Editor’s note: This article by Rita Liao was originally published by TechNode. It has been re-posted here with permission.

On October 19th, the twenty-year-old Chinese tech giant NetEase announced that its second pork farm had just been launched in an idyllic county in the southeastern province of Jiangxi, spanning a 2.2 million-square-meter farm encircled with pine trees, just by a large reservoir.

Yes, Chinese tech tycoons aren’t always just about finding the next most disruptive thing in tech. Richard Liu, founder and CEO of JD.com started a free-range chicken project by subsidizing local farmers. Ding Lei, the 46-year-old shy, low-profile founder and CEO of NetEase has been raising organic, non-GMO black pigs for the last eight years under the company’s agricultural affiliate Weiyang.

When the pork was ready to go mass-market last winter, Ding served it to a group of friends who were some of China’s most prominent tech bosses: Sohu founder Zhang Chaoyang, Xiaomi CEO Lei Jun, Meituan Dianping CEO Wang Xing, Qihoo 360 CEO Zhou Hongyi, Baidu President Zhang Yaqin, to name a few. The meal was served during the annual World Internet Conference, a summit held by Chinese government agencies in the historic water town of Wuzhen in eastern China for high-profile figures to muse on internet trends and policies. Ding Lei in particular was psyched at the dinner, local media reported, not only because of NetEase’s impressive growth that year, but because he was one step closer to his vision: bringing better, safer food to Chinese people.

After episodes of food safety scares—from glow-in-the-dark pork to gutter oil—China’s more affluent class is increasingly turning to organic foods. Hormone- and chemical-free aside, NetEase’s black hogs grow up on vast, uncontaminated farmland and are, according to the company, nurtured with organic feed, customized music, and smart toys. They live for a longer cycle of 300 days before being shuffled to the slaughter house, compared to 150 days for regular pigs on the market. The farms are equipped with sensors to track the pigs’s health status to make sure the best meat is reared.

NetEase Weiyang is chasing after China’s insatiable appetite for pork. Since the Chinese economy started to grow rapidly in the late 1970s, pork demand expanded by an average 5.7% every year until 2014. China is now the world’s biggest pork market, and for the older generations who have suffered from years of starvation and poverty, pork is still considered a luxury today. Though there is a rising awareness to cut back on meat amongst the younger, better-educated generation, pork remains the most consumed meat in the Chinese diet.

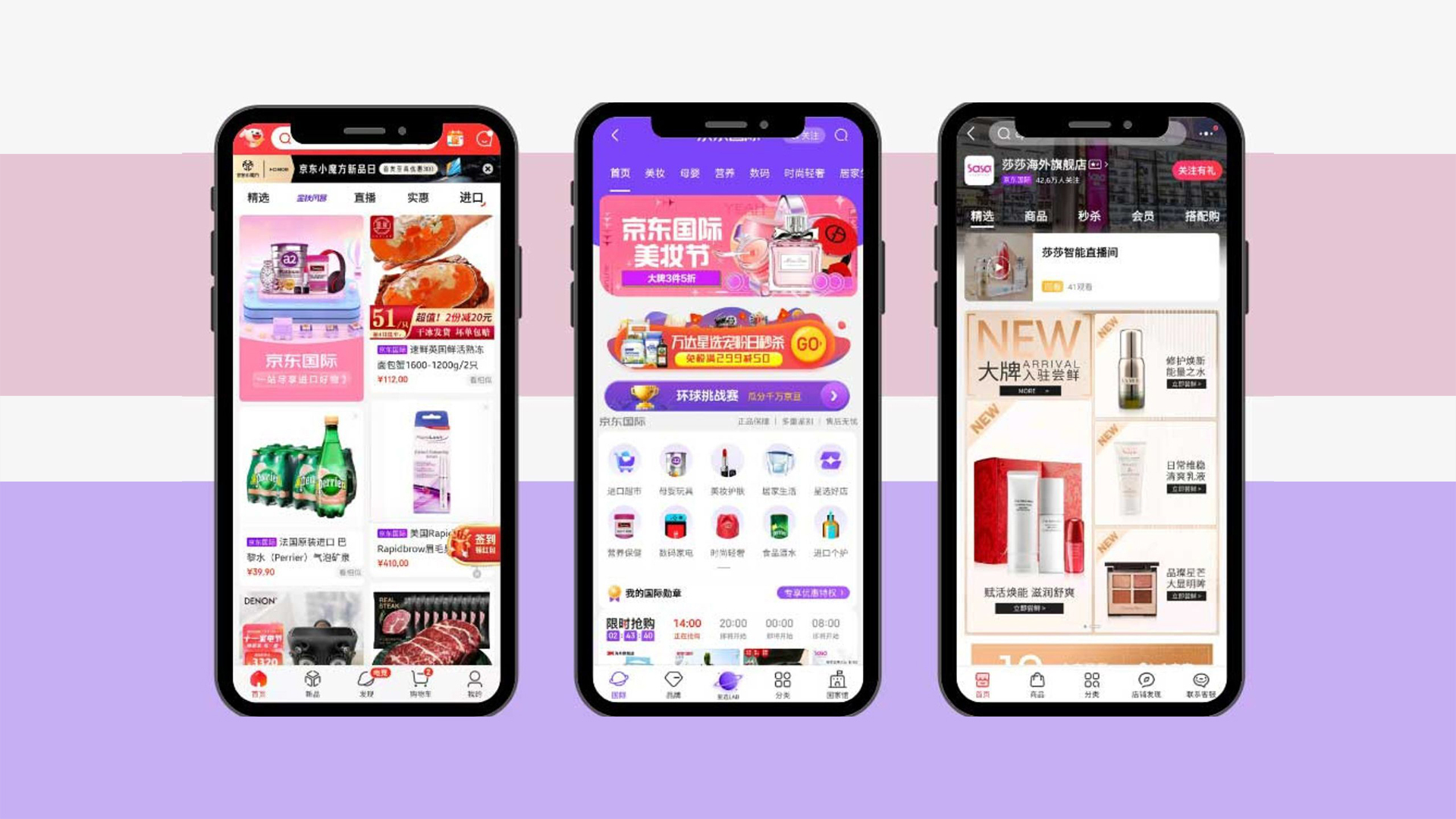

It thus came as no surprise that NetEase’s first black pig on the market was auctioned off for nearly 110,000 RMB ($16,531) last December. The pork is currently sold in bundles of mixed parts on NetEase’s newly-minted proprietary e-commerce brand Yanxuan with similar price tags to other black pork brands: 159 RMB ($24) for 1.05kg, 198 RMB ($30) for 1.4kg, or 239 RMB ($36) for 1.75kg.

In April, NetEase Weiyang completed a 160 million RMB Series A round led by Meituan Dianping and Sinovation Ventures. JD.com also participated with a strategic investment. The money would be used for “promoting and copying” the farming model that it had trialed for years from its first farm, the company said (in Chinese). Ding’s well-intended pork project has, however, been called into question. Skeptics comment that Weiyang’s black pork, which took seven years to go mass-market (in a limited supply), is merely a publicity stunt by Ding.

“Yes, I am performing a stunt,” Ding said in a rebut to local media. “The important question is what the stunt is for. My intention is to explore new farming models by raising pork and at the same time, make a contribution to solving food safety problems. I am putting on a stunt to raise people’s awareness. So what’s wrong with it?”

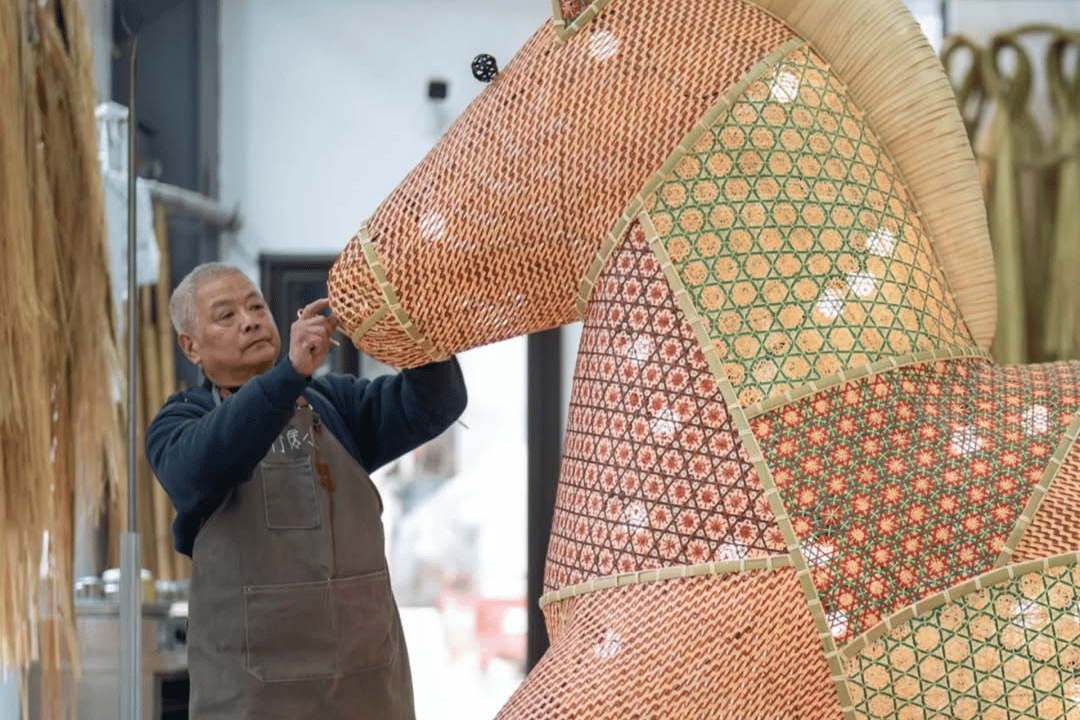

This pursuit of quality craftsmanship has already been reflected in NetEase’s e-commerce business and gaming. Yanxuan, which launched in 2015, has seen surging gross merchandise value (GMV) by selling durable products of spartan aesthetics targeted at the rising middle class, similar to those of Muji’s. Like Tencent, NetEase derives most of its revenues from online video games. Its recent hit Onmyoji is widely praised for its beautiful graphics. There’s a saying in China’s tech industry: If it comes from NetEase, it comes with quality (网易出品,必属精品). NetEase’s pork game is seeking to live up to that praise.