Seems there’s some big trouble in startup China. Two of the country’s most buzzed companies of the past two years — shared bike pioneer Ofo and “Starbucks killer” Luckin Coffee — have been the subject of headlines lately that may be making their investors sweat.

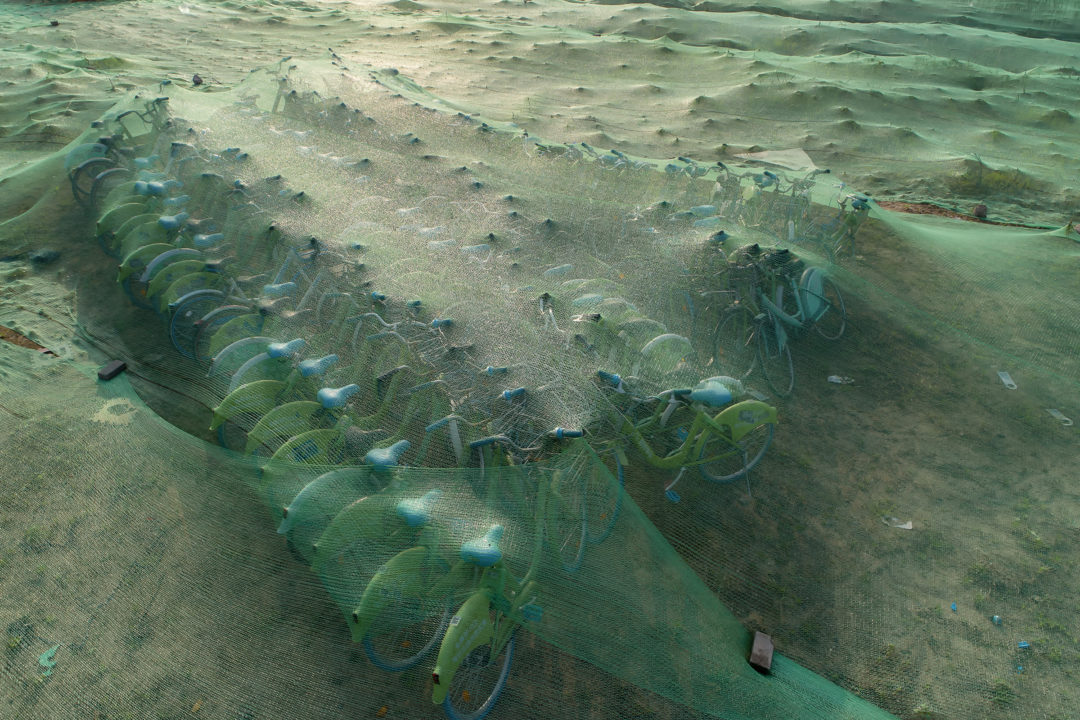

Ofo’s troubles are nothing particularly new. In fact, the company behind the yellow bikes that once littered China’s streets has been in strife for so long now that we’ve pretty much run out of bicycle-related puns to describe their situation. We’ve been through bumps in the road, the wheels coming off, and the company reaching the end of the road.

But around the time their international Twitter account was seemingly going rogue with April Fools messages that have since been deleted, the company was telling anyone who’d listen that everything was fine and that they were in “normal operation” mode as rumors swirled that they’d applied for bankruptcy.

“Chinese media originally reported on Tuesday an entry on the national bankruptcy disclosure e-platform, which showed that an individual named Nie Yan filed a bankruptcy application for Beijing Baike Luoke Technology, Ofo’s domestic operator. The application to the People’s Court of Beijing’s Haidian District is dated Mar. 25.

“On Wednesday evening, an Ofo representative told TechNode that the company has not entered bankruptcy proceedings, but that an Ofo user had filed the court application. The company “communicated” with the Beijing court today, and maintains that operations across supported cities are proceeding “normally.””

Wondering how it came to this? Here’s our guide to China’s shared bike boom and bust:

China Explained: All You Need to Know About the Bike Sharing Boom (and Bust)Article Oct 23, 2018

China Explained: All You Need to Know About the Bike Sharing Boom (and Bust)Article Oct 23, 2018

So what of Luckin Coffee? Well, the much-hyped (often self-hyped) coffee chain unicorn has reportedly put up its coffee machines in Beijing, Shanghai, Shenzhen and other major cities as collateral to secure around 6.7 million USD in new funding.

That could signal that Luckin is under financial pressure, according to analysts cited in Chinese media, but news portal ECNS reported that,

“The company explained on Tuesday that it is a normal business move in line with the startup’s asset-light strategy. Equipment-based leasing is a new financial tool to maximize the value of assets, it said.”

So there we have it.

For more background on how China’s startup sector is hitting the brakes, check out the latest Digitally China Podcast:

Digitally China Podcast: China’s High-Rolling Startup Industry Hits the BrakesOver the past five years, China’s internet industry has seen dizzying growth, with each year hitting record-levels of funding, but now things are changing – fastArticle Mar 28, 2019

Digitally China Podcast: China’s High-Rolling Startup Industry Hits the BrakesOver the past five years, China’s internet industry has seen dizzying growth, with each year hitting record-levels of funding, but now things are changing – fastArticle Mar 28, 2019