Amid the current rush of Chinese tech companies filing for IPOs — both in the US and in Hong Kong — Meituan-Dianping provides for a fascinating example of China’s “super apps”, platforms which offer a plethora of services in an attempt to retain users within their branded ecosystems.

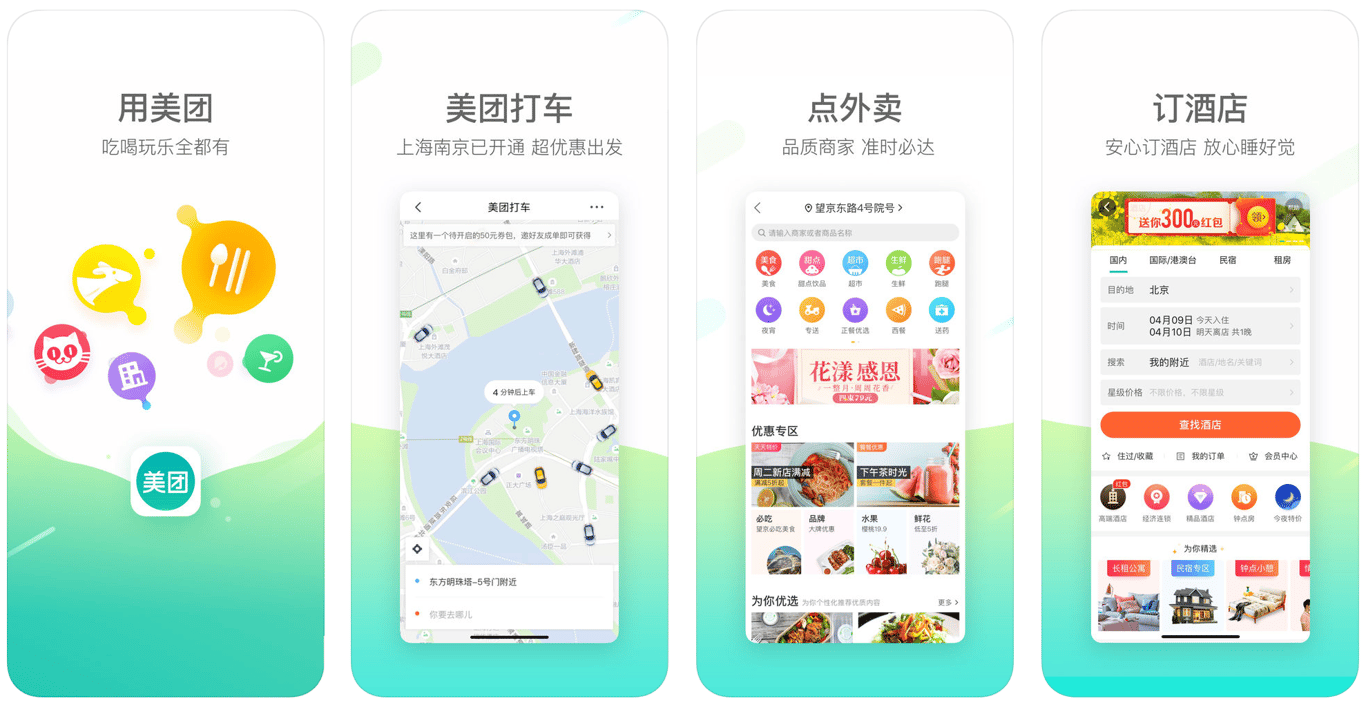

With over 300 million users, Meituan has gained major popularity in China in recent years as a one-stop app for an array of services — everything from getting a taxi and purchasing plane tickets to ordering food delivery and booking seats at the cinema. Dianping meanwhile began life as a restaurant review service but has expanded into a multitude of other areas.

And with a proposed $60 billion Hong Kong IPO recently announced, the company looks set to make some significant moves in the near future — and potentially take the fight for user loyalty to some of China’s biggest tech companies.

What Is It?

Meituan-Dianping breaks down into two major companies, Meituan.com and Dianping.com. Before these companies merged to create the current super app in 2015, Beijing-based Meituan enjoyed widespread popularity in second and third-tier cities, while Shanghai-based Dianping took pride of place in first-tier urban centers.

Meituan was founded in 2010 by Wang Xing essentially as a rival to Groupon. The app offered discounted coupons for food and entertainment outlets, primarily used for purchasing movie tickets and eating out at restaurants. Although it’s since expanded into a range of extra services, one of its most significant moves was into the world of food delivery, a huge — and hugely valuable — market in China in the last few years.

Related:

In Shanghai, You Can Now Get Take-Out Food Delivered by DroneArticle May 30, 2018

In Shanghai, You Can Now Get Take-Out Food Delivered by DroneArticle May 30, 2018

Dianping, meanwhile, was founded by Zhang Tao in 2003, around one year before Yelp was launched. But much like the San Francisco-headquartered platform, Dianping offers users the opportunity to sound off about restaurants and services, or peruse ratings from supposedly real people via its review function. From this base, it too has grown rapidly to add everything from table-booking to ticket purchasing.

In 2015, the two companies merged to create Meituan-Dianping. After being piloted in Shanghai and Beijing, a new-look Meituan app, incorporating many of Dianping’s functionalities, expanded to second and third-tier cities and reported a total of 200 million users by the end of 2015. Meituan has since become one of China’s highest-valued tech start-ups and its latest figures include 310 million transacting users and 4.4 million active merchants.

Meituan in the Market

The merger brought two of China’s top investors together. While Meituan was backed by Tencent, rival Alibaba had invested in Dianping. With Tencent and Alibaba being market competitors, the unification created tensions between the two parties which ultimately led to Alibaba selling most of its Meituan stock in early 2016.

Related:

![]() One China, Two Ecosystems: Alibaba vs TencentArticle Nov 20, 2017

One China, Two Ecosystems: Alibaba vs TencentArticle Nov 20, 2017

The rift between Tencent and Alibaba has helped spur some fierce competition in the market. Since Alibaba sold its Meituan stock, the Hangzhou-based giant has backed some of Meituan’s key competitors including food delivery app Ele.me and local commerce platform Koubei.

But Meituan-Dianping has years of data backing it against its existing competitors and any potential new entrants. Ernan Cui, a consumer analyst at research group Gavekal Dragonomics, believes “Alibaba is less competitive than Meituan-Dianping [in food delivery because] the entry barrier is quite high, because people trust the information accumulated on the latter’s platform”.

Hungry for Expansion

Not that that means the company is resting on its laurels — far from it. Rather than focus on one core business, Meituan has expanded into an increasingly dizzying array of services in an attempt to become a “one-stop super app”.

In April, it added a bike-sharing sector to its app with the $3.7 billion acquisition of China’s largest bike-sharing company Mobike, having spent the preceding few months rolling out taxi-hailing services. Days later, ride-hailing market leader Didi promptly declared that it was getting into food delivery:

A Food Delivery Service’s Leap into Taxis and Shared Bikes is Just Another Day in China’s Wild West Investor EcosystemArticle Apr 06, 2018

A Food Delivery Service’s Leap into Taxis and Shared Bikes is Just Another Day in China’s Wild West Investor EcosystemArticle Apr 06, 2018

Meituan therefore brings together services from apps like Groupon, Yelp, and OpenTable to create an all-in-one powerhouse app. All within this one platform, you can read and review restaurants, purchase deals for restaurants and services, order food delivery, reserve a table and pay for your meal, and order a taxi service or unlock a shared bike.

Hans Tung, managing partner at GGV Capital and an early investor in Dianping says, “Providing a multitude of services as a ‘super app’ allows Meituan to generate significant revenues from merchants and avoid using capital-intensive subsidies to lower prices for consumers.”

Food delivery continues to be the app’s leading service, however. In 2017, more than 70 percent of all transactions on Meituan were derived from food delivery. Meituan held a 41 percent market share in online food delivery last year.

Meituan on the App Store

Meituan’s travel operations, including purchasing plane tickets and booking hotels, remains another strong suit. The company is the number two in hotel booking service in China, holding a 36 percent market share and occupying a position that lead Priceline to purchase a $450 million stake in the app last year.

The Road Ahead

That’s not to say the road ahead is without obstacles for Meituan-Dianping. Despite the app’s success, the company has yet to make a profit. In 2017, the company experienced an adjusted net loss of $430 million, down from 2016’s $830 million net loss, but still some serious money.

In an effort to raise funds, Meituan-Dianping filed for a Hong Kong IPO at the end of June. Bank of America Merrill Lynch, Goldman Sachs Group Inc., and Morgan Stanley are reported to be sponsoring the app’s IPO.

The company is seeking to raise $4 billion from the move and has said these funds will be used towards upgrading its technology, developing new products and services, and making acquisitions and investments. The actual listing of Meituan’s shares is likely in October.

Yet in order to maintain its edge, Meituan has been forced into a series of costly price wars — not just in its core business of food delivery versus Ele.me, but now also in the ride-hailing realm, where it is effectively a newcomer. Quite where those battles will take it as it looks to consolidate a position as one of China’s main “super apps” will be fascinating to observe.

You might also like:

How Douyin (TikTok) Became the Most Popular App in the WorldDouyin (TikTok) has weathered repeated controversy to be named as the most downloaded non-game app on Apple’s App Store for the first quarter of 2018Article May 09, 2018

How Douyin (TikTok) Became the Most Popular App in the WorldDouyin (TikTok) has weathered repeated controversy to be named as the most downloaded non-game app on Apple’s App Store for the first quarter of 2018Article May 09, 2018

Ex-Alibaba/Dianping Executive Si Jianghua Bets on a Cashierless FutureArticle Jan 19, 2018

Ex-Alibaba/Dianping Executive Si Jianghua Bets on a Cashierless FutureArticle Jan 19, 2018

A Guide to the Coming Chinese Tech IPOcalypseArticle Mar 14, 2018

A Guide to the Coming Chinese Tech IPOcalypseArticle Mar 14, 2018