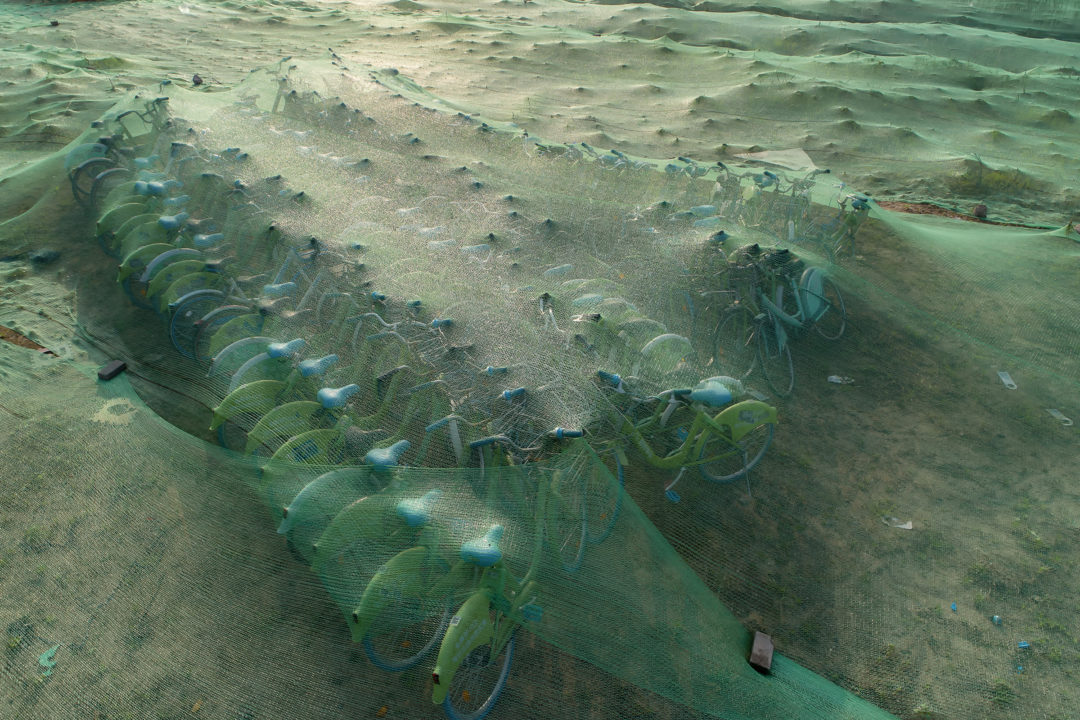

If you’ve spent time in Beijing within the last year, you’ve probably noticed the proliferation of colorful bicycles parked around the city. Sometimes appearing in hordes of hundreds, these bikes, which are available for hourly rentals at low cost through mobile phone apps, are part of a brand war waged on urban street corners throughout China.

The two biggest players are Ofo (yellow bikes that began appearing on Beijing campuses in late 2014) and Mobike (more upscale, with built-in GPS, popularized in Shanghai in late 2015). Considering production costs and the fact that bikes are routinely recalled for repair – not to mention vandalized or stolen – it’s a wonder that these companies think they can break even selling rides priced at 0.5 to 1 yuan (about 15 cents).

To many, the business model of bike-sharing companies simply doesn’t make sense. Yet Ofo is valued at $1 billion, and Mobike has raised more than $300 million this year alone. What do investors see?

In a word: potential. Specifically, the potential to dominate the market – it’s a big one, you might have heard – by gobbling up all the small fry (the more than 40 shared bike start-ups in this country, all trying to capitalize on the dockless bicycle frenzy). With enormous space remaining for expansion into global markets – Ofo and Mobike are planning to take their proprietary technology to places like Singapore and England this year – investors may be anticipating a huge sale or IPO. Even now, investors can still be sold on the impression that they are “getting in early.”

The number of customers who trust these two companies is also immense. According to a Mobike white paper released last month, “during peak periods, over 200 people are allocating bikes every second.” According to Ofo, the company handles more than 2 million transactions every day – and was the ninth Chinese company to exceed one million daily translations, joining the likes of Taobao and JD.com. With peers like these, a profitable future seems inevitable.

Like startups the world over, the key to making money is impressing investors. Ofo and Mobike make money by raising money, competing for capital in a mad dash for scale and market dominance. The Mobike white paper also claims that users have traveled more than 2.5 billion kilometers, which equates to taking 170,000 cars off the road and reducing carbon emissions by 540,000 tons. Now, aside from obvious assumption fallacies from that statistic, what this indicates is that bike sharing will only get greater government support in the future. None other than premier Li Keqiang, who’s serious about his environmental goals, has said: “The business model of Mobike looks like a revolution.”

And that, of all things, just might make these private bike-sharing companies the safest of all bets.