China’s short video market is currently exploding — and the country’s biggest tech companies are getting involved. Baidu, Alibaba, and Tencent have all launched Vine-like short video apps in recent months, joining the relatively established offerings of Kuaishou and Douyin.

As short video starts to push out zhibo livestreaming as the hottest trend on the Chinese internet, with user numbers having doubled in 2017 and witnessed similarly rapid growth so far this year, here’s a guide to the main competitors:

Douyin

If you’ve heard of just one of the dozens of short video apps to emerge in China in recent months, it’s probably this one. Known as Tik Tok in English, it topped the iOS download charts for non-game apps for the first quarter of 2018 despite, or perhaps because of, a number of controversies over the nature of its content. Created by ByteDance — who are also behind hugely popular news app Jinri Toutiao — the app has been accused of purposely promoting pornography, of banning Peppa Pig, and of inducing phone addiction among China’s millenials.

We’ve written in more detail about Douyin before; here’s our longer run-down of the app:

How Douyin (TikTok) Became the Most Popular App in the WorldDouyin (TikTok) has weathered repeated controversy to be named as the most downloaded non-game app on Apple’s App Store for the first quarter of 2018Article May 09, 2018

How Douyin (TikTok) Became the Most Popular App in the WorldDouyin (TikTok) has weathered repeated controversy to be named as the most downloaded non-game app on Apple’s App Store for the first quarter of 2018Article May 09, 2018

Interestingly, Douyin’s parent company recently announced that it was going to enter the long-form video streaming market by signing up and producing TV shows and films for another of its video platforms, Xigua. The move puts ByteDance in direct competition with the likes of streaming sites Youku and iQIYI. Complicating things further, Baidu-backed iQIYI — the company responsible for smash hit shows Rap of China and Yanxi Palace — recently announced its own short video spin-off, specifically aimed at older users.

Kuaishou

Kuaishou (meaning “quick hand” in English, and also known as Kwai) is another of the more established short video apps in China. The platform, which offers livestreaming services as well, was launched in 2011 and quickly found popularity among users outside of China’s “top tier” cities. However, it too has seen a number of controversies and has something of a reputation for “vulgar” content, as this piece explores in more depth:

China’s tech giants are following users back to their small city hometownsArticle Aug 18, 2017

China’s tech giants are following users back to their small city hometownsArticle Aug 18, 2017

Although it was founded by entrepreneur Xu Hua (originally as a GIF maker), Kuaishou also has investment from Tencent. At the beginning of the year it closed a 1 billion USD funding round amid talk of an upcoming IPO, and in June the company flexed its muscles to acquire anime and TV show-centric rival AcFun.

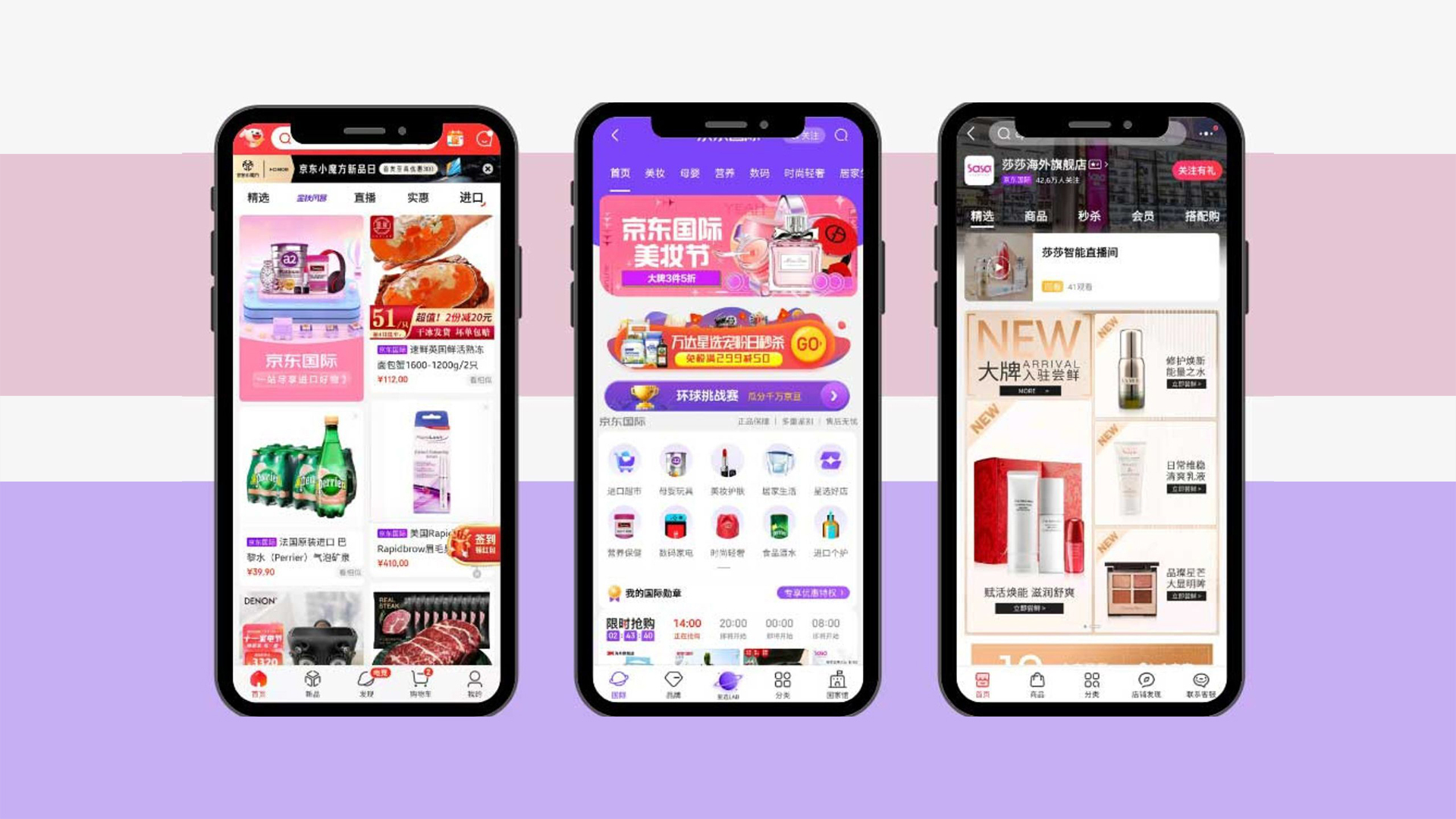

Lu Ke

Launched this week, Lu Ke (a play on “look” in English) is Alibaba’s short video offering. Although it encourages users to “share every high from life” and is divided into categories such as “travel” and”food”, it’s mostly focused on providing a platform for Taobao sellers, with the ability to include links to stores on the shopping site being a key function. There’s also a messaging-like section where potential buyers can ask the uploader questions.

Lu Ke’s launch comes after Taobao introduced an AI-powered video add-on for sellers on its site:

Alibaba’s New AI Program can Create its Own Videos Using “Emotional Computing”Article Apr 24, 2018

Alibaba’s New AI Program can Create its Own Videos Using “Emotional Computing”Article Apr 24, 2018

That link into the Taobao and Alibaba ecosystem could well be one of Lu Ke’s biggest assets. How much the content will venture into Douyin-rivalling territory remains to be seen.

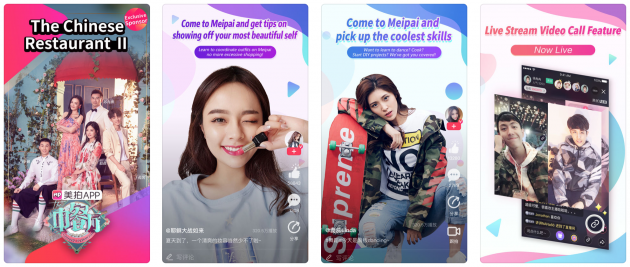

Meipai

The video offshoot of photo enhancement/beautification app Meitu — which allows users to alter their skin tone, airbrush features, and add cutesy rabbit ears on photos — Meipai brings a similar editing suite to moving images. The app offers both short video and livestreaming options and there are also some interesting features like being able to see live comments from other users on your productions, but really, you’re here for the filters and editing suite.

Nani

In December, Baidu announced that “a super fun short video app and social platform has finally arrived!” despite the market for such products already being pretty crowded at the time. Named Nani, the slick-looking app offers a lot of the same functions as the other short video apps on this list, but also plugs into the Chinese search giant’s popular Tieba forum network.

It’s still early days for Nani, but it may need to come with something a little more original to really barge in on China’s short video market.

Weishi

Tencent has a stake in Kuaishou, but it’s also been pushing its revived Weishi (or “WeVideo”) program lately, with WeChat users seeing a promotional link for the app every time they try to post a video or photo to their “Moments” friend feed in recent days.

Tencent incorporating its own short video app into its all-conquering WeChat platform has been on the cards for a while and led to a public spat with Douyin’s main backer earlier this year after the latter was effectively shut out from WeChat. To make matters worse, Weishi looks a lot like Douyin and shares a number of the same features, including trivia and dance battle games.

Weishi was actually launched originally in 2013, but was taken offline by Tencent in spring of last year after its growth stagnated. As part of the app’s resurrection, its parent company has reportedly been spending 3 billion USD on “subsidies” to lure KOLs over to the platform. That, plus the leveraging of existing user bases on Tencent-owned chat apps QQ and WeChat has seen Weishi hit the top of the free download charts on Apple’s App Store this week.

—

You might also like:

Shots Fired: Smartisan’s New “Bullet Messaging” App is Taking Aim at WeChat – and Just Topped the App Store’s Download ChartsArticle Aug 29, 2018

Shots Fired: Smartisan’s New “Bullet Messaging” App is Taking Aim at WeChat – and Just Topped the App Store’s Download ChartsArticle Aug 29, 2018

How Rap Became the Advertising Medium of Choice for China’s Brands – and GovernmentAs soon as rap music became mainstream in China, advertising execs leapt onto the unsuspecting genre as a communication medium for young consumersArticle Sep 17, 2018

How Rap Became the Advertising Medium of Choice for China’s Brands – and GovernmentAs soon as rap music became mainstream in China, advertising execs leapt onto the unsuspecting genre as a communication medium for young consumersArticle Sep 17, 2018

“Hermès Fried Rice” and the Cult of Online Influencer FoodsArticle Jun 28, 2018

“Hermès Fried Rice” and the Cult of Online Influencer FoodsArticle Jun 28, 2018