Since China’s opening up in the late 1970s, the modern meal in the country has changed drastically. With increased wealth and modernization, China’s food landscape began to change, and diets along with it. As a nation of 1.43 billion people, and more spending power than ever, what China puts on its dinner plate affects trade, agriculture, and food trends globally.

From takeout to tracking calories, here are some things we can expect for Chinese eaters in 2020.

More Takeout

Food delivery in China has experienced nothing short of an explosion over the last five years, and shows no signs of slowing in 2020. (In fact, it’s projected to double.)

These platforms operate along the same lines as services like UberEats, but competitive discounts — thanks to subsidies provided by delivery giants that can make takeout cheaper than eating in — and the ease at which drivers can jet across cities on mopeds helped spark a craving for convenience that feeds the now 40.2 billion-dollar industry. Two main players dominate food delivery in China: Alibaba-backed Ele.me, and food review/delivery giant Meituan-Dianping.

Related:

Meituan: The “One-Stop Super App” That’s Hungry for ExpansionArticle Jul 04, 2018

Meituan: The “One-Stop Super App” That’s Hungry for ExpansionArticle Jul 04, 2018

The biggest change might not be how this food is delivered, but what it’s delivered in. As China faces a mounting trash problem, and cities start to more strictly enforce waste regulation, concern over packaging waste has led some to call for more sustainable packaging as part of takeout services.

More Meals for One

Though perhaps not to the extreme as neighboring Japan, China looks like it might be serving more solo meals in 2020.

Once written off as gimmicky, convenience stores and ecommerce platforms are stocking an increasing number of ready-to-eat “meals for one” (link in Chinese) — even meals like hot pot, which are traditionally communal.

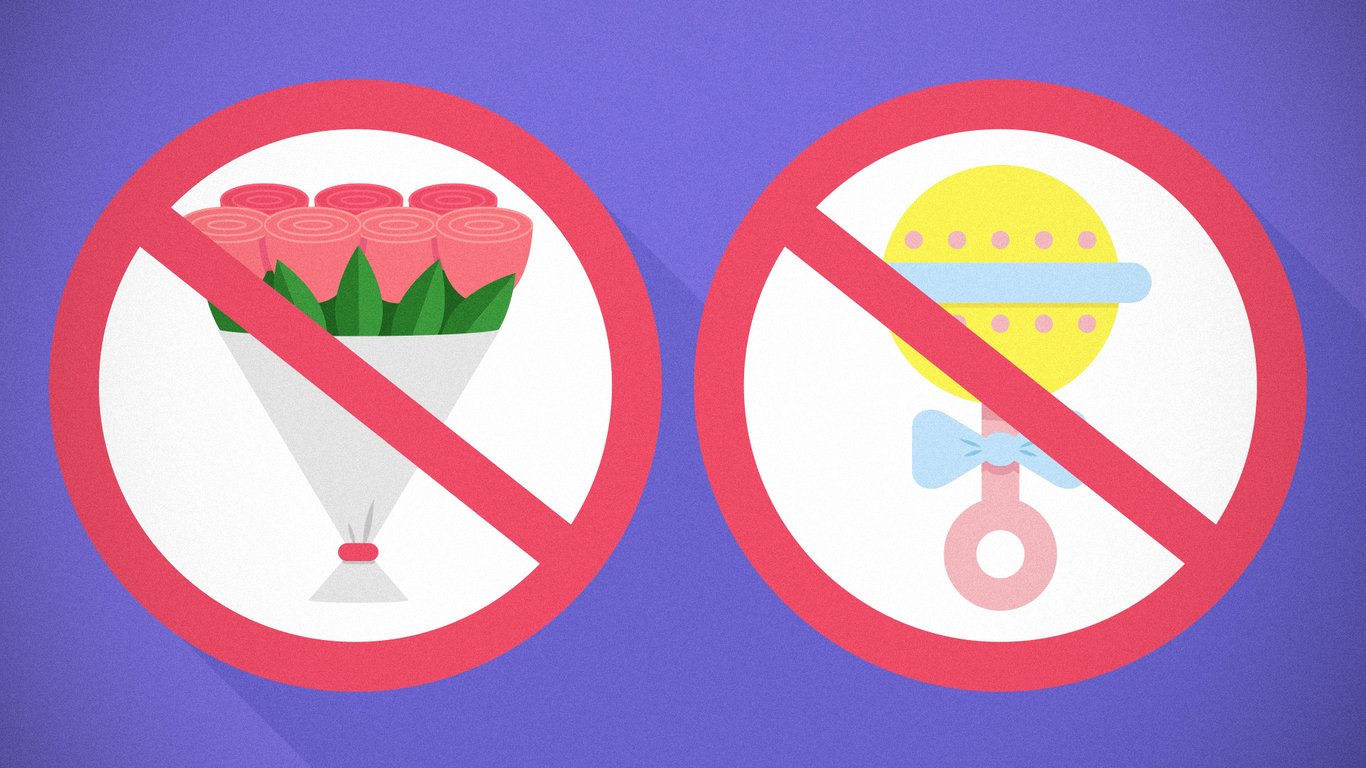

One possible reason? More millennials in China are staying single by choice — postponing, and even forgoing marriage and children altogether. Many cite the rising cost of child rearing and “commitment phobia” as some of their most pertinent reasons.

Related:

Why China’s Millennials Are at War with Marriage and Having BabiesPost-‘90s millennials online are saying, “death to the next generation”Article Sep 11, 2019

Why China’s Millennials Are at War with Marriage and Having BabiesPost-‘90s millennials online are saying, “death to the next generation”Article Sep 11, 2019

Snacks and Small Bites

As it turns out, the fastest growing food sector in China is pretty small in size. China’s snack industry is expected to be worth 3 trillion RMB (444 billion USD) by 2020.

As with the rest of Chinese food, snacks come with their own distinct flavors and specialties, like Sichuanese spicy mala (麻辣), that lately even Western brands have sought to integrate. Lays have been throwing out a wide array of localized flavors for some time now, while last year Oreo released a string of limited edition China-only flavors, as well as Tang Dynasty-inspired Oreos in partnership with Beijing’s Palace Museum.

Related:

Watch: We Tried One-of-a-Kind Chinese SnacksIn this series debut, RADII staff members go toe-to-toe, taste-testing Chinese snacks, from shrink-wrapped quail eggs to spicy chicken OreosArticle Jun 07, 2019

Watch: We Tried One-of-a-Kind Chinese SnacksIn this series debut, RADII staff members go toe-to-toe, taste-testing Chinese snacks, from shrink-wrapped quail eggs to spicy chicken OreosArticle Jun 07, 2019

But out of a burgeoning concern for health and wellness, an increasing number of consumers are scanning the ingredient labels and avoiding oily, fatty, and carb-laden traditional snacks in favor of healthier options.

Health Food

It makes sense that as China’s leisure class has grown, more people have had more time (and disposable income) to be concerned about their health. Now 72% of China’s urbanites say they actively pursue a healthier lifestyle, according to a recent McKinsey consumer report, and an increasing number are putting their money towards goods such as fresh produce, health supplements and sports equipment.

Yet as people increasingly adopt a more active lifestyle — the number of marathon events in China, for instance, almost doubled in the span of two years — some sports still lag due to differing concepts of fitness between China and the West.

Related:

What Powerlifting’s Struggles Say About China’s Changing Gym CultureChina’s weightlifting team has swept the Olympics since 2000, but powerlifting, its more accessible form, is struggling to catch up.Article Jan 15, 2019

What Powerlifting’s Struggles Say About China’s Changing Gym CultureChina’s weightlifting team has swept the Olympics since 2000, but powerlifting, its more accessible form, is struggling to catch up.Article Jan 15, 2019

Health foods however, seems likely to be one area where Chinese consumers will follow some of the trends set in the US and Europe in recent years.

Foods Gone Viral

Never underestimate the power of the influencer. The word wanghong (网红), which indicates internet celebrity or virality, pervades almost all aspects of commerce in China. Similarly, KOLs (key opinion leaders) can be found everywhere. These are online figures who often capitalize on their good looks, personality, and specific expertise — beauty, for instance — and boast a sizable fan base as a result.

For a food stall, restaurant, or tea shop that hits the wanghong jackpot, and generates chatter on social media feeds, lines on any given day can snake around the block. (Bonus points if you’re related to a pop idol.)

Related:

“Hermès Fried Rice” and the Cult of Online Influencer FoodsArticle Jun 28, 2018

“Hermès Fried Rice” and the Cult of Online Influencer FoodsArticle Jun 28, 2018

Less Pork, More Veggie (and Vegan) Eats

Even meat-loving China is in step with a global trend towards embracing veganism and vegetarianism, in light of climate change and an increased awareness of animal welfare. But the issue that might tip China’s potential “flexitarians” isn’t so much one of ethics as it is one of scarcity.

Related:

Mission Impossible Burger: Can China Go Beyond Meat Once More?Can a new generation of homegrown plant-based substitutes convert China to flexitarianism?Article Nov 21, 2019

Mission Impossible Burger: Can China Go Beyond Meat Once More?Can a new generation of homegrown plant-based substitutes convert China to flexitarianism?Article Nov 21, 2019

Pork is a cornerstone of most Chinese cuisines — even the standalone word for meat, “rou” (肉) is synonymous with “pork” — and today the nation accounts for over half of global pork consumption. But then came swine flu, which brought China’s pork supply down to a new low since the mid-1970s.

As swine flu decimates as much as half of domestic pig populations and criminal gangs reportedly use crazy extortion tactics on pig farmers, eaters could face skyrocketing pork prices in the next year. This fact, combined with governmental health concerns and diminishing farmland needed to raise pigs, leads some to believe there’s an opening for homegrown vegan substitutes in the Chinese market.