Competition in the bike sharing industry is quickly evolving. Ofo was one of the early market leaders, but now rumors of its impending doom continue to circulate on a near daily basis, while another forerunner, Mobike, makes advances at home but hits bumps in the road overseas. Meanwhile, despite apparent saturation, the market continues to see new budding competitors entering in an attempt to disrupt the status quo.

As the playing field continues to shift and change, it’s important to go back to the beginning. What is dockless bike sharing and how did the industry become what it is in China today?

WHAT IS BIKE SHARING?

Dockless bike sharing, as we know it now, is an innovative system of smartphone apps and QR codes that allow users to pick up bikes wherever they can find them and drop them off wherever they’re trying to go.

The color-coded bikes, fully equipped with handlebars, wheels and kickstands also feature built-in combination locks that can only be unlocked by scanning the attached QR code with the corresponding brand app. Once unlocked, the user is typically charged a small fee of 1RMB per hour, or half hour, for the ride.

Related:

State Media Xinhua Touts China’s “Four Great New Inventions”Article Aug 08, 2017

State Media Xinhua Touts China’s “Four Great New Inventions”Article Aug 08, 2017

The colors of the two most ubiquitous bikes on the market so far are bright yellow (Ofo) and orange (Mobike), but will these colors dominate the streets forever? Why not blue, or sky blue, perhaps? What about green, orange, or turquoise? The latter colors are already increasingly prominent in “lower tier” cities, i.e. those beyond Beijing, Shanghai, and Guangzhou.

With these questions posed, here is some background on the companies that started it all – Ofo and Mobike – and the challenges ahead.

OFO ORIGINS: KIDS WITH A DREAM

The year 2014 was a time when Chinese citizens were encouraged by the Chinese government to dream digitally, to innovate and create in the ever-advancing realm of technology and smartphone apps. Inspired by the call, five students from the prestigious Peking University set out to revive a method of transportation that had been in recent times dubbed as inferior: bicycles.

Three of the five students were members of the PKU bicycling club, so it made sense. Dai Wei, Xue Ding, Zhang Siding, Yang Pinjie and Yu Xin cofounded the start up in the spring of 2014 with the dreams of merging their love for environment-friendly transportation with digital entrepreneurship. The name of their company? A three letter word resembling a person on a bike: ofo.

Ofos became so widespread that even the police could be seen using them

But it wasn’t until they endured a series of trials and errors and nearly hit rock bottom financially that they realized they wanted to create some sort of smart-phone empowered bike-sharing system. After finally arriving at the idea in the summer of 2015, they began making bigger moves.

At the start of that fall semester, they introduced their first fleet of conspicuous yellow bikes to the PKU campus, cranking them out at a production cost of 250RMB (36USD) per bike. After paying a deposit of 199RMB (50USD) up front, users were free to take their bikes for a spin at 1RMB per ride.

Ofos and Mobikes lining a sidewalk in Shanghai

In a matter of months they were counting over 4,000 orders per day. CEO Dai Wei and his team didn’t know it yet, but they had started a transportation revolution.

Then their big break came. Robin Luo, a big time investor from GSR Ventures, spotted the yellow bikes on campus during an event, set up a meeting with the students involved, and soon afterwards invested 1.5 million USD into the venture. It was time for Ofo to take off its training wheels.

Following this kick-start Ofo expanded into other parts of China, and by the end of 2016 they possessed a fleet of 85,000 bikes providing more than 500,000 daily rides around the country. In September of that year Ofo received a 130 million USD investment led by Xiaomi and CITIC’s private equity arm.

In 2017 the company looked beyond China. Armed with a fresh investment of 450 million USD from Didi and CITIC, they began by expanding to Singapore in February, finishing with Paris in December. The company was officially a multinational unicorn, and to top it off Alibaba took it under its wing in June 2017 with a 700 million USD investment.

To date, Ofo has raised a total of 2.2 billion USD, and currently boasts 32 million rides per day in over 200 cities. But, as we’ve noted, in recent months Ofo has been backpedaling in the international marketplace and is experiencing considerable problems at home.

Bike-Sharing Company Ofo Backpedals on International DreamsArticle Jul 20, 2018

Bike-Sharing Company Ofo Backpedals on International DreamsArticle Jul 20, 2018

In July Ofo announced it would be removing its services from Australia, Austria, the Czech Republic, Germany, India, Israel and the Netherlands. That same month Ofo reportedly laid off the majority of its staff in the U.S., pulling its services from every city except Seattle, San Diego, and New York, where it will introduce a pilot program in the Bronx.

Yet as Ofo seemingly reaches the end of the road, its rival is pushing ahead and its investors are placing their bets on new competitors.

MOBIKE ORIGINS: GROWN-UPS KNOW BETTER?

In 2014, tech reporter Hu Weiwei, either by her own inspiration or prominent investor Li Bin’s, hit on the same idea the PKU Ofo team wouldn’t discover until the following year – a bike rental system empowered by smartphones.

Already backed by investor Li Bin, Hu quickly utilized her tech world connections to assemble a team of cofounders that stood in stark contrast to the ragtag group of students from PKU – a tech startup dream team, one might say.

One cofounder was Xia Yiping, who had managerial experience in the loT departments of major automobile companies like Ford and Rolls Royce. Currently Xia serves as the head of Mobike’s Artificial Intelligence Lab. Another was heavyweight Davis Wang. Wang had experience at Google China and Tencent before landing a GM position at Uber Shanghai. Wang quit that position to become Mobike’s CEO.

Related:

![]() One China, Two Ecosystems: Alibaba vs TencentArticle Nov 20, 2017

One China, Two Ecosystems: Alibaba vs TencentArticle Nov 20, 2017

Though Mobike was founded in January 2015, the company didn’t officially launch its first fleet of orange bikes until April 22, 2016, giving the cofounders a full year to draw on their depth of experience to design a quality system.

Their planning produced tangible results. One game changer was their bikes’ smart-locking system, which unlike Ofo’s static-locks would unlock automatically after scanning the bike’s QR code. The bikes were also incredibly durable, built with solid rubber tires and aerospace aluminum frames.

These features made for quite an expensive bike, costing between 1000-3000RMB (150-450USD), but Hu and her team were betting that between low maintenance costs and airtight security that these moves would pay off in the long term.

Piles of Mobikes and Ofos have become common sights on Chinese sidewalks

And by the end of 2016 Mobike had already raised 100 million USD from the likes of Tencent, Panda Capital and Hillhouse Capital Group. In June of 2017, Mobike received another 600 million USD from Tencent, and soon after announced its plans to expand into 200 new cities before the end of the year, many outside of China.

These massive Tencent investments were hinting at what was to come – in April 2018 Mobike was acquired by Tencent-backed Meituan-Dianping. Mobike was officially team Tencent.

That same month Mobike began rolling out a series of innovations that were impressive enough to make Ofo sweat, starting with a shared electric car developed by Guizhou car company SITECH.

Related:

Mobike’s New Shared Car is Here and Oh Boy the Future is NowArticle Apr 20, 2018

Mobike’s New Shared Car is Here and Oh Boy the Future is NowArticle Apr 20, 2018

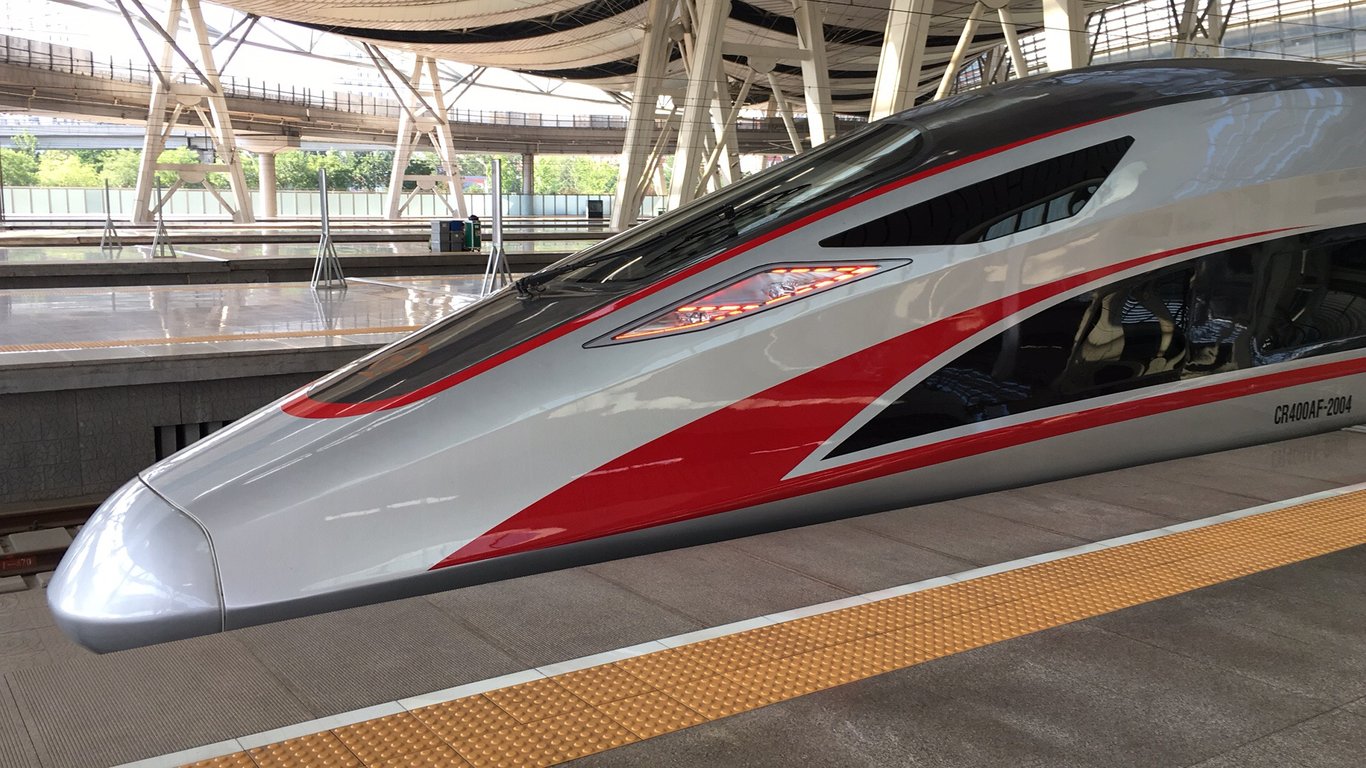

Then in July, Mobike announced it was going deposit-free, meaning users would no longer need to pay deposits to use their services. To top that month off it introduced a fleet of electric bikes equipped with Tesla-grade batteries.

Mobike has also been making strategic geographic moves in the international market. In August it announced an expansion of its services across India, a country Ofo had abandoned just one month before. It did however, have to withdraw from Manchester in the UK having apparently underestimated how much vandals would take a liking to their fleet of bikes.

With Ofo on the decline, is Mobike posed to dominate the international market for the foreseeable future? There are a few other notable startups to look out for.

NEW BIKE-SHARING COMPETITORS: A CROWDED PELETON

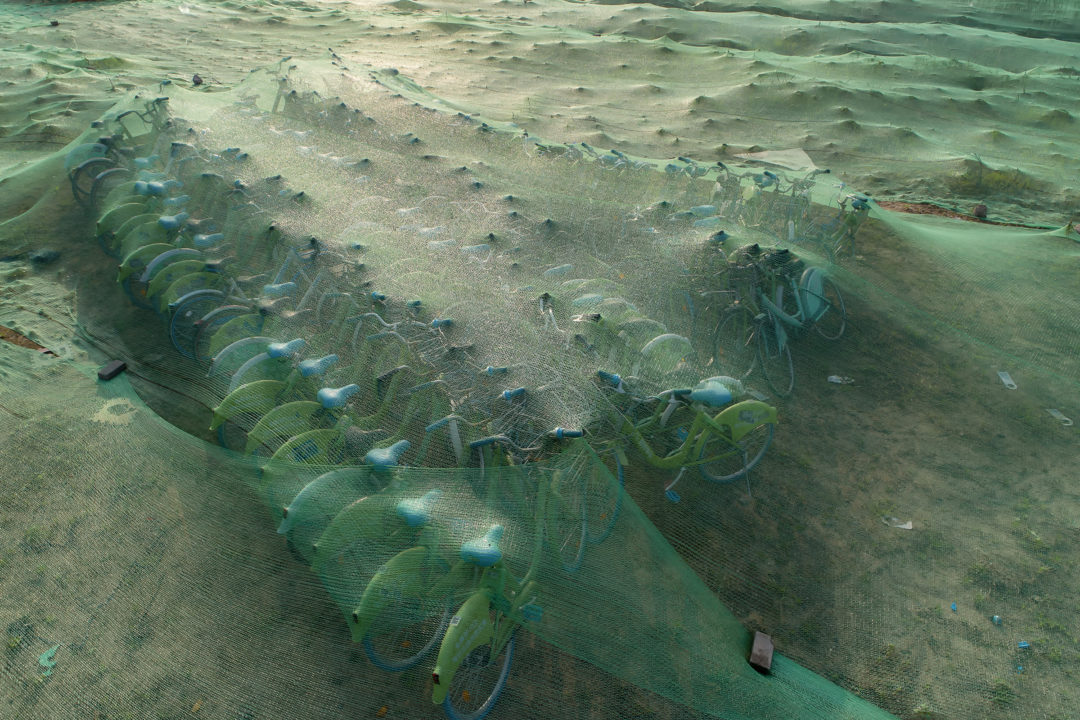

A creative shared bike stack in Chengdu

Launched in 2016, Hellobike is undeniably the premiere up-and-comer in the Chinese bike-sharing market. Raising a staggering 1.5 billion USD in less than two years (its team mostly hails from Alibaba), the company is currently ranked third in China’s bike-sharing industry as measured by monthly active users (MAU).

In terms of strategy, Hellobike differentiates itself from Ofo and Mobike by focusing its services on second and third tier Chinese cities rather than major urban centers. It also went deposit-free before Mobike did, which may have spurred the orange giant to do the same.

Two other lower ranked companies worth noting are bluegogo and Didi’s own brand, Green Orange. Didi revived a bankrupt bluegogo at the start of this year, and then began replacing bluegogo’s bikes with its own Green Orange brand. But Didi already invested in Ofo and even owned over a 25% stake in the company at one point – what is this side project?

Rumors continue to swirl that Didi is warning off potential investors in Ofo following a major falling out with the company, and that Didi’s clout is enough to leave the bike-sharing pioneer starved for cash. Reports this week that Ofo founder Da Wei has stepped down from his position as legal representative at the company have been seen in some quarters as one of the final nails in the firm’s coffin.

THE ROAD AHEAD

Is Ofo on its last kickstand? Will Mobike move forward to dominate the international bike sharing marketplace? Will another capable competitor rise to challenge these giants in China and beyond? Really, these questions miss a larger point.

In the end, this is still a proxy war between the Chinese conglomerates Tencent and Alibaba – as usual. With a faltering Ofo on its hands, Alibaba (via Didi) has turned its attention toward other promising companies such as Hellobike and bluegogo to continue the war with Mobike, now in the hands of Tencent-backed Meituan. Sorry but yes, it’s really that simple.

—

Related:

Watch: Jaw-dropping Video of China’s Shared Bike Graveyards Goes ViralArticle Jul 28, 2018

Watch: Jaw-dropping Video of China’s Shared Bike Graveyards Goes ViralArticle Jul 28, 2018

A Food Delivery Service’s Leap into Taxis and Shared Bikes is Just Another Day in China’s Wild West Investor EcosystemArticle Apr 06, 2018

A Food Delivery Service’s Leap into Taxis and Shared Bikes is Just Another Day in China’s Wild West Investor EcosystemArticle Apr 06, 2018

![]() Bike-Sharing Behemoths: The Familiar Business Models of Ofo and MobikeArticle May 27, 2017

Bike-Sharing Behemoths: The Familiar Business Models of Ofo and MobikeArticle May 27, 2017