Wang Kai, who inherited a “foreign trade company” (外贸厂, wài mào chǎng) from his family in Foshan, Guangdong, sells over 2,000 orders of hanfu, traditional Chinese clothing, per day to buyers around the world.

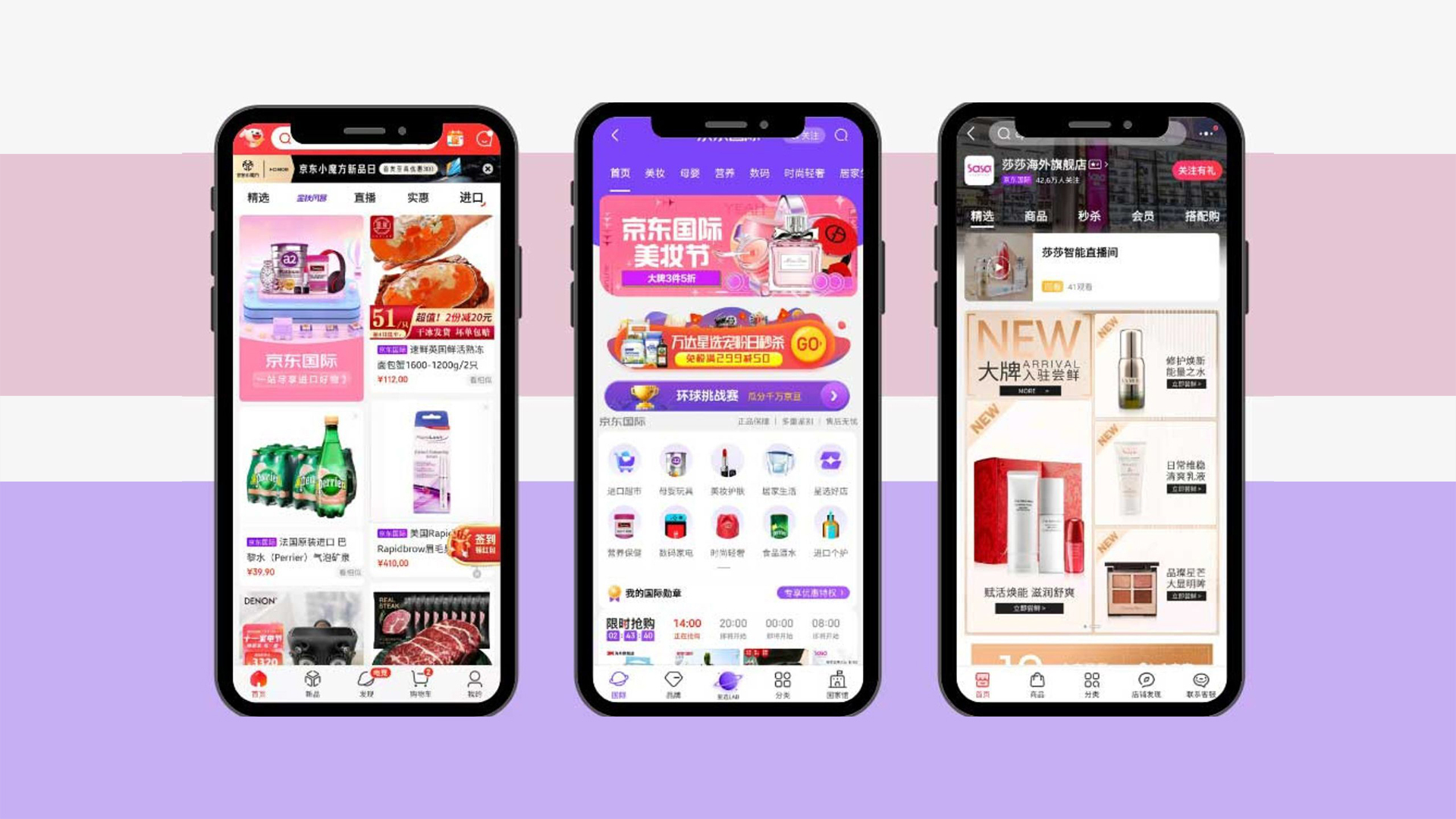

Foreign trade companies like Wang’s are experiencing a renaissance through the exponential growth of “cross border e-commerce” (跨境电商, kuà jìng diàn shāng) in China. Wang sells his hanfu on global e-commerce sites, where his customers are primarily in the U.S., the U.K., and also in smaller markets like Australia, New Zealand, and Southeast Asia.

Over the past few years, young people in China have seen cross border e-commerce as a new opportunity to hit the jackpot. Wang, who’s not yet 30, said there are around 200 e-commerce sellers in Foshan, almost all of whom are Gen-Z.

Yet on the other side of the Chinese border, attitudes towards e-commerce platforms are very different. Indonesia was, until recently, the second largest market for TikTok Shop. As reported by Rest of World, local businesspeople like the owner of a small hijab store in Yogyakarta feel that they are facing an existential threat from cheap imported products sold on e-commerce platforms such as Shopee, Lazada, and TikTok Shop.

In 2023, Indonesia was the first country to ban direct sales from social media, in hopes of reducing sales through e-commerce giants and bringing customers back to brick and mortar businesses. Now, government officials in Jakarta have announced that it will impose import tariffs of up to 200% on some products from China, as reported by AP. This is particularly significant as China had previously enjoyed low duties in Indonesia due to regional trade agreements.

Other countries in Southeast Asia are similarly calling for higher tariffs in an effort to protect local businesses. According to The Bangkok Post, Payong Srivanich, chairman of the Thai Bankers’ Association, is advocating for higher tariffs in fear of domestic companies shutting down.

However, TikTok Shop is experiencing its best year in Thailand so far. In the past year, the e-commerce giant reported more than 500% growth in gross merchandise value in Thailand, demonstrating the strength of the Southeast Asian market.

At the same time, Chinese sellers are also trying to position themselves optimally as the e-commerce market in Southeast Asia matures. According to one user on Xiaohongshu who advises on global e-commerce, sellers should set up e-commerce shops locally in Thailand to be truly profitable, taking advantage of the cheap cost of labor.

Banner image via Xiaguang She.