsung in only a few short quarters, he said. This was largely at the expense of local Indian brands, and Xiaomi achieved this feat by “selling US$300 smartphones for US$150,” and by partnering with Amazon and Flipkart, according to Lei.

In Indonesia, Xiaomi was rebuffed by traditional offline channels that weren’t satisfied with the low profit margins associated with selling Xiaomi products. Xiaomi is instead gaining traction by partnering with China e-commerce players like JD.com, which are fine with sacrificing profits for market share in the country. Xiaomi recently announced that it will invest US$1bn in startups in India to build a mobile ecosystem like the one they have in China.

It really is the World Internet Conference

First it was copy to China. Then China innovation. Now even a company as big as Facebook is cribbing their Messenger product roadmap from Tencent’s WeChat.

In 2015, the US saw about US$72bn in venture investing, versus US$12.5bn for Europe combined. China was at roughly US$60bn. In the two years since, local Chinese governments have reportedly poured another US$250-350bn into Chinese venture capital firms.

At the conference, I learned that there are now 60,000 VC firms in the country, as well as 130,000 startups resident in some 3,200 incubators. There isn’t enough market in China to support this many companies at this level of investment, so China is going global. When you go from 50% market share to 15% in five quarters, as Indian handset brands just did, you will know what that means. Buckle up — its’ going to be a wild ride!