With meatless meat mooncakes selling like hotcakes during Mid-Autumn Festival, plant-based OmniPork popping up in restaurants across Beijing and Shanghai, and giants like Impossible Foods and Beyond Meat setting their eyes on the country’s population of 1.4 billion — plant-based protein is seeing something of a renaissance in China.

While such products are causing a stir in many countries, China actually has a millennia-long history of “mock meat” — it’s been a staple on the plates of the country’s Buddhist community for centuries. Renowned Chinese food expert Fuchsia Dunlop has even dubbed China “the birthplace of fake meat,” writing of “convincing replicas” of pork and mutton dishes made using vegetables dating back to the Tang Dynasty (618-907CE).

Related:

Chinese Takeout: A Vegetarian Oasis in Meaty Gansu ProvinceQinglian (Green Lotus) strives to be an oasis of vegetarian cuisine in Dunhuang’s desert, where meat-heavy menus pervadeArticle Apr 11, 2019

Chinese Takeout: A Vegetarian Oasis in Meaty Gansu ProvinceQinglian (Green Lotus) strives to be an oasis of vegetarian cuisine in Dunhuang’s desert, where meat-heavy menus pervadeArticle Apr 11, 2019

Fast-forward over a thousand years, and these mock meats are a multi-million dollar industry. The Good Food Institute reports that in 2018, the value of China’s plant-based meat industry hit 6.1 billion RMB (910 million USD). Vegetarian food manufacturers and restaurants model tofu, wheat gluten, mushrooms and other vegetables into all manner of meats, from layered tofu skin “chicken” to mashed carrot and potato “crabmeat.”

Yet despite this rich history and thriving market, mainstream perception of traditional plant-based products isn’t all that positive. “It’s often considered not tasty, or reserved for the Buddhist and vegan communities,” explains Tao Zhang, co-founder of Dao Foods, a cross-border impact venture and incubator nurturing innovative plant-based and clean meat entrepreneurs in China.

That’s why a new generation of plant-based protein producers and advocacy groups are out to change these perceptions.

China Craving Meat

Today, China accounts for over a quarter of global meat consumption and half of global pork consumption — on mass, the country consumes more meat than any other nation in the world. Per capita, China currently eats only half as much as the United States, but this gap is set to close as incomes rise. According to Caixin Global, meat consumption per capita is expected to increase 10 percent by 2026 — reaching 55kg per person annually — with pork accounting for 60% of this figure.

For Zhang, though, this demand presents a unique long-term opportunity for plant-based products. “In order to accommodate such a huge need for more and better-quality meat products,” he says, “China will need to either significantly grow its livestock industry or seek alternative solutions.”

Related:

Chinese tech conglomerate NetEase has been quietly raising pigs for eight yearsArticle Oct 29, 2017

Chinese tech conglomerate NetEase has been quietly raising pigs for eight yearsArticle Oct 29, 2017

Given that increasing the livestock industry would pose what he calls a “serious challenge” to the country’s “already less than optimal environmental situation — especially given the lack of water, arable land, or sufficient soybeans to feed all the animals,” he deems it an unsustainable option, leaving an opening for plant-based meat to thrive.

Pair the environmental factors with issues such as soaring pork prices, triggered by African swine fever (ASF) which has been tearing through the country’s hogs since mid-2018; calls from the government to cut meat consumption in half due to health concerns such as obesity and type-2 diabetes; and increasing awareness of food safety scares — and it seems only natural that the consumption of vegan products are on the up.

The Economist reports that, while only 2% of the country is vegetarian, a survey of “big-city residents” carried out in 2017 found that “flexitarianism” — or “casual vegetarianism” — is also on the rise, with 36% of participants pledging to eat less pork, red meat and poultry due to health, environmental, and food safety concerns.

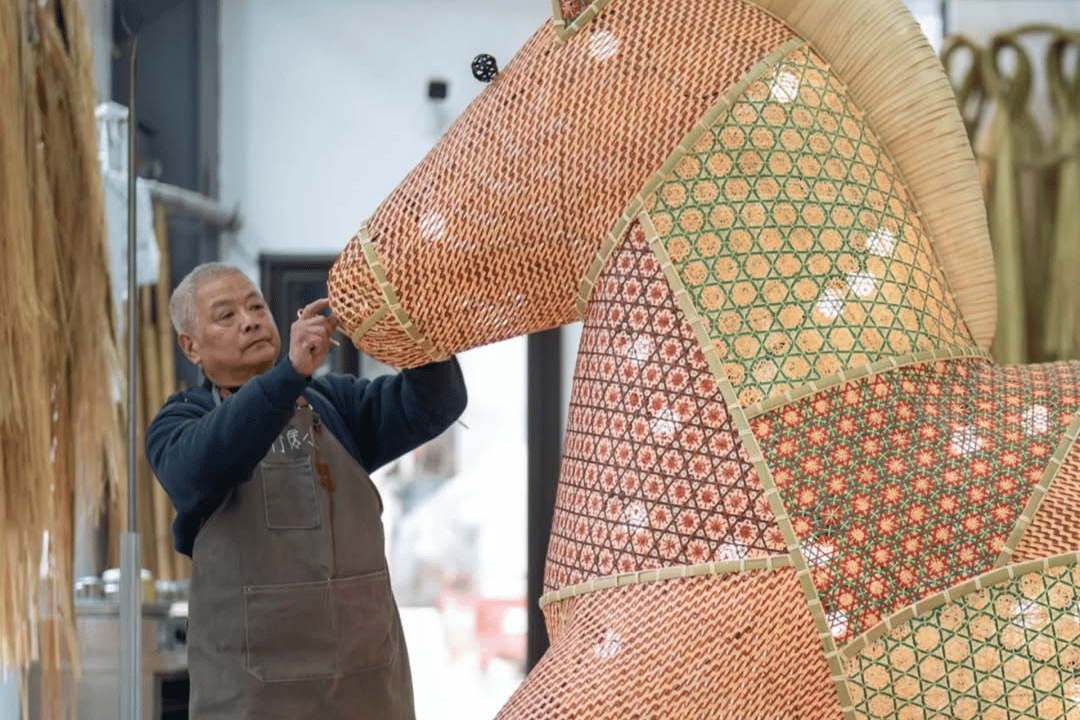

Image: courtesy Dao Foods

However, it will take more than touting the negative impacts of eating meat to convert the masses to reducing their animal protein intake. In order to succeed in China, Zhang believes it needs what Dao Foods calls “Next Generation Good Food” products — “new, exciting, delicious, affordable and accessible” plant-based proteins associated with an alternative “fun and sexy” lifestyle — all created with the country’s 400 million millennials in mind.

With open minds, disposable incomes, and an ever-increasing awareness of issues like environmental protection, food safety, and animal welfare, for many players in this nascent sector, Chinese millennials are a prime audience.

Plant-Based 2.0

Perhaps it’s not surprising, then, that the international poster children for “plant-based meats 2.0” — Impossible Foods and Beyond Meat — have their sights firmly set on China. The Impossible Burger tested the waters with a limited run at the second China International Import Expo (CIIE) this month in Shanghai, and Reuters recently reported Beyond Meat’s plans to start production in Asia before the end of 2020, as it inches closer to its target.

We’ve got a treat for the meat-lovers of China #ImpossibleFoods https://t.co/MOaar1ntew

— Impossible Foods (@ImpossibleFoods) November 7, 2019

However, while they juggle challenges from regulatory hurdles — such as Impossible’s use of GMO product Heme, and issues of labelling (“is it meat or is it soy?”) — to competitive pricing, Zhang believes there is a window for local players to create China’s own Beyond Burger equivalent tailored to the Chinese market. After all, compared to “meat-intensive products like burgers and hotdogs,” Zhang explains that “in a lot of Chinese dishes the meat isn’t the center of the plate — it’s more used to increase the flavor.”

One new wave product to launch in Beijing and Shanghai this month is plant-based pork mince, OmniPork. Created by Right Treat, a subsidiary of Hong Kong-based food sustainability social enterprise Green Monday, OmniPork is designed with the mass Asian market in mind.

Image: courtesy Green Monday

Founder David Yeung explains that their product focuses on “Asian cuisine and Asian applications,” making pork a natural choice as the most consumed meat in the region. Closely mimicking “traditional pork,” Yeung explains the plant-based meat — made from pea protein, non-GMO soy, shiitake mushrooms and rice — is meant for all kinds of uses, such as filling dumplings, flavoring congee, rolling into meatballs, pan-frying, and steaming.

Entering China via a series of mainstream restaurant collaborations, OmniPork is currently available in chains like café group Wagas, with plans to feature in Taco Bell and Hong Kong tea restaurant Tsui Wah from December 2019, alongside high-end establishments such as Shanghai Michelin-starred restaurant T’ang Court as of early next year. (OmniPork mince will also be available on the group’s plant-based Tmall Global store, Green Common, as of November 29.)

OmniPork’s plant-based taco (image: courtesy Green Monday)

Despite the fact that China currently doesn’t have a well-established community of meatless meat eaters outside of its practicing Buddhists, for Yeung the adaptability of Chinese consumers and the creation of an “aspirational lifestyle” associated with plant-based meats gives him hope — especially set against the backdrop of “black swan” events like African swine fever.

Yeung explains that while getting people on board is “an ongoing education process,” China is “very fast at adopting new things, many times they are ahead of everyone in terms of adopting new lifestyles.” Particularly, he adds, this happens among young people whose lifestyle choices are increasingly driven by social factors, such as “aspirations for health and the environment.”

However, while OmniPork labels itself as “Right Meat” — a product that’s good for the planet, people and animals — Yeung acknowledges:

“No matter how much we talk about carbon footprint, calories or cholesterol, people choose their food based on taste, price, and convenience.”

Also hitting Chinese headlines this year is Beijing-based Zhenrou (“Precious Meat”). Founded by Lu Zhongming, Zhenrou launched Suzhou-style pea-protein “pork” mooncakes during Mid-Autumn Festival, and sold out their 3,000 boxes within six days, according to CCTV.

In an interview with Xinhua, Lu says he sees “huge potential” for a new generation of plant-based meats in China — not to replace real meat, but rather to give “consumers one more choice.” He sees this especially among “generation[s] born after [year] 2000″ who have “never experienced food shortages and are willing to do their best to protect the environment and animals.”

Still, even with a range of innovative products tailored to modern Chinese palates and an optimistic outlook for the future, there may still be hurdles to overcome to create a new generation of flexitarians. Despite the success of his mooncakes, Lu feels that Chinese consumers aren’t fully on board yet, as many of Zhenrou’s customers this year had studied overseas and been exposed to plant-based eating, while 20% of orders came from foreigners living in China.

Sowing Seeds of Change

While veganism is having a moment in Western Europe and America, it’s a much tougher sell in the Chinese mainland — especially outside top tier cities — where food is at the heart of culture and tradition. “Coming out as vegan is a taxing process,” says Eve Samyuktha, founder of Plant-Based Consulting and its non-profit advocacy group Vegans of Shanghai (VoS). “You have to face your family, friends and answer so many questions.”

Samyuktha feels that in China, “the population isn’t ready to understand plant-based meat just yet.” Despite the rich history of plant-based meats, she adds, “unlike Western countries where the advocacy [among mainstream consumers] has built up over 60 years — in China that 60 years is just starting now.”

Even labelling something “vegan” could be a turn off for China’s potential flexitarians. “The Mandarin word for vegan is ‘quan su’ [全素], meaning ‘strict vegetarian.’ It’s not an all-inclusive word.” She further explains that the character “su” (素), also meaning plain, could help account for some of the negative connotations:

“The etymology [of “su”] comes from making thread for clothes without any dyes — ‘plain white clothes.’ It suggests something that’s boring and bland.”

To push the movement forward, Samyuktha emphasizes the importance of community building and getting the products out there. “For us, getting a foot in the door is getting the product in the mouth,” she says. “The whole plant-based movement is a demonstration of what the food is like, so you have to do the demonstration first before explanations.”

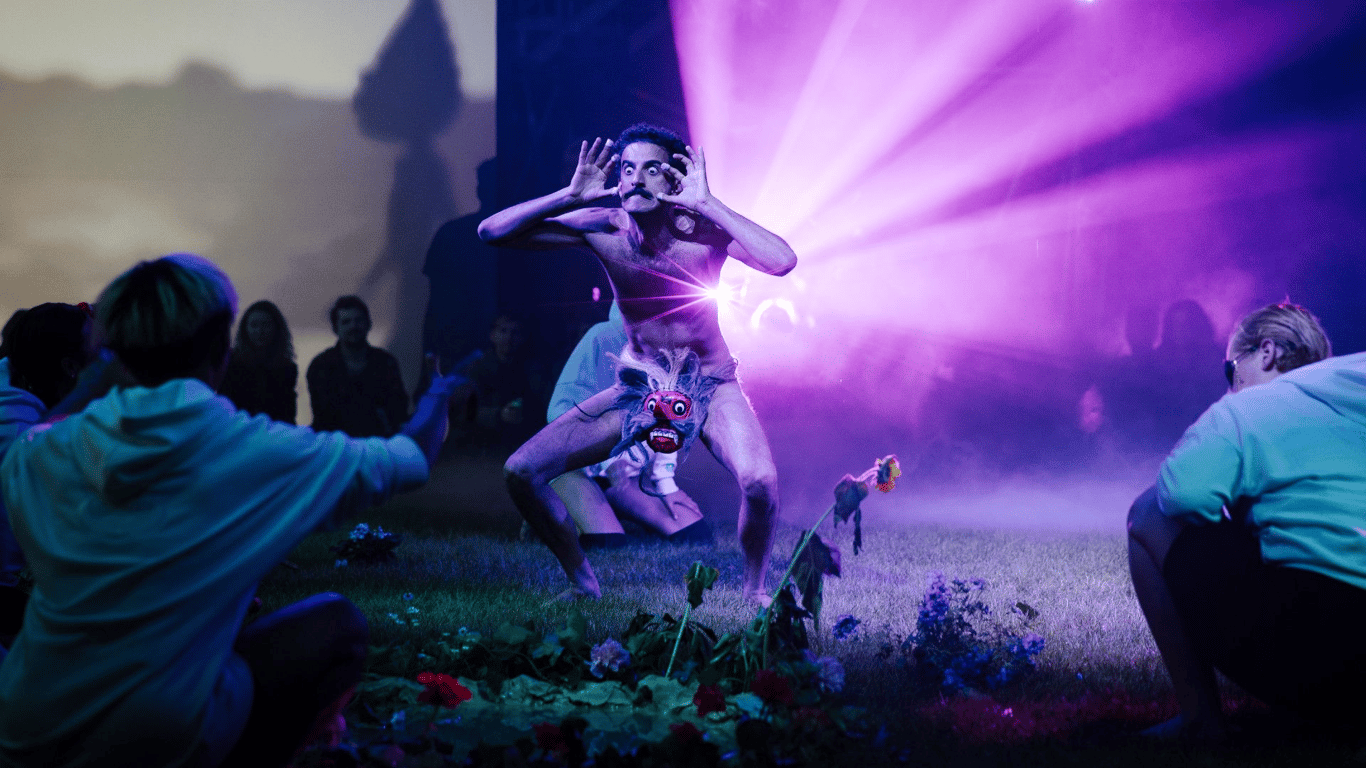

With this in mind, Vegans of Shanghai held its first plant-based festival this spring, but called it MeatFest — with “Plant-Based” written beneath the main title. “If we had called it VeganFest, we would have only attracted vegans,” explains Samyuktha. “The idea was to bring the mainstream consumers for restaurants to test and see if they’re ready for that market.”

Drawing in over 4,000 people, the feedback among locals was a positive sign for Samyuktha. “The Chinese consumers thought it was fun and cool. Most asked if the products were pork or beef,” she says, and that’s where VoS wants the conversation to be. “We don’t want people to ask, ‘Is this soy protein or pea protein?’ When someone is digging into a sausage or dumpling they know is vegan, there’s already the perception that it’s not going to taste like meat — even if it’s really good.”

Guests at MeatFest 2019 (image: courtesy Plant-Based Consulting)

To Samyuktha, part of the battle is to make people rethink what “meat” means in the modern world. She argues that when people refer to “pork,” it has two definitions: pork as a product made from pigs, and “pork” more broadly defined, as a food. As entities like Impossible and OmniPork get closer to replicating meat’s flavor and texture, she feels there’s no reason why people can’t have the latter without the former.

Originally from Chennai, India — a country with a similarly lengthy history of vegetarian cuisine — Samyuktha herself ate meat before opting for a vegan diet. She says:

“I love the taste of meat, and I crave it. I just don’t want it from ‘pork,’ the animal. And that is the point we’re trying to make: we love bacon, just don’t make it from animals. It can come from a different source, like plants.”

If converting China’s masses to veganism in the near future seems unlikely, there is hope for flexitarianism. As entrepreneurs continue to evolve and innovate plant-based meats for China’s millions of millennial meat-eaters — while the traditional meat industry faces mounting challenges — the stage seems set for meatless meat disruption.

Header image: “Meat” balls made from plant-based meat substitute Omnipork (courtesy Green Monday)