It all started with baby formula. But in the last decade, China’s unofficial daigou industry has been booming, with Chinese shoppers overseas sending all kinds of products back to the motherland’s eager consumers. Yet as authorities launch an apparent crackdown on the practice, luxury brands’ stock prices have taken a hit. So what’s going on?

What is “Daigou?”

The term “daigou” (代购) generally has a couple of meanings. It can be the act of overseas shopping for Chinese consumers, or the people themselves who send the product to Chinese consumers. The latter have become a phenomenon. This is not just a few friends helping each other out on trips abroad, but a multi-billion dollar market.

The word daigou might not be in the Oxford English Dictionary just yet, but there is a Wikipedia entry and it’s appeared in global news outlets including the BBC (“More than a million people globally are now working as daigou, according to some estimates”) and Australia’s ABC (“Ever seen people clear entire shelves of baby formula at your local pharmacy or supermarket?”).

So how does it work? Potential customers browse through pictures and information posted by daigou online (usually on messaging app WeChat) and message the sellers once they find something. These products can range from baby formula powder to cosmetics, and from sportswear to luxury items such as designer bags and watches.

The overseas shoppers then purchase items for Chinese consumers who are unwilling or unable to buy said items in China, whether due to availability issues or sheer mistrust of China-made products. These items are then sent to the buyer or carried across the border in the daigou shopper’s own luggage (which is where the line between “personal shopper” and “smuggler” starts to get a little blurry for some).

Why is Daigou Such a Phenomenon?

Lack of trust has been a major factor in the growth of daigou. In 2008, 6 infants in China died due to tainted baby formula powder — a story that still resonates today, especially when similar issues, such as the recent faulty vaccine scandal, emerge. The fear of tainted products, especially including healthcare and beauty products, has therefore driven people away from Chinese brands but also led to levels of distrust around foreign brands in China due to apparently different regulations and standards at home and abroad.

However, distrust in domestic brands isn’t the only pillar propping up daigou. Taxes levied on luxury brands (some as high as 30-40%) have prompted customers to cast their gaze to other countries where the same items can be found at a cheaper price. Daigou will often send luxury items to customers at a lower price than can been found in China. They’ll charge a relatively small handling fee, but overall the Chinese customers benefit from this transaction.

Related:

China’s “Dallas Buyers Club” Spotlights an Ongoing Country-Wide IssueArticle Jul 09, 2018

China’s “Dallas Buyers Club” Spotlights an Ongoing Country-Wide IssueArticle Jul 09, 2018

The business has become so big that foreign entities are increasingly looking at how they can capture the market. The Australian Post has been experimenting with what amounts to their own daigou service, for example.

Australia is an especially attractive place for daigou activity due to its relative proximity to China and the prevalence of an array of foreign brands. Assuming they’re able to get access to the country, once there the daigou’s role is fairly straightforward. As one Sydney-based daigou seller told us, “I don’t need to invest lots of money on doing this business. I’m really just promoting some photos and information on WeChat.”

Yet as revenues have risen, so too has discomfort with the practice in certain corners of the government. And in the midst of a trade war and high profile crackdowns on tax evasion, there is speculation that the golden age of daigou may be coming to an end.

Is there a Major Daigou Crackdown?

In recent weeks there have been widespread reports that Chinese border authorities have been instigating more thorough customs checks — and certainly the long lines to pass through customs at some of the country’s main airports appear to corroborate this. Jing Daily reported last week that, “Chinese authorities have finally started to crack down and are inspecting returning tourists’ bags for undeclared goods, sending shares of some luxury brands tumbling.”

That could mean sales of certain products take a hit internationally. As Bloomberg notes,

Chinese consumers make up the lion’s share of growth for the luxury business and account for roughly a third of the industry’s sales, according to consultancy Bain. Many do the bulk of their high-end shopping during visits to Tokyo, Seoul, Paris and other tourist destinations, where prices are lower than at home.

While some liken daigou activity to smuggling, ironically if such shopping visits fall under closer scrutiny many brands could see their actual sales volumes falling.

“Daigou shoppers boost other countries’ economies, not China’s,” the Australia-based daigou operator told us. “Also, currently, daigou do not need to pay taxes as the government cannot track their cash flow. It is a loss for the government.”

Hopefully the “problem” of daigou will galvanize domestic brands to reconsider their business practices and provide better products rather than relying on the government to target daigou. Regardless, the success of daigou signals to the companies of fake or faulty products that people are willing to pay more for higher quality, something they’d do well to take note of.

Related:

Don’t Bring Lawyers, Guns and Money to ChinaArticle Dec 04, 2017

Don’t Bring Lawyers, Guns and Money to ChinaArticle Dec 04, 2017

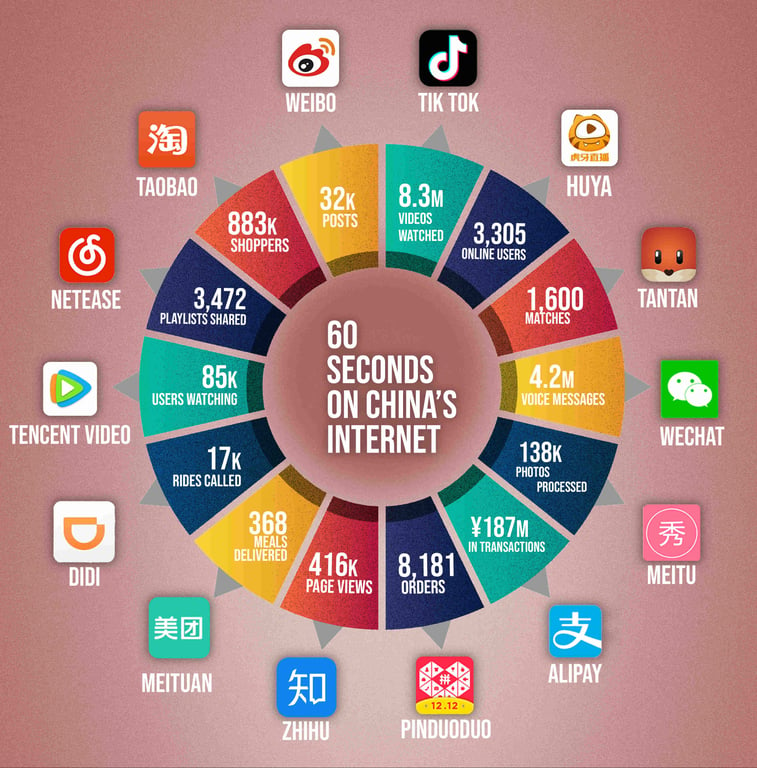

Infographic: Here’s What Happens in One Minute on the Chinese InternetArticle Sep 25, 2018

Infographic: Here’s What Happens in One Minute on the Chinese InternetArticle Sep 25, 2018

Open Sesame Magazine is Curating “Weird Taobao”Article May 24, 2018

Open Sesame Magazine is Curating “Weird Taobao”Article May 24, 2018

Header image: Peter Bond on Unsplash