As we predicted back in October, the Beijing-based bike sharing pioneer Ofo is wobbling on its last kickstand.

Here are signs the end is near: One, every sidewalk is littered – one might even say plagued – with broken yellow bikes. Two, the cash-strapped company started slamming the breaks on its operations in Germany, Australia, and Israel and backpedaling from the American market earlier this year.

Now, the billion-dollar start-up seems a bell’s ring away from bankruptcy.

In an internal letter circulated among local news outlets on December 19, Ofo founder and CEO Dai Wei stated that over the past year, the Alibaba-backed shared bike service has been under immense cash flow pressure.

“We have to return users’ deposits, pay back suppliers, and maintain the company’s operations,” Dai wrote. “One yuan must turn into three.”

Related:

Watch: Jaw-dropping Video of China’s Shared Bike Graveyards Goes ViralArticle Jul 28, 2018

Watch: Jaw-dropping Video of China’s Shared Bike Graveyards Goes ViralArticle Jul 28, 2018

On top of that, the company said it was unable to secure external funding, and even considered filing for bankruptcy, “so that everyone would not have to continue to bear such pressure.” Rumors continue to abound that ride-hailing giant Didi has been blocking new investment into Ofo after the latter refused to sell out to the former.

That same day, Chinese media reported that the 27-year-old executive had been blacklisted for debt default (the ruling came on December 4). The Haidian District People’s Court in Beijing requires Dai to get approval before engaging in “excessive spending,” defined as: taking vacations, buying cars or properties, splurging on hotels or golf courses, sending his children to expensive private schools, flying first-class, and purchasing seats better than second-class on high-speed trains.

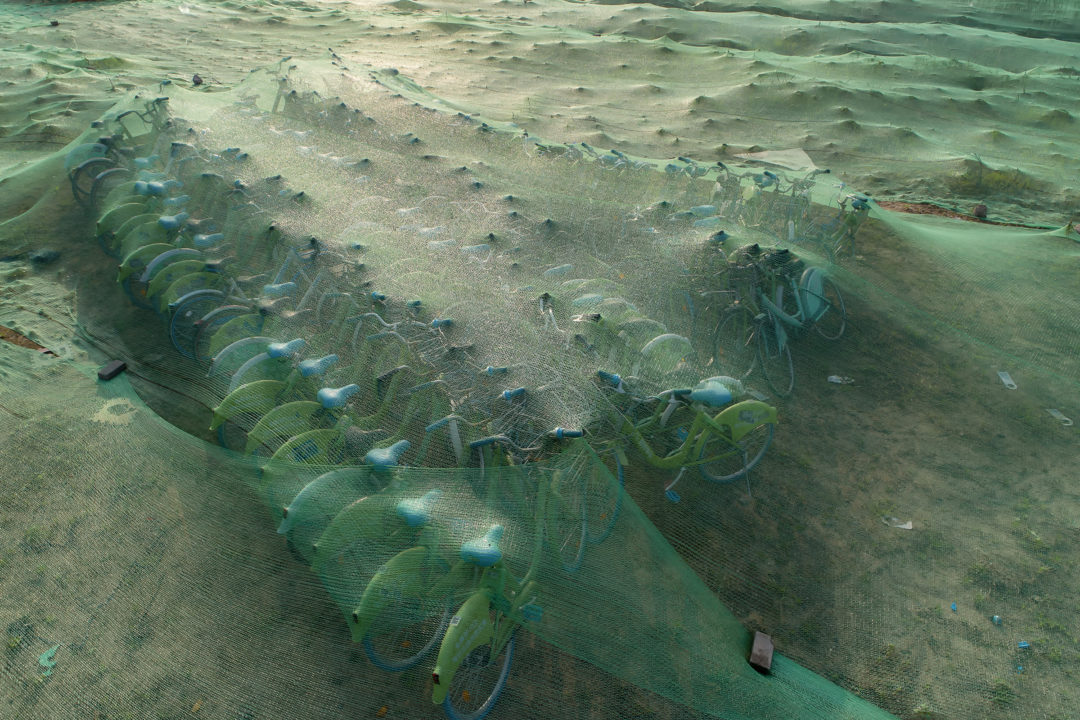

Piles of broken Ofos have become common sights on Chinese sidewalks

This legal blow comes a few days after hundreds of Ofo customers swarmed the company’s headquarters demanding their deposits back. Users had initially been asked to pay a 99RMB deposit (14USD) to use the service, which was later bumped to 199RMB (29USD). That leaves Ofo scrambling to find around 1.2 billion RMB (174 million USD) if it is to refund all of its users.

In his letter, Dai claimed that Ofo would “be responsible for every penny we owe, and be responsible for every user who has supported us!” But as negative headlines about the company pile up like Ofos in a shared bike graveyard, users have become increasingly jittery about the viability of retrieving their refunds.

As of Thursday evening, 11.7 million customers were waiting in the virtual line for their money back – making getting a refund from Ofo harder than snagging Hamilton tickets when Lin-Manuel Miranda was performing.

Piles of disused Ofos and Mobikes in Shanghai

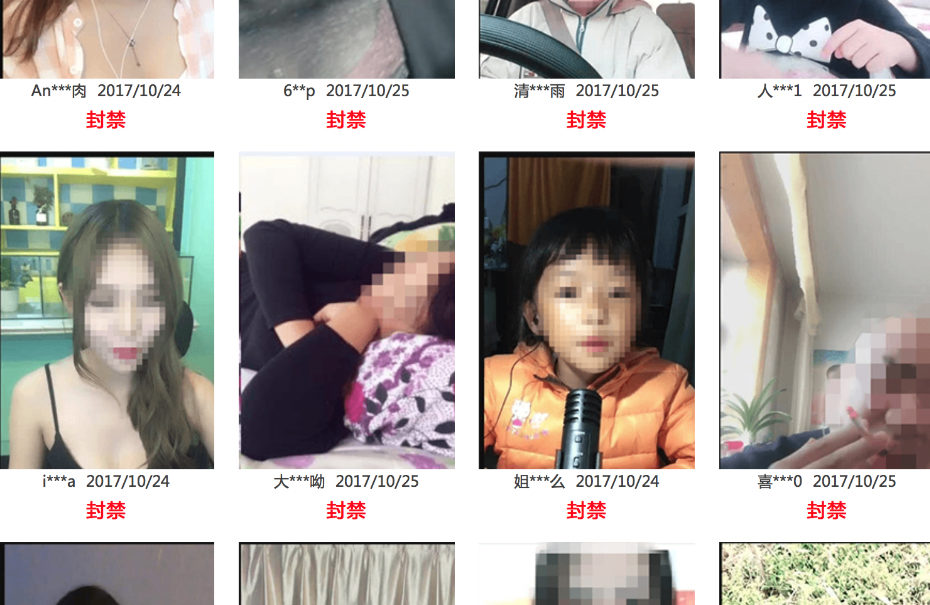

And if that wasn’t enough negative press, Ofo’s refund strategy has also come under fire for favoring foreigners. On December 13, Weibo user zjt93 posted screenshots of an email written in English stating that he applied for a refund more than a month ago and was willing to sue. Sadly, but unsurprisingly, this “pretend to be a foreigner” strategy worked, and zjt93 got his money back the next day. Netizens weren’t too happy about this, evidenced by the hashtag “pretend to be a foreigner and Ofo will give you a refund in seconds” (#假装外国人ofo秒退押金#) climbing Weibo’s hot search list.

A Weibo user claims to have received a quick refund from Ofo after posing as a foreigner

Given the number of angry clients and the amount of controversy, we’re almost surprised an Ofo-themed diss track hasn’t dropped yet.

For the bigger picture on bike sharing culture in China, including Ofo’s origins and how it got to this point, see below:

China Explained: All You Need to Know About the Bike Sharing Boom (and Bust)Article Oct 23, 2018

China Explained: All You Need to Know About the Bike Sharing Boom (and Bust)Article Oct 23, 2018